by The Hutch Report

Sun, 08/12/2018

There has been many financial crises over the past century, yet few of those provided much of a warning that they were about to hit. It only becomes clear after the fact. We then begin to hear speeches on what there was to learn and how to avert any future crisis, until the next crisis arrives in a slightly different form. Philosopher George Santayana, once wrote, “Those who cannot remember the past are condemned to repeat it.” History has proven this to be true.

We now have a situation brewing in Turkey, yet there are many in the financial media who are already quick to write off the current collapse in the Turkish Lira as contained to Turkey and that the size of Turkey’s GDP makes it less of a threat. Yet, Turkey’s GDP is double the size of what Thailand’s was during the Asian crisis. Therefore, in order to understand the current crisis in Turkey, it is worth looking back at the Asian crisis of 1997.

In 1997, just before the crisis hit, Thailand’s economy was booming. Banks were lending freely. The resulting large quantities of credit that became available generated a highly leveraged economic climate, which led to excessive real estate speculation, and pushed up asset prices to an unsustainable level. An economic expansion, that nobody wanted to end, was in full force. In fact, the Thai central bank kept the currency artificially high, fuelling the speculative bubble.

I guess you could say that there were signs of a brewing crisis if you choose to focus on them. Banks began lending against the security of the buildings that didn’t have too much of a chance at being filled. Muang Thong Thani was a housing estate built for 700,000 people and became a victim of the coming crash. At the time of the mid-1990s, Thailand, Indonesia and South Korea had large private current account deficits and the maintenance of fixed exchange rates encouraged external borrowing and led to excessive exposure to foreign exchange risk in both the financial and corporate sectors. Capital controls were being reduced and there was a lack of transparency.

In 1995 the US dollar began to strengthen. For the Southeast Asian nations which had currencies pegged to the US dollar, the higher US dollar caused their own exports to become more expensive and less competitive in the global markets. Southeast Asia’s export growth slowed dramatically in the spring of 1996, deteriorating their current account position. Once the financial markets sensed that the Thai foreign currency reserves were dwindling, they started shorting the Thai Baht. The asymmetric information in the financial markets led to a “herd mentality” among investors. Their actions helped to magnify the underlying weaknesses and hence, make the first domino fall.

The economy ground to a halt, salaries were cut and the price of everything began to go up. The IMF stepped in with a loan but that didn’t help so they went to the US for help but they refused. The US was hardly worried that a small country like Thailand could cause any significant damage beyond its own borders.

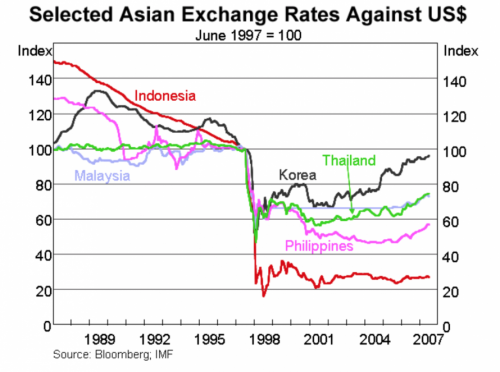

Once Thailand began to unravel, speculators and traders began to get worried about other South Asian countries, such as Malaysia, Indonesia and South Korea. Like a classic run on the bank, investors began to dump their positions in those countries, and at the same time speculators were quick to short the currencies, putting more downward pressure on them. Current Prime Minister of Malaysia, and also Prime Minister at the time, Dr. Mahathir bin Mohamed stated, “As the currency and the stock market went down, we felt totally helpless.” Once the contagion hit Indonesia, the Government and economy collapsed and from that fallout, the social fabric began to collapse. The IMF had to step in and provide huge loans, but with those loans came conditions. These countries were then subjected to acute economic austerity.

The contagion then spread to South Korea but by the time the IMF got to their central bank the money was all gone. In spite of the fact that the South Koreans had convinced everyone their financial foundation was stable. In order to avoid a default, South Korea received a bailout of $55 billion in new loans and credits. In the end roughly $116 billion flowed out of Southeast Asian Markets.

At the time, US hedge fund LTCM, controlled $100 billion in global assets and $1 trillion indirectly. The Asian financial crisis was not factored into their complex mathematical risk equations and therefore took Long Term Capital Management completely by surprise. Contagion came to America.

Looking back, one important point here is that this contagion was not set off by anything fundamental beyond Thailand. If Thailand had been contained, the other economies may have adjusted and set stricter controls in order to avoid a Thai scenario. It was fear of the unknown and a loss of confidence that forced the financial markets to make the moves they made. The corruption, overbuilding, and foolish loans were just kerosene for the fire once the match was lit. Today’s world financial markets and economies are so interlinked that events impacting one region will have an emotional behavioural impact on another. One domino falling sparks fear in the markets that others are sure to follow.

So the question is looking at today’s markets, who will be the first domino to fall? Some thought Cyprus but that was contained. Then there was Greece but that was contained. There was talk of Italy being the first. Then last week we had Turkey. If the Turkish situation deteriorates you can bet that the financial markets will, like during the Asian crisis, become nervous regarding areas beyond Turkey bringing considerable risks of financial contagion. We already saw investors dumping stocks such as Italian bank UniCredit last week, for fear that they are over exposed to risks in Turkey. According to the Bank for International Settlements, international banks had outstanding loans of $224 billion to Turkish borrowers, including $83 billion from banks in Spain, $35 billion from banks in France, $18 billion from banks in Italy, $17 billion each from banks in the United States and in the United Kingdom, and $13 billion from banks in Germany. So what happens next is anybody’s guess but to believe that it couldn’t happen again is probably not the most prudent view to take.

Published at https://www.zerohedge.com/news/2018-08-12/will-turkey-be-first-domino-fall