Privatisations of state-owned assets have become a central plank of EU/Troika agreements with debtor nations such as Greece, Ireland, Italy, Spain and Portugal, but there has been little examination of their track record nor an examination of who really benefits. This report puts a spotlight on the legal and financial corporate giants making millions out of the new wave of privatisations across Europe.

In the last years the Troika (made up of the European Commission, European Central Bank and the International Monetary Fund) has pushed through privatisation programmes in indebted EU countries, despite major popular opposition. This briefing examines the consequences of those privatisations. It puts a spotlight on the process, exposes the corporate players that have profited, and examines whether the sale of state-owned assets has delivered on its proponents’ promises.

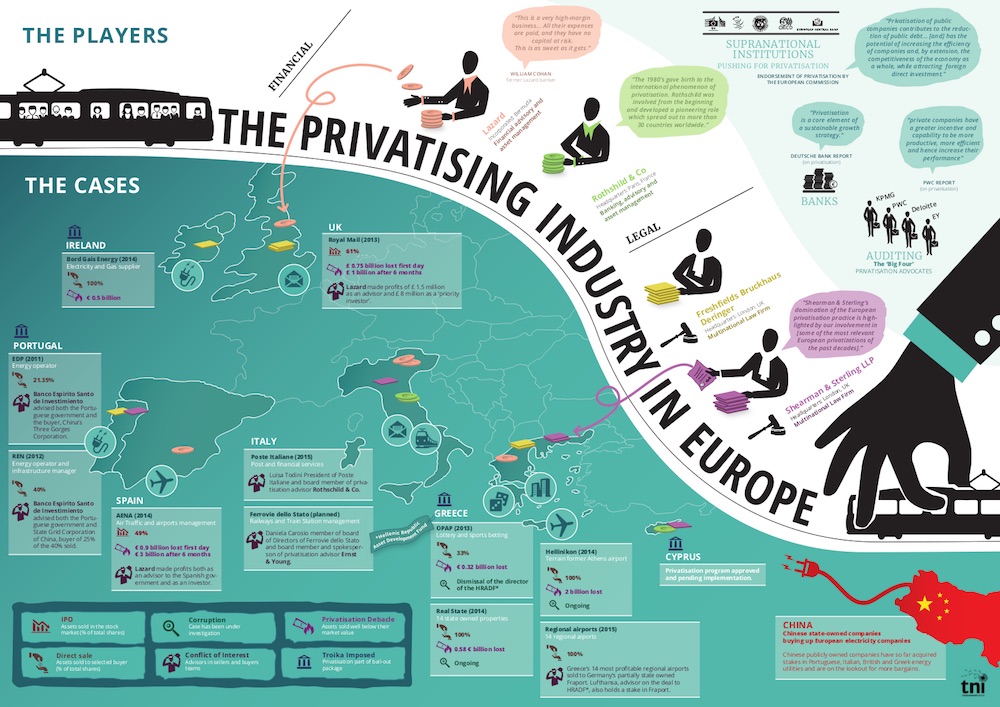

A close examination of nine high-profile privatisation deals across Europe shows that:

- A small coterie of legal, financial and accountancy firms, many based in the UK are reaping huge profits from the new wave of crisis-prompted privatisations. The firms include the financial advisory firms NM Rothschild, the UK law firms Freshfields Bruckhaus Deringer, Clifford Chance, Allen & Overy, and Norton Rose Fulbright, and the accountancy firms based in London PricewaterhouseCoopers and Ernst & Young. They also actively promote privatisation at the European level.

- A number of the key lead corporate players, such as Lazard, have been involved in both advising on privatisation and then profiting from their advice. In the case of Royal Mail, Lazard made an £8 million profit from purchasing and then reselling shares.

- The rationale put forward by advocates of privatisation does not stand up to the evidence. Privatisation has failed to provide promised revenue as only profitable firms are being sold and consistently at undervalued prices. Meanwhile the latest research by the IMF and by European universities show that there is no evidence that the privatised firms are more efficient than state-owned firms.

- Despite the rhetoric in favour of private management, many of those who win concessions and buy formerly privatised assets are state-owned companies. Chinese state-owned corporations, in particular, have become dominant players in buying up European energy companies in Portugal, Greece and Italy.

- Privatisation in Europe has encouraged a growth in corruption, with frequent cases of nepotism and conflicts of interest emerging in Greece, Italy, Spain, Portugal and the UK

The Privatising Industry in Europe