Transform the euro into a bancor – solves most EU problems

By Trond Andresen

Why this ritual genuflexion at the EU “altar” also from so many other progressives these days, especially in the UK?

Leave that to the big egoes in the EU hierarchy. Better with an EU as a looser but still comprehensive cooperative arrangement between self-governed European countries. Small is beautiful. And more efficient.

Norwegians voted no to joining the EU in 1972 & 1994 (I participated very actively on the NO side in both campaigns). Resistance in my country was and is left-wing, something that is hardly known among academics and pundits outside Scandinavia – they think that all EU skepticism must be right-wing like mostly in the UK. But we EU-skeptic Norwegians can’t understand that some progressives (among them some Post Keynesians) consider the EU worthwile, the way it is constructed and how it has functioned in practice.

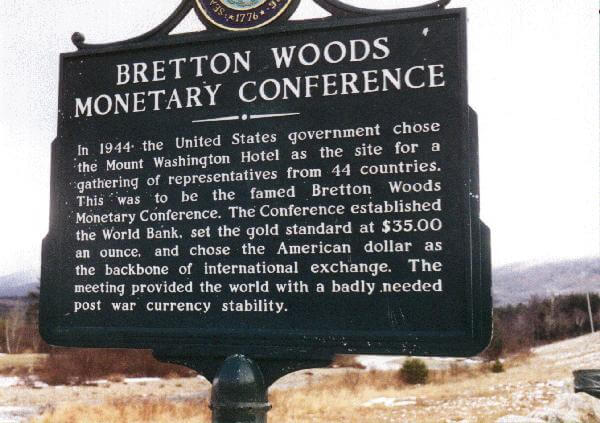

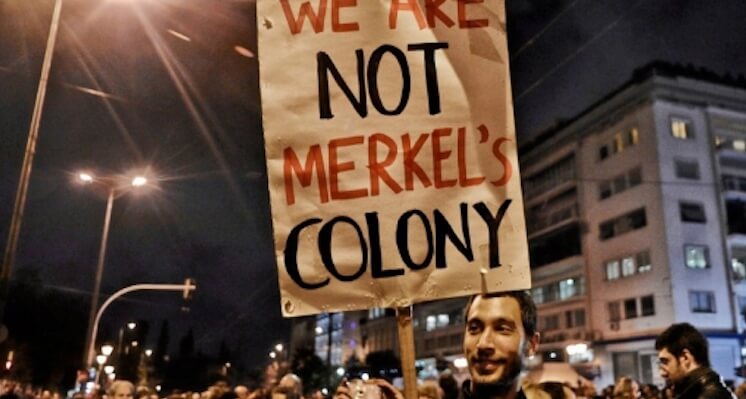

Anyway, if one wishes to save the euro, change it into a “bancor” for the EU, run by a “European Clearing Union”: with national currencies, but trade in euro, with adjustable exchange rates by the European Clearing Union, following Keynes’ proposal from Bretton Woods 1944. If the euro had functioned like the bridge currency bancor in his International Clearing Union proposal, it would have worked well*. Greece could devalue and Germany would have to revalue. And German and other foreign banks would not have the death grip on the Greeks that they have today, since the latter could issue their own currency as needed. The power balance would shift dramatically in the right direction. And the unemployed would get jobs and income.

At the same time, the EU political class and their media chums would still have kept their beloved ECB and euro, so their loss wouldn’t be too devastating.

You may read also Keynes’ proposal from Bretton Woods 1944 here:

http://www.defenddemocracy.press/clearing-up-this-mess/