By Ernesto Screpanti*

Since the end of World War II, tribal rivalries and xenophobic sentiment in Europe have never been as strong as they are today. And this is but one of the European Union’s “successes”. Not to mention the resurrected warmongering vocation that led the Union to feed conflicts in Libya, Syria, Ukraine and, when the Union was still in the preparatory phase, to favor the explosion of devastating civil wars in Yugoslavia.

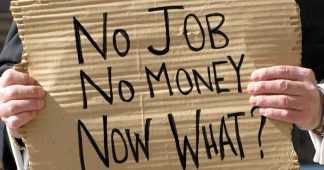

Another series of “successes” has involved the social and economic sphere, with increases in unemployment, poverty, and inequality; the deterioration of labor conditions; reductions in workers’ rights; greater labor insecurity and precariousness; worsening welfare in the areas of education, health services, public utilities and social security; the proletarianization of the middle classes; rising uncertainty and, last but not least, the threatening of household savings by a predatory financial sector.

Meanwhile, the process of convergence of the national economies, prophesied by the founding fathers as one of the most important effects of the Union, turned out to be precisely the opposite. The Northern European economies are growing faster than the average, being led by massive trade surpluses, while the Southern ones are growing more slowly, thus undergoing prolonged de-industrialization with high unemployment and public debt. Moreover, the average growth rate of the Eurozone GDP, which had been predicted to rise in comparison to that of the 1990s, has instead diminished.

Then there is the burying of democracy, a tendency which had already begun with the turn of the century globalization, and which was accelerated by the Union. This led to a process of constitutionalization of the treaties, which is gradually nullifying the national constitutions. And it is doing so without the peoples’ consent, given that whenever they have been called upon to ratify (anti)constitutional “reforms”, the European peoples have rejected them. Then the Union has built a monstrous bureaucratic apparatus, which has taken on such political powers that it is able to effectively condition national government policies. What else has to be said to convince you that such a European Union must be demolished?

The social nature of the European Union

The political organisms that determine the monetary and fiscal policies of the Union are the European Central Bank and the German government, and neither of them is accountable to the European peoples.

Germany’s supremacy over the European economy was already well established in the 70s, and became unwieldy after the German unification of 1990. With the foundation of the Union, the government of that country succeeded in gaining unprecedented competitive advantages for its industry. Through the Hartz reforms (2003-2005) and restrictive fiscal policies, wage growth was put under check, thus completing a process of subjugation of the working class that had begun in the 90s. Moreover, German firms extended their value chains toward Eastern European countries (and partly toward the South), where wages are much lower than in Germany. At the same time, German firms enjoyed a moderate growth in productivity. In this way, German industry benefited from labor costs that grew systematically less than those of its principal competitors, especially France and Italy. This has enabled Germany to maintain a high and growing trade surplus, thus pushing the Southern countries toward deficit (Italy until 2012; France, Spain, Greece and Portugal still today).

Since the Eurozone current account surplus was almost always (at least until 2012) lower than Germany’s own, the Euro appreciated against the Dollar to a lesser extent than the Deutsch Mark would have done. At the same time the Italian, French, Spanish, Greek and Portuguese currencies were not able to devalue against that of Germany. This fact gave Germany a competitive advantage which added to that generated by the labor cost dynamics. Moreover, the German trade surplus is also fed by restrictive fiscal policies. The latter, besides maintaining unemployment and underemployment at the level required to keep workers’ militancy in check and induce trade unions to collaborate, has also helped slow down the growth of imports.

One consequence of Germany’s trade successes was a series of debacles in France, Italy, Spain, Greece and Portugal, for whom the Euro is an overvalued currency, thus adding to the disadvantage caused by a higher growth of labor costs.

The German governments have chosen to “defend” national industry from the effects of globalization with a policy of real depreciation based on austerity and neoliberal “reforms”. They then imposed this model of mercantilist policy upon the rest of Europe, via their restrictive fiscal policies. Since Germany’s output growth was pulled by exports rather than by consumption and public expenditure, it resulted in lower growth for Germany’s European partners, as their exports were not being adequately pulled by German imports. At the same time, by virtue of the constraints imposed by the Maastricht Treaty and the fiscal compact, the highly indebted countries could not expand their economies through growing public and private expenditure. All this determined a systematic divergence between the economies of the North and South of Europe. On the other hand, by virtue of the Kaldor-Verdoorn law (by which productivity growth is partly determined by GDP growth), the low development rates of the Southern economies additionally caused low increases in their productivity, with the consequence that labor costs continued to be subject to diverging dynamics, thus closing a vicious circle that promises to protract and exacerbate this situation for a long time ahead.

Following the Euro devaluation that began in 2014 and the upsurge in global trade growth from 2016, exports are now growing fast all over the Eurozone, and the GDP growth rates have recovered too, albeit less so in the Southern countries (except Spain).

Left-wing observers have developed two different interpretations of the current historical situation. Some blame German mercantilism, as the expression of a neo-imperialist policy in Europe. With its huge trade surpluses, Germany has accumulated a high net international investment position. The value of foreign assets owned by German citizens and companies is much higher than that of German assets owned by foreign subjects. In other words, Germany is the principal creditor and proprietor within Europe. Moreover, German companies have built international value chains that exploit the enormous wage differences between the North and East of Europe. Finally, by generating underdevelopment and unemployment in the South, they are also transforming this area into a huge semi-industrialized periphery in which they produce or subcontract low-cost intermediate and semi-finished products (in 2016 French wages were about 93% of German wages, Spanish 80%, Italian 76%, Portuguese 53%, Greek 45%). Not to mention the constant flow of skilled and highly skilled workers, especially young people, from the South to the North of Europe. At the same time, German companies are buying manufacturing firms all over Europe at sale prices.

The other interpretation focuses on class struggle rather than on conflict among nations. The austerity policies that the German government and the European Commission impose upon all countries of the Union are expedient to the maintenance of the high unemployment regime necessary to keep the workers’ movements on their knees. In this way, not only is wage growth kept under check, but it is also easier to pass the labor market “reforms” required to increase exploitation. All European capital, big and small, national and multinational, is interested in these reforms. In other words, the German ruling classes are not just pursuing the interests of national capital, but they are acting as the vanguard of the capitalist class for the whole continent. Hence, the German-led European Union is the political instrument used by capital to wage its class struggle. It is a real State in the Marxian sense of “a committee for managing the common affairs of the whole bourgeoisie”, and is all the more effective in the class struggle the less accountable it is to the European peoples. It aims to impose the capitalist interest in accumulation and exploitation upon the European peoples.

Which of the above is the correct interpretation? I think they are both valid. They are complementary rather than antithetic. The German ruling class acts with the intention of favoring national interests – but the interests of national capital rather than those of the working class. Just ask the workers with mini-jobs, midi-jobs, one-euro-jobs, precarious jobs, the immigrants, or the two and a half million unemployed. And, although most German workers enjoy some job security as well as decent direct and indirect wages, the fact remains that the trend of the wage share in national income has been decreasing since the 1970s and has not been reversed by the European Union. It is also a fact that in Germany too, as in the rest of Europe, poverty and inequality have increased. The point is that the austerity policies implemented by the German government have determined a similar tendency throughout Europe. This policy is conducive to a strategy of real depreciation based on wage curbing. It is therefore no surprise that the industrial circles of the various countries affected insist in applauding German policies and preaching “let’s do it like Germany”.

The European Union would be considered a disaster if it were intended as a political organization aiming to increase the welfare of its peoples and reduce the previous differences in income and wealth among nations. However, if the EU is seen for what it really is, it becomes clear that no error and no disaster has occurred, and that things have gone precisely as they were designed to. The European Union has turned out to be a great success… from the point of view of capital. Never, in European history, has the working class been so exploited and so frightened (except, perhaps, in the Fascist Germany and Italy of the 30s).

The question we must raise is whether or not this Union can be reformed and converted into a political organism devoted to achieving full employment, reducing national differences in industrial production, reconstructing the welfare state, reducing inequalities, eliminating poverty and redistributing income in favor of wages.

To be optimist, we should be able to answer the following in the affirmative: 1) Would European capital accept reforms aimed at the achievement of such goals? 2)Would the German ruling classes accept some of the following proposals: a) donate 5% of German GDP to the Southern countries; b) introduce expansive fiscal policies and generate a huge budget deficit; c) let German wages rise so as to drastically reduce the trade surplus; d) abolish the bail-in rules and allow national governments to rescue distressed banks through nationalization; e) compel the German taxpayers to finance part of the interests on the sovereign debt of the profligate and lazy nations; f) put the BCE at the service of a full employment policy; g) renounce part of their political power in favor of a federal government accountable to a real European parliament?

Lexit, Euro demolition and the crisis of passage

So, let’s start thinking about how to demolish the European Union. This demolition could take different forms and be triggered, for instance, by a Eurozone break-up into Northern and Southern areas, an agreed return to the national currencies, the exit of a Northern country, or in yet other ways. The left must be ready to act under any circumstances to transform such a crisis into a collapse. One event that is becoming increasingly probable with the passing of time is the unilateral exit of a Southern country. I think that the left should consider this perspective and include Grexit, Spaxit, Italexit etc. in its programs.

In any case, we must be aware that the exit of any country from the EU will cause a crisis, and that such an event will take place even before the exit itself. The crisis will blow up because of the propagation of exit expectations. In countries like Italy, whose public debt is mostly owned by private financial institutions, and especially in those like France, whose public debt is mainly owned by foreign banks, it is highly probable that speculative attacks will bloat the spreads of public securities yields. Thence the national banks who own consistent quantities of these securities could become distressed. Capital and liquidity flights could ensue (in certain countries, like Italy, they have already begun). Panic would be felt among vast strata of the population, and banks might have to face dangerous bank runs. The flow of credit to consumption and investments might stop. Many borrowers would delay payment of their debts, and many lenders could go bankrupt. Stock exchange crashes would be unavoidable and households and companies might face wealth losses resulting in negative wealth effects. In a situation of credit rationing and rising uncertainty, impoverished consumers and investors would reduce expenditure. Thus, the crisis would extend from the financial markets to the real economy.

Other problems would arise immediately after the exit. One concerns the TARGET2 balances. In September 2017 these were negative for Italy (-432.5 €bn), Spain (-373.4), Portugal (-76.8), Greece (-64.2) and France (-7). Surprise, surprise, the highest positive balances (878.9 €bn) were German. It is as if the official reserves accumulated by Germany with its current account surpluses had been lent to the other five countries to cover their current account deficits and/or their capital flights, or in other words to buy German goods and bonds. Now, negative TARGET2 balances are not a problem as long as a country stays in the Economic and Monetary Union. However, in the case of an exit they must be settled by the Central Bank of the exiting country. Some payment delay or nonpayment device will need to be negotiated with the ECB.

Another problem might be caused by the length of time required by the mints to produce new banknotes and coins in Lire, Pesetas etc. In this case, part of the production could be subcontracted to other mints. Moreover, since the exit will be followed by devaluation, there could be wealth losses among the companies and households who have debts and net liabilities abroad. These, however, will be offset by the wealth gains of the subjects holding net assets abroad. Finally, redistribution consequences may arise due to the possible inflationary effects of devaluation.

We must be aware of the unavoidability of a crisis, but also of the fact that its length and harshness depend on the skill and determination of the government called upon to manage it. For instance, the inflation caused by devaluation may be countered with an exchange rate maneuver aimed at devaluing the national currency against the Euro/Mark and revaluing it against the Dollar, in addition to a policy of tax cuts on imported energy resources.

Above all, however, we must be aware that a crisis of passage is the short run cost we should be ready to bear to let the Southern economies exit the lengthy stagnation they are doomed to undergo if they stay in the Eurozone.

What could a single country do outside the Union?

Exit from the Eurozone is not sufficient to resolve all the economic problems of countries like Italy and Greece, which have at present the highest probability of leaving the Union. If we remained in the EU we would still be obliged to comply with the founding and amending treaties, and abide by the diktats of the Commission and the Court of Justice. It is necessary to exit the EU completely, so that our representative and participatory institutions get back all the powers required to enact social, fiscal, monetary, commercial and industrial policies. And, to avoid a lengthening of the crisis, the exit must be achieved with a swift repudiation of the treaties, rather than with an application of their rules (which might require two years of negotiations).

One important thing to do immediately after the exit is to decree the nationalization of the Central Bank. Alternatively, if such a subversive provision proves too daunting, we should at least establish the Ministry of the Treasury as the supreme monetary authority. The Central Bank then takes on the function of lender of last resort for the government. Moreover, an ample overdraft facility in the Treasury account opened at the Central Bank needs to be decreed legitimate. These two provisions serve to make it clear to the rest of the world that the State cannot default and that it is able to determine the cost of its debt. Whatever the magnitude of debt following exit from the EU, it would no longer be a problem for the State or for its lenders.

In other words, one of the most important advantages the exiting countries would obtain from liberation is the recovery of their monetary sovereignty. This is necessary to remove the internal constraint on expansive fiscal policies, and therefore implies the recovery of effective fiscal sovereignty too. The possibility of running heavy budget deficits would not be sufficient if the government were subject to the speculators’ tyranny in determining the debt service. Putting the Central Bank under the control of the Treasury means freeing the country of such tyranny.

Another advantage produced by monetary sovereignty lies in the possibility of devaluing the national currency, which can be used to remove the external constraints on fiscal policies. A balance of payments deficit determined by Keynesian expansive policies may be eliminated by means of devaluation. I have already observed that devaluation could have very limited inflationary effects if the government were willing to check them. At any rate, I do not think we should worry too much about a slight inflationary effect of devaluation. This would be useful – not only because part of the GDP growth would be led by exports, but especially because it would slacken external constraints on expansive fiscal policies.

A further thing to accomplish, following nationalization of the Central Bank, is to rescue the commercial banks at risk of bankruptcy. The banks’ shares would devalue dramatically during the crisis. The Treasury could buy and recapitalize them. Then they should be managed in the public interest, for instance, to support industrial policies.

At this point, the government will have regained all the instruments necessary to launch an economic recovery and take care of the unemployment and non-employment amassed over decades of wanton neoliberalism.

The question we must now raise is: How far can a country like Greece or Italy go if it is ruled by Abenomics (expansive fiscal and monetary policies accompanied by devaluation)? My answer is: It can go ahead, but not extremely far. Forget the economic miracle of the 50s and the 60s. Those times were characterized by an international payment system that ensured exchange rate stability and discouraged beggar-my-neighbor policies. One country, the USA, played the function of world accumulation engine quite well by pumping up its imports with its GDP growth, and many American multinationals made massive direct investments especially in Europe. None of these conditions exists today.

To be optimistic, we could hope to do as well as certain countries outside the Eurozone. For instance, the Swedish annual GDP growth rate was 1.43% in the years 2008-2016; the United Kingdom’s was 1.02%; and Japan’s 0.47% (Italy achieved a shameful -0.78% and Greece a tragic -3.29%). We should most probably make do with imitating Japan. Sweden’s success might remain a dream.

Although such a jump would in any case represent good performance, I do not think we should be content with it. Italy, Greece and other Mediterranean countries must mend a decade of disasters. If they aim to reach full employment rapidly, they must be able to grow at least 3% a year for a decade. Some protectionist measures may help improve their performance by slackening the external constraint without devaluing too much, but I doubt we can go very far in this direction.

The point is that, if the governments of countries like Italy or Greece wish to run counter to the austerity policies imposed by Germany, they will face a big balance of payments problem. If this is tackled with devaluation and/or protectionism, other countries can only be expected to react. France and Spain would encounter serious difficulties, both because their industries would lose competitiveness, and because the “markets” would immediately unleash a crisis by speculating on their sovereign debts (which are near 100% of GDP) and betting on their exit from the Eurozone. And these are good reasons for following Italy and Greece out of the Union.

What would happen afterwards? It goes without saying that we will need to launch a policy of international trade cooperation. The problem is whether such a policy is possible when governments play the most chauvinistic forms of mercantilism, those based on protectionism and competitive devaluation. In reality, not only France and Spain, but the entire Euroland could take umbrage against the unilateral exit of Italy or Greece. The exit itself would be perceived by the other countries as an act of hostility, even independently of the changes in international competitiveness, since it would cause wealth losses among their banks and other subjects with positive net asset positions in these countries. Can you imagine how mad Luther’s heirs would get with the well-known Mediterranean opportunists? And it would not be surprising if the European Commission decided to offset the trade effects of an Italian or Greek devaluation with a compensatory tariff.

Can these countries bear a commercial war with the rest of Europe? Consider that their economies are somewhat open: in 2016 the degree of trade openness, measured as (export+import)/GDP, was 56% in Italy and 62% in Greece. This means that they can ill afford either a commercial war or autarchic closure. They especially depend on imports of raw materials, oil and gas. Certainly, this dependence can be reduced via a policy of developing renewable energy sources, but only in the long run. In the short run we are all dying. And in this case the short run could well last 10 years!

True, the USA has systematically grown faster than the European countries despite far more protectionist policies. But remember that: 1) the degree of the US’ trade openness (27%) is less than half of Italy’s and Greece’s (as well as Portugal’s, 79%, Spain’s, 63%, France’s, 60%) and less than a third of Germany’s (84%); 2) American industry is not over-dependent on energy imports; 3) it is not even over-dependent on exports, the export/GDP ratio being 11.9%; 4) the huge size of the domestic market makes protectionist measures effective; and 5) external constraints on expansive fiscal policies are practically inexistent because the Dollar is the principal international reserve currency.

Some observers dream of Poland-like success. In the period 2008-2016, Poland’s GDP grew yearly at a striking 3.18%, with a peak of 5% in 2011. This country’s growth is based on large scale social dumping and its economy has adapted to become a huge industrial periphery, producing low cost intermediate goods for German industry. Well done, but consider that in 2016 Polish wages were about 38% of Italian wages and 63% of Greek wages. How many “reforms” should we still introduce?

There is no doubt, however, that the very nature of capitalist accumulation pushes in such a direction. Trade competition would increase following a Euro break-up, and a nationalist government might wish to comply with a process that is part of this competition, namely, the process of globalization based on the movements of foreign direct investments. It is difficult to control this kind of capital movement. You can forbid portfolio investments and liquidity flights, but you cannot forbid a multinational from closing a factory or from cancelling a subcontracting order in Italy and transferring it to Poland. How would the Italian government react if Bosch threatened to stop buying freezer parts from Whirlpool in Siena and start buying them from Whirlpool in Lodz? To answer this question, just imagine what kind of decision would be taken by Sergio Marchionne if he were promoted from his current position as CEO of Fiat Chrysler Automobiles to that of Italian Minister of Labor. The workers would obviously be asked to choose, democratically, whether they prefer a wage cut or job loss.

In other words, if growth has to take the form of capitalist accumulation, nominal devaluations and trade barriers could not be sufficient. Capital would also demand a massive dose of wage depreciation. If we have to navigate between the Scylla of high exploitation and the Charybdis of slow growth, the market sirens will insist on singing “dumping dumping”, and governments working in the “national” interest will not be able to resist the temptation: they will try to bring about as much social and fiscal dumping as possible. Forget any hope of wage rises and shorter working days.

In the present phase of global capital accumulation, with firms continuing to internationalize and nations in the grip of a mercantilist revival, a government wishing to practice the Keynesian compromise using Abenomics would be unable to re-launch sizeable growth. Abe’s Japan is a case in point. Yet a nationalist government could try to re-launch such growth with a strong increase in exploitation. In this case, Poland provides a case in point.

Summing up, I am convinced that the economies of Southern European countries would do better outside Euroland than inside it, but I also suspect that they would not do so much better as to enable the working classes to rapidly make up the ground lost over the last 20 years: either growth will be moderate or exploitation will be immoderate. There are two fundamental causes. One has to do with the degree of trade openness of our economies; the other with the capitalist nature of the growth process. These two causes, together, would take a government that had freed itself from the Euro dictatorship and place it even more firmly in the hands of the global “markets” dictatorship.

To build a Europe of the peoples

If we succeed in demolishing the European Union, but are not satisfied with moderate (Japan-style) economic growth or with immoderate (Poland-style) exploitation, we must have the courage to aim for Utopia. We have to think of a way out of the morass by triggering two processes of radical transformation: a process of political re-aggregation in Europe and a process of overcoming capitalism.

The best form of international cooperation for an exiting country is the following: a new united Europe should be constituted immediately after the demolition of the old one. And it should be constituted as a proper federal State. Federal, because it must safeguard the cultural identities of the various peoples. State, because it must be a political organism with a true democratic constitution, a true parliament and an accountable government. The government must be endowed with all the instruments required to enact policies of social transformation and industrial development, to overcome local differences in industrialization, and to expand freedoms and rights.

I hasten to specify, however, that for a long transition phase the federation must involve only the Southern countries – say, the three big Mediterranean peninsulas and France. Imagine a scenario in which the exit of Italy and Greece causes difficulties for France, Spain and Portugal, and consequently induces them to leave the EU themselves. Subsequently, perhaps after a period of commercial wars, the peoples of the exiting countries would understand that they need to re-aggregate.

Why must the federation be limited to the South of Europe for a certain time? Because, after almost half a century of the Currency Snake (from 1972), the European Monetary System (from 1979) and the Single Currency, the differences from Germany have grown so great that it is not possible to invert the tendency without breaking free from the Northern countries and enacting a strong industrial policy protected by trade barriers and devaluation. Let me insist on one particular point: it must be a political federation, and not, for instance, merely a monetary union. A monetary union of Southern Europe would reproduce the problems of the present European Union, with the sole difference that Lombardy would play with Sicily and Greece the same game that Germany is now playing with Italy and Greece.

The economic advantages of a South European Federation would be many. Here are some of the most significant. Integration would prevent commercial wars among the federating countries. It would constitute a continental economy with a much lower degree of trade openness than that of the individual countries or their sum. It would constitute a market broad enough to enable companies to enjoy economies of scale and some of the advantages of internationalization without the need for offshoring. It would reduce the governments’ vulnerability to the pressures and blackmail of the multinationals. Finally, it would increase the efficacy of a protectionist policy, since the companies producing import substitutes could achieve economic efficiency more successfully the broader the internal market, while the exporting companies facing commercial retaliation from other countries would also have a greater probability of survival with a broader internal market.

If such a South European Federation aims for sustained growth, the government cannot solely rely on “market sovereignty”. Rather, it must equip itself with effective industrial policy instruments, to be able to launch or re-launch important industries oriented toward exports, import substitutions and R&D investments. Moreover, we will need an industrial policy oriented toward the substitution of fossil energy sources with renewable sources. Finally, the industrial policy should aim to industrialize or re-industrialize vast regions of the continent, so as to reduce some of the deepest internal differences.

Yet industrial policy is not enough. If the federation is to be a democratic State that works for the people and not for capital, the government must also enact fiscal and monetary policies aimed at the achievement of full employment, the advancement of the poor classes’ living standards, the improvement of working conditions, and the reconstruction of the welfare state.

Most of these objectives are difficult to attain with capitalist growth and the global “market sovereignty”. How would capitalist firms react to wage increases, reductions in working hours and the strictures of industrial policies? Trade barriers would not be sufficient to contrast any tendency to offshore and outsource. Hence, the overthrow of capitalism becomes almost a necessity for economic growth. This is an epochal consequence of globalized capitalism – accumulation has become incompatible with a Keynesian compromise on a national basis. The government of the Federation must be aware of this problem and be able to enact the policies required to deal with it. Two in particular come immediately to mind.

First, it is necessary to support enterprises recuperated by the workers who lost their job due to the closing of plants. A law regulating these practices already exists in Italy, but is imperfect and limited, having been worsened by the impositions of the European Union. The law needs to be reformed, among other things, by augmenting the financial facilities for the constitution of workers’ cooperatives, and by extending the number of cases to which it applies. Obviously, it must become a federal law. The development of a strong cooperative sector represents an effective defense against rampant globalization; for capital does offshore, the workers don’t (when they are not unemployed).

Second, when company sizes are so big as to make the constitution of proper cooperatives difficult, the government must favor the creation of new firms or the acquisition of old ones with a sizeable share of public ownership. This kind of policy is especially important when the existing firms are in distress or show social irresponsibility (for instance, because they offshore, or pollute, or tend to accumulate monopolistic power).

In particular, public ownership, either through nationalization or through State participation, must be imposed upon companies working in sectors afflicted by significant market failures: public goods (e.g. infrastructures), merit goods (e.g. health services), information asymmetries (e.g. banks), common goods (e.g. environment), and natural monopolies (e.g. water distribution).

These policies must be realized in a flexible way and with popular consent. In a long transition period, development could be based on a mixed economy with cooperative, public and capitalist firms competing in a well-regulated market.

Conclusions

I can see the condescending smile on the faces of many dismal science practitioners. Nevertheless, I wish to make it clear that my appeal for the courage to aim for Utopia was not ironical. After all, history is a history of changes, and we Europeans should know that the most radical changes often blow up unexpectedly. The question we must raise now is: how could the desired change come about?

To start with, let me make clear that a new European Federation must not be created with treaties signed by States uniting national interests. We already watched this film and did not like it. National interests are normally interpreted by ruling classes as coinciding with an interest in “growth” within the present mode of production, i.e. an interest in capital accumulation.

And forget the illusion of “national sovereignty”, according to which the Italian or Greek or French peoples would recover true democratic sovereignty simply by exiting the European Union. Do not forget that the entrance of our countries in the Union were decided by governments who enjoyed “democratic” legitimacy.

What is required is the building of a “real democracy”. We need to trigger a political transformation in which the exploited masses are the active agents. This change could take the form of the constituent process of a new Europe. One can imagine a serious economic crisis that would make the working classes aware of the need to exit the Euro cage, to free themselves from the political domination of the present ruling classes and from the economic domination of the “sovereign markets”, and hence the need to build a new political system in which the peoples can self-govern.

One could hypothesize a sort of European Resurgence: a movement for liberation and unification nourished by a revolt against an antidemocratic ideology – neoliberalism – and against States subservient to the interests of capital. This Resurgence should lead to the birth of a new State and a new constitution, and to the creation of a democracy open to socialist transformation.

* Department of Political Economy and Statistics, University of Siena. This is a modified version of the Preface to the book (in Greek): C. Lapavitsas, T. Mariolis and K. Gavrielidis, “Economic Policy for the Recovery of Greece” Athens: Livanis, 2018.