Berlin made an alliance with world finance in 2009-10, in order to punish Greece, discipline European periphery and impose upon all Europe a “dictatorship of the markets”. Now it is paying also the price

D.K

Deutsche Bank and the global financial crisis

By Nick Beams

Deutsche Bank’s shares plunged to record lows this week, sparking talk of a government bailout to avert a new financial crash. The turmoil surrounding Germany’s biggest bank demonstrates that all of the contradictions of the global financial system that led to the meltdown of 2008 are once again erupting. Now, however, these contradictions are fuelling and intersecting with economic and political tensions between the major powers. These geo-political conflicts are, in turn, intensifying the financial crisis.

The financial position of Deutsche Bank has been of concern for a number of years, with the International Monetary Fund saying last June that it appeared to be “the most important net contributor to systemic risks in the global financial system.” But the immediate cause of the present crisis was political.

After a protracted investigation, the US Department of Justice moved last month to impose a $14 billion penalty on Deutsche Bank for fraudulent practices in relation to the US sub-prime mortgage market in the lead-up to the 2008 crisis. Both the substance of this decision and the circumstances surrounding it indicate that it was a calculated move to hit Germany’s only major international bank.

The decision was leaked to the Wall Street Journal, rather than being discussed behind closed doors so that a private settlement could be reached. It emerged in the midst of rising tensions between the US and the European Union, particularly with Germany.

Following the EU decision to hit Apple with a €13 billion back tax bill—a step that met with trenchant criticism from US government and corporate circles—the Justice Department move in relation to Deutsche Bank was widely regarded in European circles as payback. Tensions over the Apple penalty and its implications for US investment and profit-making in Europe had been compounded by the virtual scuttling of the US-sponsored Trans-Atlantic Trade and Investment Partnership by Germany and France.

The Deutsche Bank share plunge was halted on Friday, at least for now, on the back of news that the US was prepared to lower its fine to $5.4 billion. This, however, will prove at most to be a short-lived ceasefire in an ongoing economic and financial war.

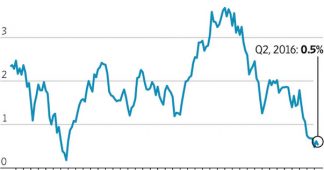

The conflicts are not temporary phenomena, but are rooted in two interconnected objective developments: the ongoing stagnation in the world economy, marked by low growth levels, declining trade, lower investment and falling productivity, and the development of a massive financial bubble reflected in the rise of stock and bond markets.

The contradiction between booming financial markets and intractable slump in the underlying economy is assuming an ever more explosive form. Notwithstanding the illusion that money can simply beget more money through speculation and central bank stimulus, financial assets represent, in the final analysis, a claim on the wealth produced in the real economy.

For decades, financial assets were roughly equivalent in size to global gross domestic product. But the rise of financialisation, starting in the 1980s, led to a situation where, by the time of the 2008 crisis, these assets were more than 360 percent of global GDP. This ratio has only increased since then as a result of the extraordinary monetary policies—the pumping of trillions of dollars into the financial system and ultra-low and even negative interest rates—adopted by the world’s major central banks.

Commenting on the Deutsche Bank crisis, one financial analyst told theFinancial Times: “Investors are now worried that sooner or later there will be a heavy price to pay for the current market distortions.” The market distortions, however, are only the immediate expression of profound contradictions in the very foundations of the global financial system.

Under conditions where financial asset claims vastly outweigh real wealth, each section of finance capital must turn ever more viciously against its rivals in an attempt to eliminate them.

These tendencies find particular expression in Deutsche Bank. For decades, it worked in close collaboration with key sections of German large-scale industry. But with the growth of global finance capital, this business model became increasingly unviable, and at the end of the 1980s Deutsche Bank sought to turn itself into a global investment bank and aggressively targeted its rivals, particularly US banks. Its criminal activities in the US sub-prime market, mirroring those of US competitors such as Goldman Sachs, were part of this process.

While American banks were strengthened by the bailouts organised by the US government, the financial position of Deutsche Bank has been steadily eroded.

Without a bailout, it needs to raise more capital from the market in order to compete. But the ultra-low and negative interest rate regime, set in place by the major central banks, means that its basic business model has been adversely affected and profit expectations have been lowered. Under conditions where Deutsche Bank continues to hold on its balance sheet high levels of toxic derivative assets and the prospects for a serious revival of world trade and economic growth become increasingly remote, its counterparties demand ever higher rates of return on credit.

As the Wall Street Journal noted: “Deutsche Bank’s biggest problem isn’t just that it needs capital, but that it will find it very hard to raise any,” since it will “struggle to convince investors that it can make a return that beats its cost of capital in the years ahead.”

Just as rival gangs conduct a turf war of each against all in a bid to strengthen their own position, so Deutsche Bank has been targeted. Hedge funds and speculators have had a field day betting against the bank.

In a statement to employees on Friday, Deutsche Bank CEO John Cryan alluded to the forces at work, declaring that in banking, trust was everything, and that “there are currently forces at play in the market that want to weaken this trust in us.”

Deutsche Bank is not the only target. The wider dimensions of the conflict were given voice in a statement this week by Valdis Dombrovskis, a vice-president of the European Commission. He declared that reforms to global banking being pushed by the United States, which would lead to “significant increases in capital requirements shouldered by Europe’s banking sector,” would not be accepted.

While not directly naming the US, he said: “We want a solution that works for Europe and does not put our banks at a disadvantage compared to our global competitors.”

The way in which the insoluble contradictions of the global capitalist economy are fuelling geo-political tensions, and vice versa, as revealed in the Deutsche Bank crisis, is of profound significance. As the tormented history of the 20th Century shows, it is an indubitable expression of a global breakdown of the capitalist system that leads inexorably, unless prevented by the international working class, to world war.