Βy Petros I. Miliarakis*

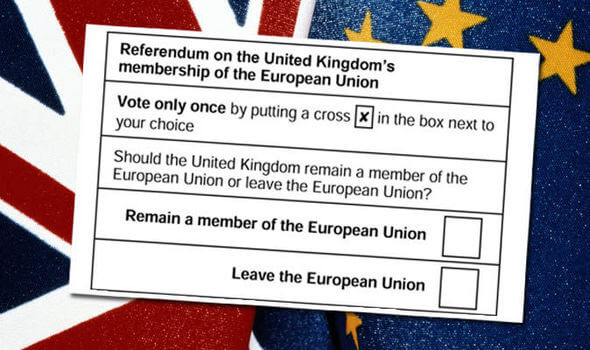

Within the next few days (on June 23. 2016) the Britons are summoned to decide on their stay in the European Union (E.U.) within the framework, besides, of the constant “reservations” the United Kingdom adopts as a standing policy on European issues. The United Kingdom (as the name of a sovereign state) is less “admissible” than “Great Britain” on the basis of reservations expressed by particular nationalities e.g. the Scotch, the Welsh and the Irish of North Ireland. Great Britain is also quoted as Old Albion, with reference to the old name of the region Albionum (6th century b.c.). In this text “United Kingdom” will be quoted, for the sake of brevity, as “Britain” – from which the term “Brexit” derives.

In view, therefore, of the developments that concern the referendum on a possible Brexit, I consider the following useful, which regularly are not brought to the public’s attention.

The provisions of Lisbon Treaty

It is worth noting, primarily, that under the previous regiment of Treaties, the right of a member-state to withdraw from the (then) Communities and in the process from the E.U., was not anticipated. The only process that could result, was based on article 62 of the Vienna Treaty on the Law of International Treaties, with reference to the “clause of radical transformation of circumstances” (clausula rebus sic stantibus). It should be noted that the possibility of withdrawal of a member-state under unilateral right was first established as precedent by the German Constitutional Court in their judgment, known to the legal and political circles, on ratification of the “Maastricht Treaty”, with which it was claimed that Germany could invoke the right of denouncement in the instance of non application, as provisioned, of the provisions of monetary integration. On this assumption the provisions of the Lisbon Treaty established for the first time (casus foederis) with the provision of article 50 TEU the right of each member-state to take decisions according to the domestic legal order on their withdrawal from the Union, with unilateral right to lodge a complaint.

For the sake of completeness of the historical grounds

For completeness of the historical grounds (whatever readiness is offered by the present outline), it should be mentioned that certain border changes have taken place in the European Communities, also in all instances of the E.U., since the independence of Algeria from France in 1962 resulted in their withdrawal from the EEC. The same happened with Greenland in 1985. Greenland is a territory of Denmark North of the Arctic Circle, yet with increased ownership (more specifically since the year 2009). Also the issue of “change of internal borders” has come up following the german reunification, which also led to the necessary legal arrangements. In the case Brexit does take place one cannot rule out deterioration of the “Gibraltar Issue” . Gibraltar is an overseas territory with Queen Elisabeth B’ as head of the state and concerns a British possession. According to a newer referendum in 2002 it was decided that Gibraltar stays under British dominion, a source of constant tensions with Spain. It should be underscored that Gibraltar concerns an important geopolitical-strategic position in the Southern Tip of the Iberian Peninsula. It had been ceded by the King of Spain to the British Crown in 1731 under the Treaty of Utrecht, with which the issues “of war for the Spanish succession” were arranged. However the issue has been revived recently, when the British government attempted to dump concrete to create an “artificial reef”! Possible withdrawal of Britain from the E.U. may raise legal issues for control over the area, with imposition of enhanced border checks and duties (!) on the side of Spain, since the Spanish government will be disengaged from the provisions of the EU Law.

What is the current state of the UK economy

In the present historical phase the British economy experiences a considerable crisis. In the first quarter of the current year 2016 the British trade deficit with the E.U. was broadened to 23.9 bn pds stg., according to data of the National Statistical Authority published in the British Press on May 10. 2016. It concerns the biggest deficit in the trade balance with the E.U. since 1998. At the same time the trade deficit of Britain with the rest of the world was broadened to the level of 1.1 bn stg over that of the respective quarter in 2015. The British economy, that is, during the referendum has to show an overall deficit of the level 37 bn pds stg! It should be noted that Britain does not participate in the “Euro + Agreement” nor has it imposed pound sterling as currency in the Sovereign Base Areas of Akrotiri and Dekelia, which constitute British Overseas Territory in Cyprus. The official currency in the said territories is EURO.

It goes without saying that should Brexit ensues, the British currency will suffer strong pressures (maybe of long duration), in the international money markets, with unforeseen, in the present phase, results for the British economy. Certainly the E.U. will face issues, surely not “strategic” on account of stay of Britain in NATO. In the money markets, however, the withdrawal of the Bank of England is an issue that could deal a blow to euro as well.

At any rate, the European Commission in London is making strict recommendations, given that “the Cameron government” has not undertaken effective action for correction of the deficit of the fiscal year 2014-2015. It is apparent that with a deficit of 5.2% in the GDP, London will have to exercise policies of compliance at the value of 3% of the GDP within a short period of time. In any case, stay of Britain in the E.U entails their automatic obligation to comply with the demands of fiscal discipline.

“Plan B”

Stay of Britain in the E.U. does not imply initially a favorable environment as to its trade balance. Such an assessment is, ostensibly, proven through recourse to the previously considerable trade deficit, despite the traditional advantages the British policy enjoys on account of the Commonwealth. On the other hand, however, it is granted that while E.U. has recently allowed competition in the financial sectors of the member-states, allowance is made so that the City of London, with important initiatives, acquires greater regulatory dominance. Therefore, exit from the E.U. as to the part concerning the City of London in no way means that benefit will result for the financial sector. Also, it has not been clarified whether exit of Britain from the E.U. will allow general recovery of the state economy and reduction of the deficits. Finally, it seems that no specific “Plan B” has been worked out on the cooperation of Britain with E.U. in the instance of exit (at least this has not been officially announced). This means that it has not been clarified whereas a “particular relationship-agreement” will be activated with the so called “European Economic Area” on the model of Norway which is granted access to the internal market as from 1994. Further, it has not been yet clarified if in the instance of exit and in application of article 8 TEU and articles 216-219 TFEU a “particular neighborhood relationship” will be created, as the case is, for example, with the 15 Mediterranean countries of Algeria, Egypt, Israel, Jordan, Lebanon, Morocco, Monaco etc. At the end of the day it should be made clear that stay of Britain in the European law and order imposes, without any shadow, absolute compliance with the system «SixPack-TwoPack» with all the consequences it entails! I wonder whether the Britons are well aware of this.

————————————————

*Petros I. Miliarakis, Barrister of the Supreme Courts and of the European Court of Human Rights, General Court-European Union. (Office: 47-49 Aristotelous Str. Athens. Postal Address: P.O Box 8080 Athens, Greece, P.C. 102 10.)