One watchdog group slammed Republicans for “choosing to sabotage the United States’ ability to tax corporations effectively and conspire with foreign governments.”

By Jake Johnson

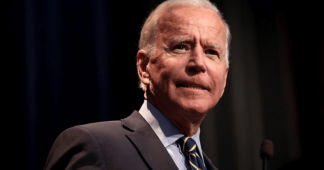

News that GOP members of Congress are coordinating with the far-right Hungarian government in an attempt to block a proposed global minimum tax on multinational companies is drawing outrage from watchdog groups and Democratic lawmakers, with one U.S. senator accusing Republicans of doing “anything it takes to help their dark money corporate backers dodge taxes.”

Just ahead of the July 4 holiday weekend, the Washington Post reported that “senior Hungarian officials say they are working with Republican lawmakers in the United States to defeat a global minimum tax backed by the Biden administration, as European and American leaders struggle to enact a groundbreaking international accord targeting multinational corporations.”

The deal’s framework, agreed to by nearly 140 countries in October after years of negotiations, includes a 15% global minimum tax rate designed to stop companies from stashing profits overseas to dodge their tax obligations, a key driver of what’s been dubbed the “race to the bottom” on corporate taxation. The Tax Foundation notes that the average statutory corporate tax rate worldwide was 40.11% in 1980; in 2020, it was 23.85%.

In recent weeks, Hungary—led by autocratic Prime Minister Viktor Orbán—has raised objections to the European Union’s implementation of the minimum tax on corporations, holding up progress on the accord and prompting applause from Republican lawmakers in the U.S., which has also yet to enact the agreement. Each member of the European bloc has veto power over tax deals.

In a statement last month praising the Hungarian government’s obstruction, retiring Sen. Pat Toomey (R-Pa.) declared that the U.S. “should be leading” the race to the bottom on corporate taxes, “not trying to prevent it.”

As the Post reported Friday, “GOP Reps. Adrian Smith (Neb.) and Mike Kelly (Pa.), top members of the House Ways and Means Committee, sent a letter to the ambassador of Hungary last week commending that country for rejecting the global tax deal” and extending “an offer for a direct dialogue with congressional Republicans as you consider Hungary’s position on the global tax agreement.”

“The letter was released by Hungarian media and later confirmed by spokespeople for the lawmakers, who did not post it to their congressional websites or social media pages,” the Post noted. “Spokespeople for both lawmakers said they were not in contact with Hungarian officials beyond the letter.”

Morris Pearl, the chair of the Patriotic Millionaires—a progressive advocacy group that supports higher taxes on the rich and large corporations—said Tuesday that in their efforts to undercut the global minimum tax deal, “Republican lawmakers are siding with billionaire donors and corrupt foreign autocrats like Viktor Orbán over the American people.”

“By choosing to sabotage the United States’ ability to tax corporations effectively and conspire with foreign governments, the lawmakers working with Hungary have revealed how little they actually care about their own country,” said Pearl. “These lawmakers have chosen to do whatever it takes to keep the rich from paying their fair share, even if protecting foreign corporate wealth means undermining the wellbeing of the United States.”

“It’s fitting that news of this anti-American behavior broke on Independence Day weekend,” Pearl continued. “These are no patriots. They’ve betrayed their oaths of office, their constituents, and their country.”

Sen. Sheldon Whitehouse (D-R.I.) tweeted Sunday that “siding with a right-wing autocrat is shameful, but that won’t stop them.”

“Money talks louder than morals,” the senator added.

Republicans will do anything it takes to help their dark money corporate backers dodge taxes. Siding with a right-wing autocrat is shameful, but that won’t stop them. Money talks louder than morals. https://t.co/5PA8CWQNmy

— Sheldon Whitehouse (@SenWhitehouse) July 3, 2022

While popular with the U.S. public, the Biden administration’s push to implement a minimum tax on the foreign profits of U.S.-based corporations faces long odds in Congress amid Republican obstruction and likely pushback from Sens. Joe Manchin (D-W.Va.) and Kyrsten Sinema (D-Ariz.), right-wing lawmakers who have objected to corporate tax hikes.

Given the present composition of Congress, the only plausible way for Democrats to advance the global minimum tax would be through budget reconciliation, an arcane process that’s exempt from the Senate’s 60-vote legislative filibuster. Such an avenue would be blocked entirely if Republicans retake the House or the Senate in November.

“I am not surprised the Republicans are doing whatever they can to defend large multinational corporations, even if it means working against the interests of the U.S. government to work with a foreign government,” Frank Clemente, executive director of Americans for Tax Fairness, told the Post. “Their patriotism evaporates when it comes to protecting tax loopholes for multinational corporations.”

We remind our readers that publication of articles on our site does not mean that we agree with what is written. Our policy is to publish anything which we consider of interest, so as to assist our readers in forming their opinions. Sometimes we even publish articles with which we totally disagree, since we believe it is important for our readers to be informed on as wide a spectrum of views as possible.