By Indrajit Samarajiva

Apr. 9, 2025

We are witnessing the planned demolition of America as a world trade center. The historical bin is laden with economic bullshit, begging to be set on fire by a historical arsonist. And so Trump emerges, hijacking history and flying tariffs into the towers of American power. I, for one, am here for it. Death to America, by suicide as well as Resistance.

Stephen Miran is the closest thing to an economic brain behind Trump. I read his stupid-ass white paper to understand stupid-ass white people, and include it for your perusal at the bottom of this article. I must qualify that rationalizing the actions of a mad king is itself madness. Trump just follows his ‘gut’ and everybody else just reads the entrails. Now that they’ve gutted the world economy, we can at least see how the guts spill as opposed to how this was foretold.

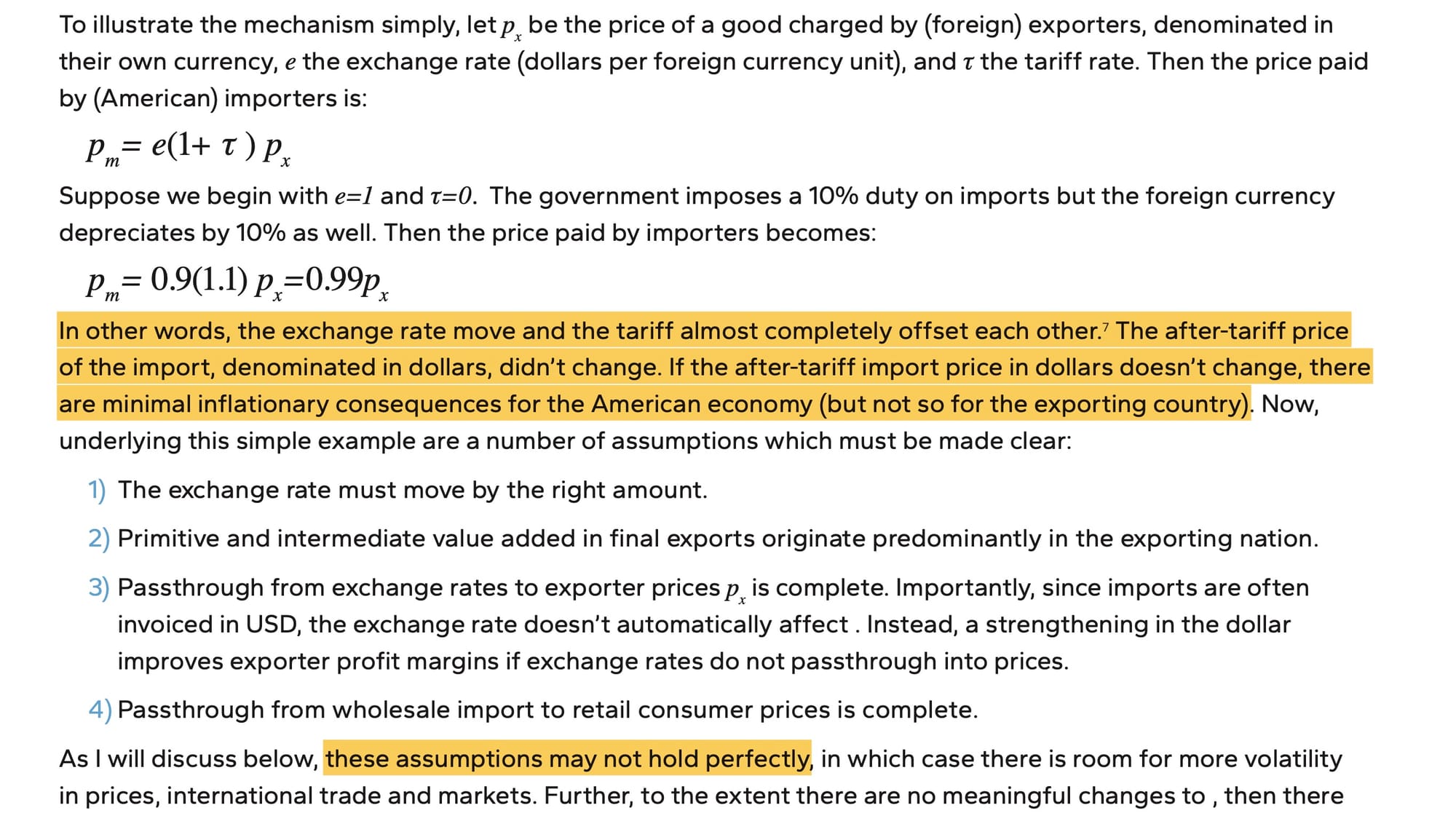

Miran’s mirage is that, “Tariffs provide revenue, and if offset by currency adjustments, present minimal inflationary or otherwise adverse side effects.” Broadly speaking, that America can have its cake and eat it too, and everybody else can eat shit. Miran said this is “consistent with the experience in 2018-2019. While currency offset can inhibit adjustments to trade flows, it suggests that tariffs are ultimately financed by the tariffed nation, whose real purchasing power and wealth decline, and that the revenue raised improves burden sharing for reserve asset provision.”

This is how tariffs are supposed to ‘pay for themselves,’ through currency adjustments abroad. For example, let’s say I’m using $100 USD to buy 100 XYZ worth of goods. If tariffs go up by 10% I have to pay $110, boo. However, if that XYZ currency depreciates by 10%, my dollars stretch 10% further than before! I can pay $90 to get that same 100 units of XYZ currency, pay the US Treasury $9 for doing such good extortion, and even pocket a dollar. Tariffs can thus actually save money, as long as a bunch of completely impossible assumptions hold.

This is what Miran calls perfect currency offset. He says, “since the exporters’ citizens became poorer as a result of the currency move, the exporting nation ‘pays for’ or bears the burden of the tax, while the U.S. Treasury collects the revenue.” This is classic beggar-thy-neighbor economics, discredited by Adam Smith centuries ago but, you know, fuck it. Calling Miran a thinker is far too generous, he’s just telling the Orange King what he wants to hear, dressing naked imperialism in formulas.

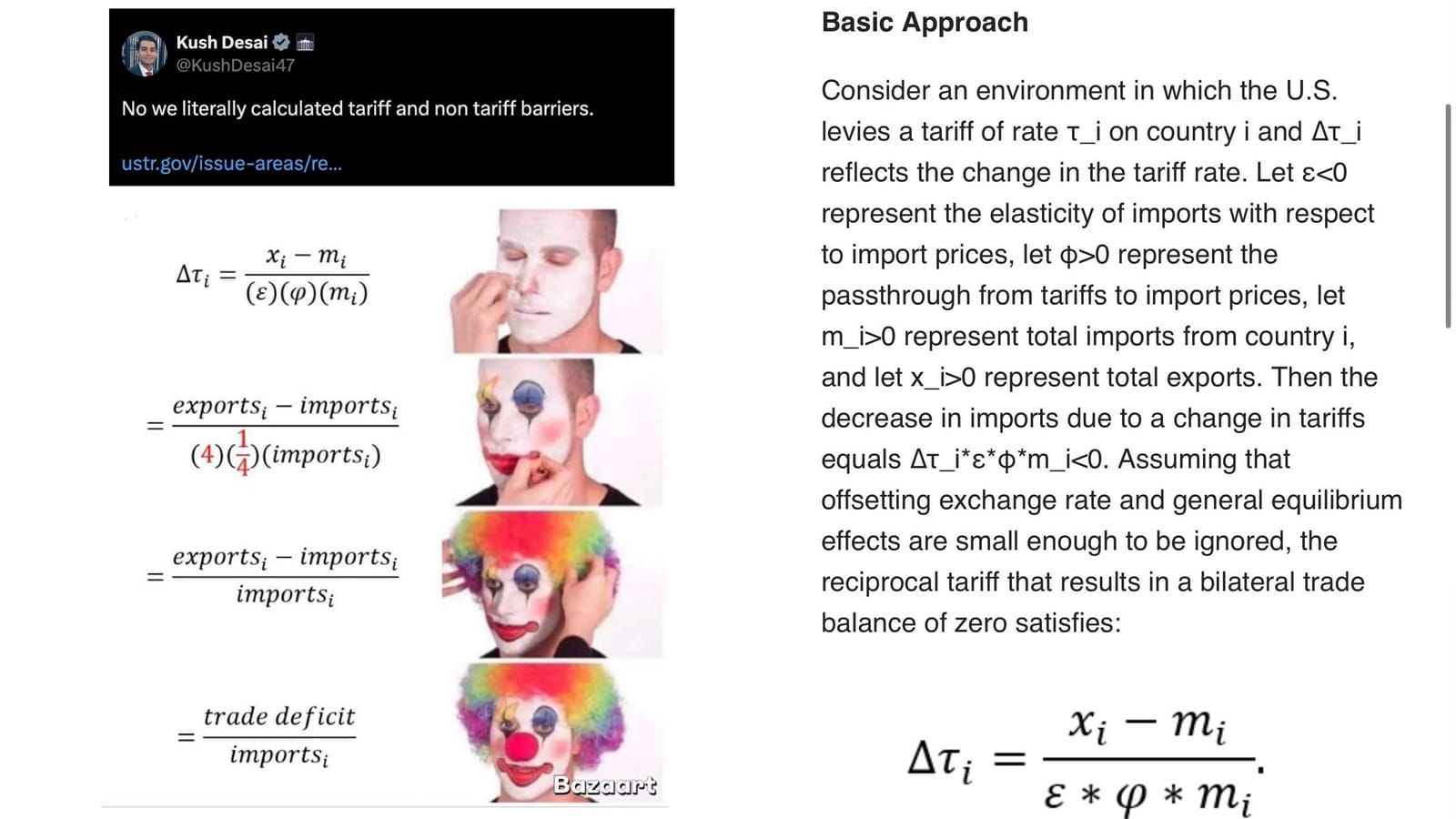

This sort of magical math is endemic across the Trump administration. For example, their formula for calculating tariffs looks complicated, but the two variables (funny E and funny O) are randomly set to 4 and ¼. One fourth of four is one, and multiplying by one does nothing. The variables just cancel out. It’s a joke.

To be honest, this is fairly standard for western economics, which has a bunch of assumptions that are provably false (like rational actors, perfect competition, or even the separation of economics from other disciplines). Economics is maddest ‘science’, imagine if chemistry had a completely unproven periodic table and did experiments on entire human populations anyways, frequently killing them. That’s Economics 101.

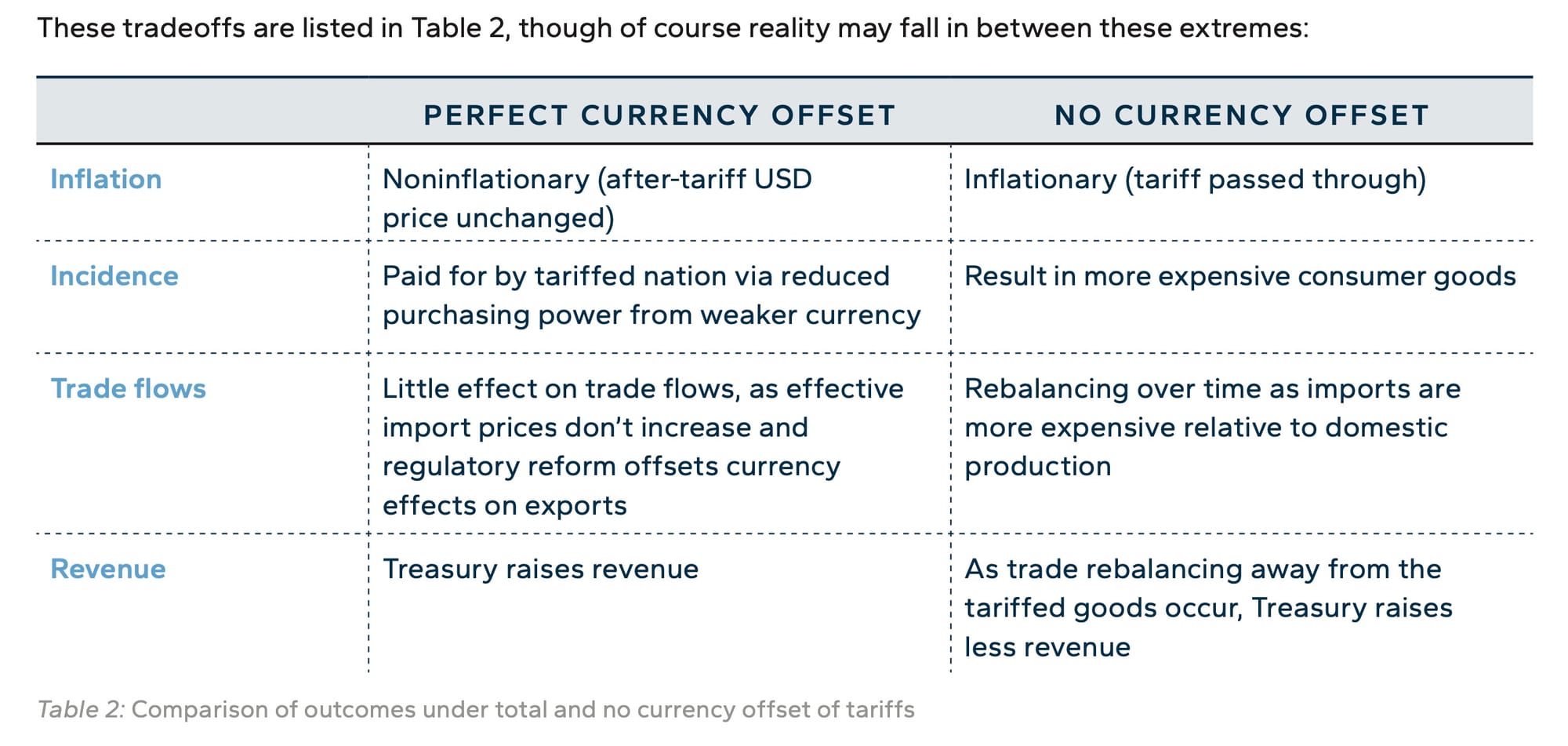

In the ‘perfect’ scenario Miran describes, tariffs are non-inflationary because of the currency offset. American prices don’t change because foreign countries get deranged and the US Treasury gets money out of nowhere. Miran lists the tradeoffs here:

It’s fitting that this theory is called currency offset because it perfectly describes the rapper Offset’s experience at the Gucci store. Offset bought so much, usually with duffel bags of cash, that Gucci gave him a 30% discount (source: internet).

The idea is that even if America raises tariffs by 30%, they’ll get a matching 30% ‘discount’ because everyone else’s currency will depreciate that much. You theoretically dump all the costs abroad, and keep profits at home. Note that the part about reshoring manufacturing is somewhat coincidental. America still has no industrial policy and no state-led development (because that would be communism). This is still pure financialization, just with the finance guys running the government. The maths should just math on their own, without America doing real work or getting ready at all. Within a few days, however, this theory ran into practice and promptly exploded.

America’s initial tariffs on China were 34% but the Yuan has only depreciated less than 1%. Give it time I guess, but this is one of those weeks when decades happen, and it’s suddenly 2030. China has flying cars and zero fucks to give. China hit America with actually reciprocal tariffs, and America re-reciprocated, hitting China with 104% tariffs now, they’re trading blows before I can hit publish. Now how does the math math? How does the Yuan lose 104% of its value? China would have to send $1000 worth of goods to America for free, with an extra $40 in a red envelope as tribute (which Miran earnestly suggests).

Currency offset is already implausible, but it’s not mathematically possible at over 100% tariffs. Trump has eviscerated any economic entrail reading, he’s just shooting from the gut and doesn’t care what he hits. Miran is at least honest when he says, “In a broader sense, sanctions can also be perceived as a modern-day form of a blockade.” What Trump is doing against the whole world is an act of war, not just a trade war, as Warren Buffett has said. This is gunboat diplomacy without guns (currently being used to genocide Palestine) or boats (America builds only 0.1% compared to China’s over 50%) or even basic diplomacy. As China said via the Global Times,

“China is an ancient civilization and a country of etiquette. The Chinese people value sincerity and trust as their core principles. We will not provoke troubles, but we never flinch when trouble comes our way. Pressuring and threatening are not the correct way to engage with China. We have taken, and will continue to take, firm measures to defend our sovereignty, security, and development interests.

China-US economic and trade relations should be based on mutual benefit and win-win cooperation. The US should align with the shared expectations of people from both nations and the people of the world, and, in light of the fundamental interests of both countries, stop using tariffs as a weapon to suppress China’s economy and trade, and stop harming the legitimate development rights of the Chinese people.”

As the CPC has long said, China pursues win-win development (a la Adam Smith, really) but what America is doing under Trump is complete lose-lose. They’re shooting themselves with tariffs, and hoping that everyone else bleeds more.

Understanding Triffin’s Dilemma

Miran at least has the concept that there are trade-offs with trade, though he basically just ignores them because ‘boss said so’. Trump wants to have his cake and eat it too, and Miran, as a simpering sycophant, just dresses up his delusions in fancy formulae. Marie Antoinette at least offered people cake, whereas Trump just tells them to eat shit and be thankful for it.

The biggest trade-off is between being a reserve currency and running a trade surplus. You basically can’t do both. The US dollar is actually America’s main export. They make up liquidity as a service on computers and get real stuff in return. This is not an actual problem but has been the greatest opportunity in human history, which they just squandered. If America wanted to take care of its people and do manufacturing it could have done, how they spent their infinite money was a policy choice and they just chose wrong. Now they’re blaming everyone else, holding a gun to their heads and blubbering.

Trump is obsessed with reducing trade deficits but also wants the dollar to be the reserve currency. How do his sycophants square this circle? Well, Miran says this will be solved by punishments and ‘policies’. In short, the beatings will continue until morale improves. As Miran says,

“Despite the dollar’s role in weighing heavily on the U.S. manufacturing sector, President Trump has emphasized the value he places on its status as the global reserve currency, and threatened to punish countries that move away from the dollar. I expect this tension to be resolved by policies that aim to preserve the status of the dollar, but improve burden sharing with our trading partners.

International trade policy will attempt to recapture some of the benefit our reserve provision conveys to trading partners and connect this economic burden sharing with defense burden sharing. Although the Triffin effects have weighed on the manufacturing sector, there will be attempts to improve America’s position within the system without destroying the system.”

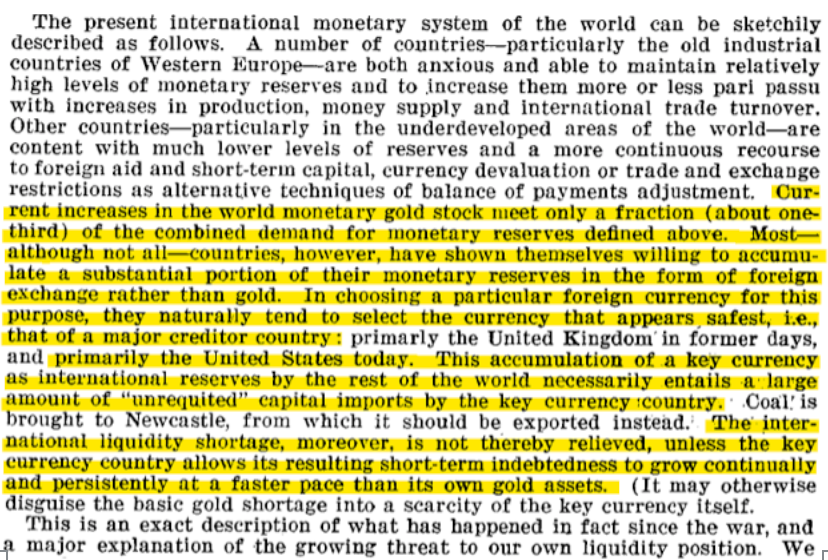

Trade policy is actually complicated and takes years, these guys are just getting ChatGPT to spit out spreadsheets and tariffing penguins. Miran’s white paper is called “A User’s Guide to Restructuring the Global Trading System” but it reads more like a cocaine user’s guide to perpetual motion. The fact is that the ‘Triffin effects’ Miran is talking about were discussed much more cogently 65 years ago, by Robert Triffin.

Triffin said was, “The accumulation of a key currency as international reserves by the rest of the world necessarily entails a large amount of ‘unrequited’ capital imports by the key currency country. Coal is brought to Newcastle, from which it should be exported instead. The international liquidity shortage, moreover, is not thereby relieved, unless the key currency country allows its resulting short-term indebtedness to grow continually and persistently at a faster pace than its own gold assets.”

Triffin said ‘requiting’ (ie balancing) the trade, would cause a Greatest Depression. Without liquidity, global finance would crash. Triffin said, “The restoration of overall balance in the US international transactions would put an end to this process and deprive the rest of the world of the major source, by far, from which the international liquidity requirements of an expanding world economy are being met currently in the face of a totally inadequate supply of monetary gold. This might trigger off tomorrow—as it did under very similar circumstance in the early 1930s—a new cycle of international deflation, currency devaluations, and trade exchange restrictions.”

Standing athwart history without reading it, you can see the Trump team doing exactly what Triffin warned against. They are trying to force currency devaluations through trade exchange restrictions, causing maximum volatility and shock. More sane hands like have proposed a super-sovereign currency (like Keynes aborted Bancor, or IMF SDRs) that could resolve Triffin’s Dilemma. This, for example, is from Dr. Zhou Xiaochuan, Governor of the People’s Bank of China, in 2009,

On a bipartisan basis, however, Americans are racist morons. As Biden’s Ambassador to China Nicholas Burns said, “We don’t want to live in a world where the Chinese are the dominant country.” They’d rather go murder-suicide with the world economic system and blow the whole thing up.

Misunderstanding Triffin’s Dilemma

To be honest, you can see that America already hit the jaws of Triffin’s Dilemma in the 1970s and have just been jaw-jawing their way through ever since. Everything since going off the gold standard has been kicking this time bomb down the road. Trump is just saying this is the end of the road, where the can explodes.

Miran has a dim understanding of Triffin’s paradox in that he thinks it can be resolved by reasserting American sovereignty, ie because the Orange King says so. He thinks America can reset to a ‘Triffin equilibrium’ not by spending decades building infrastructure, educating its people, and growing productive capacity like China did, but by putting some numbers on a spreadsheet and calling it ‘Liberation Day’. Miran talks about when “global growth exceeds the reserve country’s growth for a long period of time” which has long been happening, but he has no answer for building up America’s economy in response. Instead, they just want to throw a wrench in everybody else’s economy, and get paid for it. This is how Miran describes his idea of ‘Triffin World’,

“Such phenomena reflect what can be described as a “Triffin world,” after Belgian economist Robert Triffin. In Triffin world, reserve assets are a form of global money supply, and demand for them is a function of global trade and savings, not the domestic trade balance or return characteristics of the reserve nation. When the reserve country is large relative to the rest of the world, there are no significant externalities imposed on the reserve country from its reserve status. The distance from the Triffin equilibrium to the trade equilibrium is small. However, when the reserve country is smaller relative to the rest of the world—say, because global growth exceeds the reserve country’s growth for a long period of time—tensions build and the distance between the Triffin equilibrium and the trade equilibrium can be quite large. Demand for reserve assets leads to significant currency overvaluation with real economic consequences.

In Triffin world, the reserve asset producer must run persistent current account deficits as the flip side of exporting reserve assets. USTs become exported products which fuel the global trade system. In exporting USTs, America receives foreign currency, which is then spent, usually on imported goods. America runs large current account deficits not because it imports too much, but it imports too much because it must export USTs to provide reserve assets and facilitate global growth. This view has been discussed by prominent policymakers from both the United States (e.g. Feldstein and Volcker, 2013) as well as China (e.g. Zhou, 2009).”

What Miran misses, in his maudlin America myopia, is that no one is forcing America to import too much, just as no one’s forcing them to do fentanyl. America made policy choices to legalize stock buybacks and corruption instead of doing anything useful. They chose usury. America had literally all the money in the world and no idea what to do with it. These were all political choices, not economic consequences. America eviscerated the very idea of having a state in the 1980s (that would be communism), which leads precisely to the state they’re in (the collapse of capitalism).

America whinging now is like someone who won an inheritance from their suicidal European uncles, spent it all on drugs, gambling, and booze, and then blames it all on the inheritance. Oh, what is this horror, the consequences of my own actions, must be everybody else’s fault. America is just the latest in a long line of murdering, thieving imperialists, and the only relief is that suicide runs in the family.

Not Resolving The Dilemma

Triffin’s Dilemma is based on the idea of avoiding a depression, but Miran’s Mirage is the idea of jumping into the void head first and alone. As he said, “Unilateral solutions are more likely to have undesired side effects, like market volatility. Multilateral solutions may have less volatility, but entail the difficulty of getting trading partners onboard, which curtails the size of the potential gains from reshaping the system.” America went fully unilateral with these tariffs. They decided to—as gambler’s have said since time immemorial—to just roll them bones. This leads to the white-knuckle ride traders are on now.

China is left as the voice of reason, saying, “Development is a universal right of all nations, not the privilege of a few. There are no winners in trade wars or tariff wars, and protectionism offers no way out. All countries must uphold genuine multilateralism, jointly oppose all forms of unilateralism and protectionism, safeguard the international system with the United Nations at its core, and protect the multilateral trade framework centered on the WTO.” Unfortunately, they’re talking into the void now.

America has flown two sets of tariffs into the center of world trade and that shit is going down. It’s the demolition of a bankrupt casino, something Donald Trump is familiar with. He’s one of the few businessmen since Bugsy Siegel to lose money on casinos, and now he’s blowing up the biggest money-printing machine of all time. Trump lights the match, but the slaving, stealing American economy was always rigged, and it was always rigged to blow. As the delusional psychopath Nicky Santoro said in the intro to the film Casino, “Matter of fact, nobody knew all the details. But it should have been perfect… But in the end, we fucked it all up.”

America has been dabbling with doo-doo economics well before Trump left this flaming turd on the world’s doorstep. In the 1970s, America effectively defaulted on the gold standard and just started making shit up. Like Trump, they just kept bullshitting their way to the top, failing upwards. In the 1980s they came up with the laughable Laffer Curve, the idea they could collect more taxes by cutting them (they couldn’t). Now they’re trying to replace taxes with tariffs (the Internal with the External Revenue Service) using dubious theory laid out by Stephen Miran. This theory I call the Miran Mirage, the idea that tariffs will be paid for by currency depreciation elsewhere (they won’t).

We remind our readers that publication of articles on our site does not mean that we agree with what is written. Our policy is to publish anything which we consider of interest, so as to assist our readers in forming their opinions. Sometimes we even publish articles with which we totally disagree, since we believe it is important for our readers to be informed on as wide a spectrum of views as possible.