by Wolfgang Streeck

To understand the conflicts that have erupted in and around the Eurozone over the past five years, it may be helpful to begin by revisiting the concept of money. [1] It is one that figures prominently in Chapter Two of Max Weber’s monumental Economy and Society, ‘Sociological Categories of Economic Action’. Money becomes money by virtue of a ‘regulated organization’, a ‘monetary system’, Weber thought. [2] And following G. F. Knapp’s The State Theory of Money [1905], he insisted that under modern conditions, this system would necessarily be monopolized by the state. Money is a politico-economic institution inserted into, and made effective by, a ‘ruling organization’—another crucial Weberian concept; like all institutions, it privileges certain interests and disadvantages others. This makes it an object of social ‘conflict’—or, better, a resource in what Weber refers to as a ‘market struggle’:

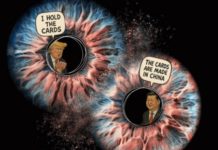

Money is not a ‘mere voucher for unspecified utilities’, which could be altered at will without any fundamental effect on the character of the price system as a struggle of man against man. ‘Money’ is, rather, primarily a weapon in this struggle, and prices are expressions of the struggle; they are instruments of calculation only as estimated quantifications of relative chances in this struggle of interests. [3]

Weber’s socio-political concept of money differs fundamentally from that of liberal economics. [4]The founding documents of that tradition are Chapters IV and V of Adam Smith’s Wealth of Nations, in which money is explained as an increasingly universal medium of exchange, serving an (ultimately, unlimited) expansion of trade relations in ‘advanced societies’—that is, societies based on a division of labour. Money replaces direct exchange by indirect exchange, through the interpolation of a universally available, easily transportable, infinitely divisible and durable intermediate commodity (a process described by Marx as ‘simple circulation’, C–M–C). According to Smith, monetary systems develop from below, from the desire of market participants to extend and simplify their trade relations, which increase their efficiency by continually reducing their transaction costs. For Smith, money is a neutral symbol for the value of objects to be exchanged; it should be made as fit as possible for purpose, even if it has an objective value of its own, arising in theory from its production costs. The state makes an appearance only to the extent that it can be invited by market participants to increase the efficiency of money by ‘putting its stamp’ on it, thus making it seem more trustworthy. Unlike Weber, who differentiated monetary systems according to their affinity to countervailing distributive interests, for Smith the only interest that money can serve is the universal interest in ensuring the smooth functioning of as extensive a market economy as possible.

Remarkably, the post-war sociological tradition chose to follow Smith rather than Weber. The demise of the Historical School of Economics—and the fact that structural functionalism, above all Talcott Parsons at Harvard, ceded the economy as an object of study to Economics faculties increasingly purified in a neo-classical spirit—enabled sociology, as it became established in the post-histoire decades after 1945, to dispense with a theory of money of its own. Instead it opted for a quiet life and chose to conceive of money, if at all, in the manner of Smith, as an interest-neutral medium of communication, rather than as a social institution shot through with power—as a numerical value, a numéraire, rather than a social relation. [5] This led to a rupture, both in sociology and economic theory, with the fierce debates of the interwar years about the nature of money and the political implications of monetary systems. These had been at the heart of Keynesian theory, in particular: see the battles around the social and political implications of the gold standard, driven notably by Keynes himself, or around Irving Fisher’s full-reserve banking model.

Of paradigmatic importance here was Parsons and Smelser’s 1956 work Economy and Society, subtitled ‘A Study in the Integration of Economic and Social Theory’. In Parsonian systems theory, money appears as a representation of purchasing power, the capacity to control the exchange of goods. It also has the special social function of conferring prestige, and thus acts as a mediator between ‘detailed symbols and a broader symbolization’. [6] Historically, money develops, as in Smith, through the growth of the division of labour, which demands an abstract representation of economic value so as to make the expansion of exchange possible. Money appears in this process as a ‘cultural object’ which, together with credit instruments and certificates of indebtedness, ‘constitute rights or claims on objects of economic value’—and hence in Weber’s terms as ‘mere vouchers for unspecified utilities’. [7]

Monetary weapons

That money is far more than this is something for which Parsons, and American sociology in general, might have found ample evidence in his own country—not merely in the interwar years, which after 1945 were somehow declared an exceptional era, but in its earlier history. The discovery of that evidence, however, had to await the emergence in the 1990s of the ‘new economic sociology’, which undertook the rehabilitation of Weber’s view of money as weaponry in the ‘market struggle’. A contribution to this development, as important now as it was then, was furnished in ‘The Color of Money and the Nature of Value’, a study by Bruce Carruthers and Sarah Babb of the domestic political conflicts over a new US monetary system after the Civil War. [8] The authors adopted an analytical distinction proposed by the political scientist Jack Knight: monetary systems, like institutions in general, could not be judged merely according to ‘the coordination-for-collective-benefits conception of social institutions’—in other words, by whether they provided an inter-subjectively communicable symbolization of values and value claims. Just as legitimate and even requisite, according to Carruthers and Babb, was the conflict perspective—we might even call it the political perspective—put forward by Knight, in which a monetary system comes into existence as the result of disagreements between actors with competing interests. [9] As such, it may possess more or less asymmetrical distributive effects and conflicting interests, which are often more important in social reality than their efficiency. [10]

‘The Color of Money’ reconstructs the political and economic divisions over the future monetary regime of the United States, and the nature of money in general, during the last third of the nineteenth century. At that time, the battlefront ran more or less centrally between the Smithian and Weberian conceptions of money. The first emphasized the dependability of money as a medium of symbolic communication, for efficient economic coordination and social integration; this was linked to a naturalist value theory and the call for a return to the gold standard. The alternative view, based on a remarkably well-developed social-constructivist theory of the value of money, espoused the introduction of freely created paper money. As was to be expected, the advocates of gold stressed the public interest in a value-symbolization that could inspire confidence, while the supporters of ‘greenbacks’—printed dollar bills—emphasized the divergent distributive effects of the two concepts of money, representing different material interests. And indeed the rival approaches were rooted in different accumulation practices and ways of life: advocates of the gold standard represented East Coast ‘old money’ and were interested above all in stability; the paper-money contingent was based in the South and West and wanted free access to credit, either to help devalue the debts they had incurred or to boost expansion. Conflicting interests over which development path the fast-growing capitalist economy should take were linked to opposing structures of class power and privilege: the lifeworld of a patrician urban class, above all in New York, against that of the indebted farmers and ‘cowboy operators’ in the rest of the country.

Cash and communicative action

Coming of age in the 1980s, German sociology took its concept of money not from Weber but from Parsons—and, via Parsons, from the economic tradition going back to Smith. This is true not just of Niklas Luhmann, in his adaptation of systems theory, but equally of Jürgen Habermas, even though—or perhaps, precisely because—Habermas developed his ‘Theory of Communicative Action’ in large measure through an immanent critique of Luhmann’s work. The problem, as I understand it, lies in the fact that Habermas’s critique of the concept of a ‘steering medium’, which he took from Luhmann and Parsons, leaves its validity for ‘the functional domains of material reproduction’ untouched, since these domains can, uniquely, be ‘differentiated out of the lifeworld’. [11] Although in Habermasian terms no one really ‘speaks’ in modern economic subsystems—that remains the prerogative of the lifeworld—the ‘special “language” of money’ suffices for that subsystem to perform its function. [12]

The assumption here, of course, is that ‘the economy’ can be thought of as a technical subsystem of modern societies, purified of lifeworld connections and able to function without them in an instrumentally rational, neutral manner. Within the sphere of competence of the economy so conceived there is no compulsion to act; it is possible instead simply to ‘steer’. Thus ‘the economy’ can be seen as a predictable mechanism of means, entirely in the spirit of standard economic theory—although embedded in a more comprehensive context of communication and action, and capable in principle of being organized on a democratic basis. With the aid of money, a ‘steering medium’ that is not just adequate to the task but ideally suited to it, this mechanism confines itself, albeit with a reduced level of communication, to coordinating the actors involved and focusing their efforts on the efficient deployment of scarce resources. [13]

The theoretical consequences are far-reaching. Habermas’s partial incorporation of systems theory—the recognition of a technocratic claim to dominance over certain sectors of society, analogous to relativity theory conceding a limited applicability to classical mechanics—depoliticizes the economic, narrowing it down to a unidimensional emphasis on efficiency, as the price for smuggling a space for politicization into a post-materialist theory of ‘modernity’. The fundamental insight of political economy is forgotten: that the natural laws of the economy, which appear to exist by virtue of their own efficiency, are in reality nothing but projections of social-power relations which present themselves ideologically as technical necessities. The consequence is that it ceases to be understood as a capitalist economy and becomes ‘the economy’, pure and simple, while the social struggle against capitalism is replaced by a political and juridical struggle for democracy. The idea that money functions as a ‘communication system’ supersedes the notion of a monetary system, in Weber’s sense; with it vanishes any idea of money’s political role, as distinct from its technical function. The same holds true for the realization that monetary systems, as political and economic institutions, conform first to power and only secondarily to the market. As a rule, then, they have a bias towards one or other ruling interest. We may say with Schattschneider that, as with the ‘heavenly choir’ of a pluralist democracy, the language of money always speaks with an accent—and normally the same upper-class accent as the choir’s. [14]

Market struggle in the Eurozone

For if money were nothing but a neutral medium of communication—a symbolic language to facilitate the productive coordination of certain types of human action—then we should expect that, after more than a decade, the euro would have brought its users together in a shared identity. Just as the Deutschmark is said to have created a ‘Deutschmark nationalism’, [15] so the euro should have created a European patriotism, as its inventors expected. In 1999, Jean-Claude Juncker—who, as Prime Minister of Luxembourg, was a leading tax adviser to multinational firms—declared that, once citizens held the new notes and coins in their hands at the start of 2002, ‘a new we-feeling would develop: we Europeans’. [16] The same year Helmut Kohl, by then already an ex-German Chancellor, predicted that the euro would create a ‘European identity’ and that it would take ‘at most five years before Britain also joined the currency union, followed directly by Switzerland’. [17] At a slightly lower level, media advertisements solicited support for the single currency with photos of youthful travellers of both sexes gazing into each other’s eyes, in a way that brings nations closer together. Their radiant smiles expressed their joy as they calculated how much money they had saved in commission payments and exchange-rate losses, travelling to their rendez-vous—identity theory and efficiency theory in one!

The ‘European idea’—or better: ideology—notwithstanding, the euro has split Europe in two. As the engine of an ever-closer union the currency’s balance sheet has been disastrous. Norway and Switzerland will not be joining the EU any time soon; Britain is actively considering leaving it altogether. Sweden and Denmark were supposed to adopt the euro at some point; that is now off the table. The Eurozone itself is split between surplus and deficit countries, North and South, Germany and the rest. At no point since the end of World War Two have its nation-states confronted each other with so much hostility; the historic achievements of European unification have never been so threatened. No ruler today would dare to call a referendum in France, the Netherlands or Denmark on even the smallest steps towards further integration. Thanks to the single currency, hopes for a European Germany—for integration as a solution to the problems of both German identity and European hegemony—have been superseded by fears of a German Europe, not least in the FRG itself. In consequence, election campaigns in Southern Europe are being fought and won against Germany and its Chancellor; pictures of Merkel and Schäuble wearing swastikas have begun appearing, not just in Greece and Italy but even in France. That Germany finds itself increasingly faced by demands for reparations—not only from Greece but also Italy—shows how far its post-war policy of Europeanizing itself has foundered since its transition to the single currency. [18]

Anyone wishing to understand how an institution such as the single currency can wreak such havoc needs a concept of money that goes beyond that of the liberal economic tradition and the sociological theory informed by it. The conflicts in the Eurozone can only be decoded with the aid of an economic theory that can conceive of money not merely as a system of signs that symbolize claims and contractual obligations, but also, in tune with Weber’s view, as the product of a ruling organization, and hence as a contentious and contested institution with distributive consequences full of potential for conflict.

Regional peculiarities

The ‘varieties of capitalism’ literature supplies some helpful preliminary indications as to why the single currency is dividing Europe, instead of uniting it—at least in so far as this work is historical-institutional in cast, rather than efficiency-theoretical. [19] Over their course of development, every country in the Eurozone has configured the critical interface between its society and its capitalist economy in its own way; the different monetary systems played a key role in the resulting national economies. [20] The single currency can be understood as the attempt, from whatever motive, to replace the national monetary systems, which were adapted to their institutional and political contexts, with a supranational monetary system that would be equally valid for all the participating societies. It was designed to inject a new, neoliberal form of money into the national economies that would enforce the development of an institutional context appropriate to its own needs.

Modern monetary systems and practices are embedded in nation states and can differ fundamentally from one country to the next. [21] In the case of the single currency, it will suffice to distinguish between the Ideal-Types of the Mediterranean countries and those of Northern Europe, Germany in particular. [22] The European South produced a type of capitalism in which growth was driven above all by domestic demand, supported where need be by inflation; demand was driven in turn by budget deficits, or by trade unions strengthened by high levels of job security and a large public sector. Moreover, inflation made it easier for governments to borrow, as it steadily devalued the public debt. The system was supported by a heavily regulated banking sector, partly or wholly state owned. All these things taken together made it possible to harmonize more or less satisfactorily the interests of workers and employers, who typically operated in the domestic market and on a small scale. The price for the social peace generated in this way was a loss of international competitiveness, in contrast to hard-currency countries; but with national currencies, that loss could be made good by periodic devaluations, at the expense of foreign imports.

The northern economies functioned differently. Their growth came from exports, so they were inflation-averse. This applied to workers and their unions, too, despite the occasional use of ‘Keynesian’ rhetoric—and all the more so in the era of globalization, when cost increases could so easily lead to production being relocated to cheaper zones. These countries do not necessarily need the option of devaluation. Despite the repeated revaluations of its currency, due in part to the revaluation of its products, the German economy has thrived since the 1970s, not least by migrating from markets that compete on price to those that compete on quality. Unlike the Mediterranean states, the hard-currency countries are wary of both inflation and debt, even though their interest rates are relatively low. Their ability to survive without a loose monetary policy benefits their numerous savers, whose votes carry significant political weight; it also means they don’t need to take on the risk of market bubbles. [23]

Inequality from diversity

It is important to stress that no one version of the interface between capitalism and society is intrinsically morally superior to the others. Every embedding of capitalism in society, every attempt to fit its logic into that of a social order will be ‘rough and ready’, improvised, compromised and never entirely satisfactory for any party. This does not stop the partisans of the various national models from decrying the alternatives and promoting their own as the most correct and rational. The reason for this is that what is at stake in the conflict of economic models is not just people’s standard of living but also the moral economy that has become established in each case.

In Northern Europe such cultural chauvinism produces the cliché of the ‘lazy Greeks’, while in the South it results in the notion of the ‘cold-blooded Germans’ who ‘live to work instead of working to live’, with calls for each side to acknowledge its errors and mend its ways. Thanks to such distortions, it seldom occurs to the Germans who call on the Greeks to ‘reform’ their economy and their society to put an end to extravagance and corruption, that they are really asking the Greeks to replace their out-of-date, local forms of corruption with modern, global forms, à la Goldman Sachs. [24]

Monetary systems designed for different social dispensations can coexist, as long as states retain sovereignty and can adjust their currencies to compensate for fluctuations in competitiveness. By contrast, an integrated monetary regime for such disparate economies as Europe’s supply-based North and demand-based South cannot work equally well for both. The consequence is that qualitative horizontal diversity is transformed into a quantitative vertical inequality. When politically differentiated national economies are forced together in a currency union, those disadvantaged by it come under pressure to ‘reform’ their mode of production and the social contract adapted to it along the lines of the countries privileged by the currency. Only if they can and wish to do so—in other words, only if the integrated monetary system creates an integrated capitalist order—can a currency union function free of friction.

Originating battles

The strategic goals and compromises of European Monetary Union were shaped from the start by these inevitably uneven outcomes; the national economies were thereby forced into selective adaptation. The euro was always a contradictory and conflict-ridden construct. By the late 1980s France and Italy, in particular, were fed up with the hard-currency interest policy of the Bundesbank—which, given the premise of the free movement of capital in a financializing common market, had become the de facto central bank of Europe. They were also irked, the French above all, by the periodic necessity of devaluing their currency vis-à-vis the Deutschmark to maintain their competitiveness; this was felt to be a national humiliation. By replacing the Bundesbank with a European Central Bank, they hoped to regain some of the monetary sovereignty they had ceded to Germany, while also making monetary policy in Europe a little less focused on stability and directed rather more towards political goals, such as full employment. To be sure, Mitterrand and his then Finance Minister, Jacques Delors, also hoped to use a currency union—which would exclude the devaluation option and impose a harder currency—to force the French Communist Party and trade unions to give up their political and economic goals. The Banca d’Italia had similar ideas.

The Bundesbank and the overwhelming majority of German economists, predominantly ordoliberal and monetarist in outlook, opposed the single currency because they feared it would undermine Germany’s ‘stability culture’. Kohl would have preferred to see the currency union preceded by a political union—ideally with a German economic policy, of course. His European partners were not calling for a common currency in order to sacrifice even more of their sovereignty, however. Kohl gave way, for fear of losing their support for German reunification; but he probably expected the currency union to be followed, somehow or other, by political union—an expectation still cherished today by Germany’s Europhile centre left, the last supporters of neo-functionalist integration theory. When major allies in Kohl’s political camp threatened to rebel, he overcame their resistance by ensuring that the common monetary regime would follow the German model, with the European Central Bank as a copy of the Bundesbank writ large.

This set the scene for the conflicts of the years to come. The slogan used by the German government to win over sceptical voters was ‘The Euro: Stable as the Mark’. Despite this, the other member states ratified the Maastricht Treaty, presumably relying on their ability to rewrite it under the pressure of economic ‘realities’—in practice, if not on paper. It helped that the 1990s was a time in which the Western economies, with the United States in the lead, were all pursuing a policy of fiscal consolidation in the transition to neoliberal, financialized economies. [25] Committing one’s country to a debt ratio no greater than 60 per cent of GDP, and budget deficits of not more than 3 per cent, corresponded to the spirit of the age; in addition, ‘the markets’ would have ways and means of punishing countries that refused to abide by these rules.

The unequal effects of the currency union soon made themselves felt. Today it is Germany, the Netherlands, Austria and Finland that profit above all from the single currency, but this has only been the case since 2008. In the early phase of the euro, uniform monetary policy turned Germany into the ‘sick man of Europe’. The ECB interest rate was higher than the German inflation rate, though lower than that of the Mediterranean countries, which therefore enjoyed the luxury of negative real interest rates. [26] The cost of government credit also sank dramatically in the South, largely because of the capital markets’ assumption—inspired in part by the European Commission—that, regardless of the treaties, the single currency contained a shared or even a specifically German guarantee of the solvency of the member states. The outcome was a boom in the South and stagnation in Germany, with high unemployment and rising government indebtedness.

Line struggles

All this changed in 2008, with the arrival of the credit crunch—or in other words, with the collapse of the financial markets’ illusions about German or European willingness to act as lenders of last resort for the debts of the South, combined with the fall of interest rates to near zero. The reason why the single currency now favoured Germany lay in the so-called over-industrialization of its economy, a fact lamented as recently as the 1990s. This made it less sensitive to the fiscal crisis and the collapse of credit than states that were more dependent on their domestic markets. For one thing it enabled Germany to focus more strongly than ever on supplying global markets with higher-quality industrial goods. A further factor was the undervaluation of the euro as a currency for Germany, in contrast to the Eurozone more generally. [27] In this way, without wanting or planning it, Germany controversially became the European hegemon, until further notice.

At the same time, the differing compatibilities of the member states’ economies unleashed an increasingly vicious tug-of-war between North and South. The struggle raised, and still raises, three distinct questions: first, the interpretation—and, perhaps, the revision—of the monetary system agreed in the Maastricht Treaty; second, the duty of member states to undertake institutional ‘reforms’, so as to align the South with the North, or vice versa; and third, assuming a persistent disparity of incomes and living standards, the question of balancing payments from North to South.

It should be stressed that none of these problems can be remedied by the methods currently being tried, however fruitful those may be. [28] All three are manifestations of a deep-seated division in the single currency as a political system. And this split, far from being eliminated by any financial ‘rescue’, will only then be felt in its full force. As far as the first problem is concerned—the disagreement over the practical operation of the Treaty—attempts by Southern states to soften up the euro, with the help of the ECB, and thus return to inflation, debt-financing and currency devaluation, have been indignantly countered by the Northern nations, which no longer want to be dragged by majority resolutions into acting as substitute lenders and guarantors for those pre-emptive injections of funds, without which their Southern partners as they stand cannot function. To this extent the internal politics of the single currency already plays a part in the alliances of member states, which are trying to pull the common monetary regime in opposite directions, one group to the South, the other (back) to the North. In their current political and economic configurations, each bloc can only function by gaining control of the interpretation of the monetary regime. But neither wishes to manage without the other. While the Northerners value fixed exchange rates for their export industries, the Southerners want low interest rates; they are prepared to accept treaty restrictions on debt ceilings and deficit limits in the hope that, in an emergency, their fellow members will be more susceptible than the financial markets to diplomatic pressure or appeasement.

In the debates about the ‘correct’ interpretation of the single currency, the current German government and its allies still have the upper hand, at least as long as the South remains dependent on their multi-billion-euro bailouts. If this continues, the Southerners will have no choice but to adapt their political and economic institutions to the neoliberal version of the European monetary regime as authoritatively interpreted by the North. [29] The outcome of such an adjustment process would be unknown; even if all went well, it would entail a lengthy transition period, full of political unrest and economic uncertainty. It would mean, for example, that the South would have to accept fully ‘flexible’ labour markets, à la the North; while in the opposite eventuality the Germans would be forced to abandon their ‘destructive’ saving habits and give up their ‘selfish’ export-based economy.

The market struggle is thus displaced onto the second question: the institutional ‘reforms’ required of member states. In addition to its economic predominance, the North can appeal to the wording of the Treaties and the reform-and-consolidation packages emanating from the ECB; the South for its part might assert its majority on the boards of the Eurozone institutions and the ECB, as well as leveraging the German political class’s need for harmony in Europe. To be sure, both sides would have to reckon with fierce, democratically legitimated resistance to reforms that strike at the heart of their nations’ political-economic settlements. The outcome might be the permanent parallel existence of incompatible institutions, beneath the common monetary regime. In this scenario, the Southerners would defend public-sector job security and protection against dismissal, while employees of Northern export firms would be unwilling to abandon their ‘factory-floor alliances’ or enter into wage agreements that might jeopardize their competitiveness and with it, jobs; the South would not be able to raise its productivity, nor the North its costs, to the point where the two could converge. [30] The struggle between the two approaches would continue, the share of exports and trade surpluses of the North rising, while the pressure on the South for deflation and rationalization would persist.

The result—and this brings us to the third level of conflict—would be a state of permanent friction over the Eurozone’s financial constitution. The struggle might be analogous to the endless disputes in Germany about the financial settlement between central government and the Länder, except that in the EMU this would be a conflict between sovereign states, without the overarching framework of a shared democratic constitution, or anything like the close network of common institutions in a nation-state. Nor would it be fought out inside a single, more or less unified economy, but rather between differently constituted national variants of capitalism, and through the medium of volatile and emotive international relations. The sums involved would be considerable, and they would constantly fall due—even if the ‘structural reforms’ demanded of the South were actually implemented and the countries affected were able to start recovering, after a deflation of 20–30 per cent. The idea that, after all this, they would be able to grow their economies faster than the Northern countries, without any assistance at all, is something only economists could imagine. [31]

How huge the fiscal transfers from the North would have to be cannot be specified with any certainty, but we can be sure they would not suffice to bridge the gulf between North and South. Recognizing that this would involve not only Greece but also Spain and Portugal, and possibly the entire Mediterranean region, the payments required of the North would be proportionally at least as great as the annual transfer of resources made by the FRG to its new Länder after 1990, or by Italy to the Mezzogiorno since the end of the Second World War: roughly 4 per cent of GDP in both cases, with the modest result of merely preventing the income gap between the affluent and the poor regions from growing any larger. [32] As for the EU’s budget, this would have to increase by at least 300 per cent, from 1 to 4 per cent of its GDP. At a conservative estimate, member states might have to transfer some 7 per cent of their public expenditure to Brussels. In Germany, where the Federal budget amounts to about half of public expenditure, the increase would have to be around 15 per cent—during a period of low growth and general fiscal constraint. [33]

These are the principal fault lines inherent in all future Eurozone domestic politics. Over and above one-off ‘rescue payments’ that might be justified on humanitarian grounds, transfers will be politically feasible only if they do not dramatically exceed the EU’s long-standing Regional Development Funds and can credibly be presented as helping a state to help itself. Regular redistributive injections of cash, as an expression of solidarity with less competitive economies in a hard-currency environment, could not be sustained in the Northern meritocracies, with their constant exhortations to work harder; nor in the long run would they be compatible with the self-esteem of the recipient countries. In the case of subsidies that are supposed to render themselves superfluous—as with regional policies at national level, or development aid in the international domain—there are bound to be questions about the payments’ end date, as well as charges that the aid is being used for consumption rather than investment. To prevent transfers legitimated as temporary emergency aid being transformed into de facto long-term assistance, the donors will grant them only under strict conditions, with the power to monitor their use. This inevitably leads to tensions between sovereign states, with accusations that donor nations are behaving like imperialists, interfering in the internal affairs of others and undermining their democracies. Recipient countries will complain about inadequate payments and unwarranted abrogation of sovereign rights, while donors will regard the requested sums as excessive and the accompanying conditions as inadequate. In future, then, the domestic policy of the Eurozone will revolve round the axis of money in exchange for control—thereby offering immeasurable opportunities for nationalist demagogic mobilizations, on every side.

A new system?

It has been a long time since we last heard positive arguments for the single currency, whether political or economic. The only grounds adduced by the defenders of the status quo against the abandonment of what Polanyi would doubtless have called a ‘frivolous experiment’ is that the consequences of a breakup, though not foreseeable, would be worse than a continuation of what has become a permanent institutional crisis. Underlying this is probably the fear of the European political class that voters might present them with the bill for having casually placed the prosperity and peaceful coexistence of the continent at risk.

Yet the costs of dismantling the single currency cannot survive much longer as an argument in favour of its continuation. The Northern hope of escaping from the current predicament with a one-off payment—or even a one-off deflation to bring about structural reform in the South—will evaporate, as surely as Southern hopes for long-term support for social structures ill-suited to a hard-currency regime. Meanwhile, the notion that a pan-European democracy might spring up out of the European Parliament and somehow ride to the rescue will turn out to be an illusion—and the longer the wait, the greater the disillusionment. [34] Less feasible still is the dream of achieving such a democracy by dint of letting the Eurozone crisis drag on until ‘the pain’ becomes too great—not so much the economic pain in the South as the moral and political anguish in the North, above all in Germany.

More likely than a headlong rush into pan-European democracy is that the national polities will fall prey to aggressively nationalist parties. The only remaining supporters of euro-led integration, apart from politicians fearful of losing their seats, will be the middle classes of the South, who dream of achieving a social-democratic consumer paradise on the coat-tails of Northern capitalism, even as this implodes; and the Northern export industries, which want to preserve the credit-financed consumption of the Southerners as long as possible, together with the competitive advantages of an undervalued pan-European currency. However, if convergence in any real sense is definitively ruled out, and the full extent of the need for regular redistributive cash injections becomes evident, the current situation will no longer be sustainable in electoral terms, even in Germany.

For this reason it is essential to stop sanctifying the single-currency regime and supercharging it—in ‘typical German’ fashion—with the expectations and attributes of a post-national salvation. [35]It would then be possible to dispense with the usual horror scenarios—Merkel’s ‘If the euro fails, then Europe fails’ was a particularly crass example—and start seeing the single currency for what it is: an economic expedient that will have lost its raison d’être if it fails to serve its purpose. [36] In Buying Time, I tentatively proposed recasting the single currency along the lines of Keynes’s original Bretton Woods model: the euro as an anchor for national or multinational individual currencies, with agreed mechanisms to cancel out economic imbalances, including the possibility of resetting exchange rates. This would in practice do away with the ‘gold standard’ implicit in the single currency, which drains the democracies dry without helping to establish a supranational democracy. Broadly speaking, this would be a return to the situation of 1999–2001, when the euro and the national currencies of the member states existed in parallel, admittedly with fixed, non-variable parities. The difference would be that now the parities could be revised by a process regulated by treaty—not by foreign-exchange markets or unilateral government intervention. Since I understood even less about the technical details than I do today, I did not elaborate on this proposal. Moreover, I was quite sure that the elites governing Europe would cling stubbornly to their unification project, however divisive it might prove to be—which is exactly what happened.

Yet since 2013, an astonishing number of voices have been heard in favour of a flexible currency regime, one that could enable democratic politics to even out imbalances through less destructive means than internal devaluations. The suggestions made range from a return to national currencies, via the temporary or permanent introduction of parallel currencies, together with capital controls, right through to a Keynesian two-tier currency system. [37] No ‘nostalgia for the Deutschmark’ is required to see the urgent need for joint reflection on the reconstruction of the European single currency, in a way that might be beneficial for Europe, democracy and society. In principle, this theme might also emerge from the no less urgent search for a better globalmonetary system than exists at present—one that has become increasingly dysfunctional since the definitive dismantling of the Bretton Woods regime in the early 1970s, and almost brought the world economy to the point of collapse in 2008.

The failure of the euro is just one development among many to dispel the illusion that arose from the anomalously peaceful conditions of the post-war period—the conviction that what money is and how it should be managed is a question that has been settled once and for all. Debates about a new global monetary and financial regime are now well overdue. Their task will be to devise a system flexible enough to do justice to the conditions and constraints governing the development of all societies participating in the world economy, without encouraging rival devaluations, or the competitive production of money or debt, together with the geostrategic contests they foster. Agenda items would include the successor to the dollar as a reserve currency, the empowerment of states and international organizations to set limits to the free movement of capital, regulation of the havoc caused by the shadow banks and the global creation of money and credit, as well as the introduction of fixed but adjustable exchange rates. Such debates could take their cue from the astonishing wealth of ideas about alternative national and supranational monetary regimes produced in the interwar years by such writers as Fisher or Keynes. They would teach us at the very least that money is a constantly developing historical institution that requires continual reshaping, and must be judged as efficient not just in theory but also in its political function. The future of the European single currency could in that way become a subordinate theme of a worldwide debate about a monetary and credit system for capitalism—perhaps even for a post-capitalist order of the twenty-first century.

Or not, as the case may be. Now more than ever there is a grotesque gap between capitalism’s intensifying reproduction problems and the collective energy needed to resolve them—affecting not just the necessary repairs to the monetary system, but also regulation of the exploitation of labour-power and the environment. This may mean that there is no guarantee that the people who have been so kind as to present us with the euro will be able to protect us from its consequences, or will even make a serious attempt to do so. The sorcerer’s apprentices will be unable to let go of the broom with which they aimed to cleanse Europe of its pre-modern social and anti-capitalist foibles, for the sake of a neoliberal transformation of its capitalism. The most plausible scenario for the Europe of the near and not-so-near future is one of growing economic disparities—and of increasing political and cultural hostility between its peoples, as they find themselves flanked by technocratic attempts to undermine democracy on the one side, and the rise of new nationalist parties on the other. These will seize the opportunity to declare themselves the authentic champions of the growing number of so-called losers of modernization, who feel they have been abandoned by a social democracy that has embraced the market and globalization. Furthermore, this world, which lives under the constant threat of possible repetitions of 2008, will be especially uncomfortable for the Germans, who for the sake of the euro will find themselves having to survive without the ‘Europe’ to which they had once looked to provide them with a safe dwelling place, surrounded by well-disposed neighbours.

Translated by Rodney Livingstone

[1] This essay originated as the Distinguished Lecture in the Social Sciences, Wissenschaftszentrum Berlin, 21 April 2015.

[2] Max Weber, Economy and Society, Guenther Roth and Claus Wittich, eds, New York 1968, pp. 48, 166.

[3] Weber, Economy and Society, p. 108.

[4] In what follows I am indebted to the important and stimulating discussion in Geoffrey Ingham’s The Nature of Money, Cambridge 2004.

[5] Ingham, The Nature of Money.

[6] Talcott Parsons and Neil Smelser, Economy and Society: A Study in the Integration of Economic and Social Theory, London 1984 [1956], p. 71.

[7] Parsons and Smelser, Economy and Society, pp. 140 ff, 106. See also Parsons’ 1964 essay, ‘Evolutionary Universals’, in which ‘money and the market’ appear as one of the four fundamental historic achievements of modern societies, alongside bureaucratic organization, a universalistic legal system and democratic forms of association. Parsons sees ‘evolutionary universals’ as structural features of social systems, without which major developmental steps would be blocked. As interconnected institutions, money and the market make ‘a fundamental contribution to the adaptive capacity of societies’ in which they have developed, because they facilitate the release of resources from their ascriptive bonds and make it possible to dedicate them to new ends. In this process, money is indispensable as a ‘symbolic medium’ that ‘represents’ in ‘abstract’, ‘neutral’ form the ‘economic utility’ of the concrete goods for which it is exchangeable, as opposed to the competing claims of other orders. Money develops differently in different societies since its functions can, to a greater or lesser degree, be assumed by bureaucratic organizations. But the question is always to what extent the institutional elements of a concrete monetary system fulfil the task of providing ‘the operative units of society, including of course its government, with a pool of disposable resources that can be applied to any of a range of uses and within limits can be shifted from use to use’: Parsons, ‘Evolutionary Universals in Society’, American Sociological Review, vol. 29, no. 3, June 1964, pp. 350.

[8] Bruce Carruthers and Sarah Babb, ‘The Color of Money and the Nature of Value: Greenbacks and Gold in Postbellum America’, American Journal of Sociology, vol. 101, no. 6, 1996, pp. 1,558 ff.

[9] Jack Knight, Institutions and Social Conflict, Cambridge 1992.

[10] In this sense, monetary systems can be regarded as analogous to political systems, which typically have a built-in tendency to distort decisions in favour of privileged interests. They have a dynamic of their own, which E. E. Schattschneider, referring to the pluralist democracy of the United States, has characterized as a ‘mobilization of bias’; ‘the flaw in the pluralist heaven is that the heavenly choir sings with a strong upper-class accent’: The Semi-Sovereign People, New York 1960, p. 35. I owe the reference to a recent essay by Jacob Hacker and Paul Pierson, ‘After the “Master Theory”: Downs, Schattschneider, and the Rebirth of Policy-Focused Analysis’, Perspectives on Politics, vol. 12, no. 3, 2014. In The Nature of Money, Ingham describes money as a ‘social relation’, whose concrete shape is determined by the particular monetary system underlying it.

[11] Jürgen Habermas, The Theory of Communicative Action, vol. 2: Lifeworld and System, trans. Thomas McCarthy, Boston 1985, p. 261.

[12] Habermas, Theory of Communicative Action, p. 259.

[13] For the treatment of money in Habermas, see also Nigel Dodd, The Sociology of Money: Economics, Reason and Contemporary Society, New York 1994.

[14] One could add that global money speaks with an American accent; while we are always told that, like the metre or the yard, ‘money has no colour’, the dollar is undeniably green, not gold, just as the euro is black, red and yellow.

[15] Jürgen Habermas, Die Zeit, 30 March 1990.

[16] Dirk Koch, ‘Die Brüsseler Republik’, Der Spiegel, 27 December 1999. Juncker’s theory of identity fits comfortably with a theory of cognition that informs the policy of social engineering he is pursuing. As an example of ‘permissive consent’, it is splendidly summed up in the following account of his practice: ‘We decide something, put it out into the world and wait for a while to see what happens. If there is no great uproar and no rebellions because most people don’t really grasp what we have decided, then we just move on to the next stage—step by step, until there is no going back’ (ibid., my emphasis). As to the underlying practical ethics, we recollect the maxim Juncker proclaimed when he presided over the Eurozone bank rescue: ‘When matters get serious, we have to tell lies’. In 2014, to the general acclaim of all right-thinking Europeans, Juncker was elected President of the European Commission; according to Jürgen Habermas, ‘Any other decision would have been a blow to the heart of Europe’: Frankfurter Allgemeine Zeitung, 29 May 2015.

[17] Rainer Hank, ‘Europa der Heuchler’, FAZ, 15 March 2015.

[18] There have been some personal tragedies along the way. Schäuble, of all people—the long-standing champion of a ‘core Europe’, with Germany and France as its indissolubly united centre—stood accused in April 2015 of an ‘intolerable and unacceptable hostility to France’, based on his alleged wish to place its economy ‘under supervision’. These attacks came in response to Schäuble’s remarks in Washington to the effect that ‘it would be better for France to be compelled to introduce reforms . . . but this is all difficult, such is the nature of democracy’—the common sense of every German finance minister, of whatever party. It was reported that the chairman of the French Socialists would be calling for ‘confrontation with the European Right’, and especially ‘with the CDU–CSU’. The Parti de Gauche demanded that Schäuble ‘apologize to the French people’; his statements were said to exemplify ‘the new German arrogance’, Germany was out to dominate Europe, etc. See Frankfurter Allgemeine Zeitung, 18 April 2015.

[19] On this distinction, see my ‘E Pluribus Unum? Varieties and Commonalities of Capitalism’, in Mark Granovetter and Richard Swedberg, eds, The Sociology of Economic Life, Boulder, CO 2011.

[20] As Fritz Scharpf emphasizes in his critical discussion of Habermas’s integration theory, the institutions of political economy—and not just the liberal guarantees of freedom and equality—belong among the historical achievements fought for through nation-states; they cannot simply be standardized at a supranational level or abolished in favour of supranational nostrums. Anyone who has witnessed the interminable debates between European trade unions over the right forms of co-determination in large and small enterprises will be well aware of this. See Scharpf, ‘Das Dilemma der Supranationalen Demokratie in Europa’, Leviathan, vol. 43, no. 1, 2015, and Habermas, ‘Warum der Ausbau der Europäischen Union zu einer supranationalen Demokratie nötig und wie er möglich ist’, Leviathan, vol. 42, no. 4, 2014.

[21] See Georg Friedrich Knapp, Staatliche Theorie des Geldes, Munich and Leipzig 1905; published in English in an abridged edition as The State Theory of Money, trans. H. M. Lucas and J. Bonar, London 1924.

[22] On what follows, see among others, Klaus Armingeon and Lucio Baccaro, ‘Political Economy of the Sovereign Debt Crisis: The Limits of Internal Devaluation’, Industrial Law Journal, vol. 41, no. 3, 2012; Lucio Baccaro and Chiara Benassi, ‘Softening Industrial Relations Institutions, Hardening Growth Model: The Transformation of the German Political Economy’, Stato e mercato 102, 2014; Charles Blankart, ‘Oil and Vinegar: A Positive Fiscal Theory of the Euro Crisis’, Kyklos, vol. 66, no. 3, 2013; Peter Hall, ‘The Economics and Politics of the Euro Crisis’, German Politics, vol. 21, no. 4, 2012; Bob Hancke, Unions, Central Banks, and EMU: Labour Market Institutions and Monetary Integration in Europe, Oxford 2013; Martin Höpner and Mark Lutter, ‘One Currency and Many Modes of Wage Formation: Why the Eurozone is too Heterogeneous for the Euro’, MPIfG Discussion Paper 14/14, Cologne 2014; Alison Johnston and Aidan Regan, ‘European Integration and the Incompatibility of Different Varieties of Capitalism: Problems with Institutional Divergence in a Monetary Union’, MPIfG Discussion Paper 14/15, Cologne 2014; Torben Iverson and David Soskice, ‘A structural-institutional explanation of the Eurozone crisis’, paper given at LSE, 3 June 2013.

[23] ‘First save, then buy’ is the motto of traditional German cultural and economic behaviour, supported by a complex bundle of mutually complementary political and economic institutions. See recently Daniel Mertens, ‘Privatverschuldung in Deutschland: Institutionalistische und vergleichende Perspektiven auf die Finanzialisierung privater Haushalte’, doctoral dissertation, MPIfG, Cologne 2014.

[24] I leave open the question of how desirable it would be for societies like Greece or Spain to ‘modernize’ in the sense of casting off their ‘feudal shackles’ (see Albert Hirschman, ‘Rival Interpretations of Market Society: Civilizing, Destructive, or Feeble?’, Journal of Economic Literature, vol. 20, no. 4, 1982) for two reasons: first, intervening in another country in this way is not an option; second, there is more than one way of (temporarily) harmonizing capitalism and society. Even more than individual American states, European nation-states can and should be treated as ‘laboratories of democracy’ (see Lewis Brandeis in New State Ice Co. vs Liebman, 1932), where ‘democracy’ may be deemed to include, not just the institutional formalities of collective debate and policy development, but the always-provisional configuring of the conflict zone between society and the capitalist economy.

[25] On this see my ‘The Rise of the European Consolidation State’, in Desmond King and Patrick Le Gales, eds, The Reconfiguration of the State in Europe, Oxford 2015.

[26] Fritz Scharpf, ‘Political Legitimacy in a Non-Optimal Currency Area’, MPIfG Discussion Paper 13/15, Cologne 2013.

[27] According to Morgan Stanley in 2013, at an exchange rate of 1.36 to the dollar, the euro was undervalued by 13 per cent for Germany and overvalued by 12–24 per cent for Italy and Greece.

[28] A striking failure of the present political debate, especially in Germany, is that the problems of the Eurozone are being treated as a single, albeit serious crisis, which can be overcome by means of what may be costly payments to rescue banks or states, or both, but which—it is assumed—will only have to be made once.

[29] In that event, the current ECB programme of quantitative easing would not imply a shift to the ‘Southern’ view but merely a temporary fix, in exchange for which the South will have to impose Northern ‘reforms’. In as much as political convictions can be discerned in someone like Draghi, they tend more in this direction than towards a regime change in favour of the South.

[30] Some time ago, in recognition of this, the German Left (Lafontaine, Flassbeck) withdrew their longstanding demand that German trade unions should adopt an aggressive wage policy in order to dismantle Germany’s competitive advantage in the single currency and thus, by adjusting to the economies of the South, help to bring about the necessary convergence. Their current demand, for the abolition of the single currency in its present form, is the logical consequence of this. See Heiner Flassbeck and Costas Lapavitsas, Nur Deutschland kann den Euro retten: Der letzte Akt beginnt, Frankfurt am Main 2015.

[31] Comparable to economists’ belief in convergence through reform is the belief of the Europhile centre left in convergence through debt relief; both are equally unrealistic and comprehensible only as rhetorical devices to immunize a utopian ideology against empirically based doubts.

[32] See my paper with Lea Elsasser, ‘Monetary Disunion: The Domestic Politics of Euroland’, MPIfGDiscussion Paper 14–17, Cologne 2014, p. 14. To put the transfer policy in perspective, it should be considered in relation to the geostrategic orientation of the EU, whose accession policy is the more strongly inspired by the US, the further east it goes. Transfers would then be necessary to the whole of the Balkans, from Serbia to Albania—all states that are potential, self-defined recipients of subsidies. It is noteworthy how little discussion there has been of the problems and costs of an expansion to the south-east, with or without a resolution of the Mediterranean crisis. The relevant keyword here might be ‘overextension’.

[33] The idea that Germany will make good Europe’s economic asymmetries off its own bat—whether out of fear of Europe or love for it—raises wishful thinking to a whole new level.

[34] See my comment on Wolfgang Merkel, ‘Is Capitalism Compatible with Democracy?’, Zeitschrift für vergleichende Politikwissenschaft, 7 February 2015.

[35] Such as the claim that the single currency is the guarantee of peace and therefore indispensable. The long European peace began in 1945, while the single currency was not launched until 1999. Together with the Common Market (with its national currencies), it was above all NATO and the Cold War that pushed the countries of Europe to maintain the peace, in contrast to the interwar period. The single currency, by contrast, became the cause of discord in Europe rather than peace. And as for the EU’s contribution to the maintenance of peace in general, the official story hardly stands up if we consider the case of Ukraine, where ‘Western’ plans for a further expansion of the EU to the East have persistently exacerbated the current state of war.

[36] Merkel’s ineffably demagogic dictum (19 May 2010) is widely treated as dogma even today in the ranks of the centre left. Europhiles like Merkel confuse Europe’s cultural tradition with the bad policy decisions for which they are responsible.

[37] The relevant literature here is too extensive to refer to it in detail. It should be noted that it hails from both ‘right’ and ‘left’, and includes reflections on how the costs of leaving a currency union can be loaded at least in part onto countries whose unrealistic promises, both explicit and implicit, had lured soft-currency countries into the currency union to begin with. See especially Heiner Flassbeck and Costas Lapavitsas, Against the Troika: Crisis and Austerity in the Eurozone, London and New York 2015, with an introduction by Oskar Lafontaine; as well as ongoing contributions by the American economist Allan Meltzer (Frankfurter Allgemeine Sonntagszeitung, 16 November 2014), the Dutch economists and journalists around André ten Dam (‘The Matheo Solution’), the French economists Jacques Maizier and Pascal Petit (Cambridge Journal of Economics, June 2013) and, among many others, Wolfgang Münchau (Financial Times, 16 March 2015).