dfgsdfRepeating any mantra to yourself loudly and often does not change reality, but you could eventually convince yourself that it does.

By Paul Goncharoff

Ukraine’s Naftogaz and the Kiev administration have been praising themselves as victors after nearly four years of litigation against Russia’s Gazprom and the long-term gas contract signed in 2009. This legal adventure finally ended through arbitration in Stockholm this past Friday.

Ukraine proudly declared themselves the winners as they narrowly escaped what could have been a national default. In truth, the Stockholm judgment does not look like a win for Naftogaz, and if the law and principles governing contractual commitments matter anymore, then Gazprom has set a good example.

The bottom line of the Stockholm decision is that Gazprom, a major Russian gas provider, does not owe or need to refund Ukraine anything, and Ukraine must still honor its now minimized contractual commitments and pay. True, the Ukrainian side will not have to pay the tens of Billions which were initially on the table when this legal spat began, but pay they must, albeit a lesser sum.

At first glance, the key issue was the price of Russian gas for Ukraine. After the 2014 coup, Kiev said the contract price was inflated, politically influenced, and had no bearing to the market. Naftogaz demanded that the arbiters rule to have Gazprom refund billions of dollars for such alleged overpayments. At the end of the day, this was a key issue for Kiev and why this entire tragi-comedy took place. In this respect, Ukraine did not win.

After 2014, Ukraine claimed that it was being overcharged, and therefore Naftogaz refused to pay Gazprom their contracted price for gas. Instead, it paid unilaterally a different amount that it subjectively considered “fair.”

Gazprom, in keeping with mutually contracted terms and conditions, could only issue an invoice for the resulting underpayment, and after Naftogaz still refused to pay (a debt of approx. $2 billion), made any further deliveries of gas contingent on prepayment.

The arbitration additionally upheld Gazprom’s position and denied Naftogaz any right to a refund for gas priced between May 2011 and April 2014 or collect any of the claimed “overcharged gas” totaling approximately $14 billion for that period. In sum, the price Kiev claimed was “inflated” was judged as in Stockholm as baseless.

Therefore, the question of who is accountable and responsible for settling debt has been clarified in Stockholm. Naftogaz must pay Gazprom $2 billion plus a fine calculated at 0.03% per day for each day this debt remains unpaid. This fine has already reached $3 million since the court decision on December 22nd, and if it not paid can reach an annualized figure of $216 million and still keep growing daily.

Like any political and economic story, there is quite a bit that does not make the flashy headlines, but plays a role in contributing to the noise surrounding an issue. Naftogaz takes satisfaction in that the settlement allowed that the gas price for the second quarter of 2014 was to be reduced from $485 to $352 per 1000 cubic meters, or 27%, thereby “saving” Ukraine about $ 1.8 billion for 2014-2015. The price of $485 was in fact fixed for that one quarter, and it was higher than the market price. The reason was that the March referendum and subsequent reunification of Crimea within the Russian Federation happened then. Up until that time, Russia had given Ukraine a discount of $100 per one thousand cubic meters of gas as payment for renting the Crimean base for the Black Sea fleet. The Kharkov treaty with Ukraine which dealt with the naval base was therefore canceled, as Crimea was once again Russia. Without this discount, the price increased by that same discounted $100 in the contracted quarterly price fix.

Key is Stockholm’s recognition that the Russian gas price for Ukraine in 2011-2014 was fair, which is much more important than the price fixed in that second quarter in question. It is worth noting in the next third quarter of 2014 Gazprom was prepared to provide Ukraine with a market price for gas again. However, as we all know today, since June 2014 Naftogaz has refused to buy gas from Russia for political reasons and calling it an “aggressor nation.”

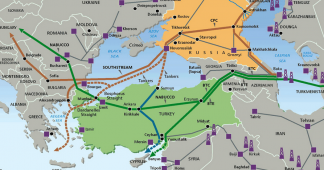

A more far-reaching result from the Stockholm proceedings was the intention to void the traditional (Gazprom) formula for gas prices which is based on a linkage to the price of oil. Instead, the price of gas will be tied directly to the spot gas market such as the European hub. Should this occur, then the future gas price for Ukraine will be linked to the cost of fuel in the European hub. This would be a major departure from the traditional pricing Gazprom has used for decades, and might set a precedent for other buyers of Russian gas, who might also want to change their price formulation. In traditional Gazprom contracts, the price of gas depends on the price of oil, and only up to 15% of the price is a spot gas component. For decades, this contractual linkage of the price of gas to oil was largely accepted as being open and fair.

Since 2014, Ukraine has been buying reverse gas from Europe at such European spot hub prices, and it has so far been more expensive than the traditional Gazprom contract. It is also worth noting that spot prices are far more volatile, are seasonally demand-affected, and as winter is a peak consumption season the prices can and do increase dramatically.

Why did Gazprom take their initial large claims to court knowing beforehand that it would be impossible to get the tens of billions of dollars from Naftogaz or Ukraine without ruining both through default? The first reason is that a “take or pay” clause was a key and mutually agreed covenant of the contractual relationship, not a point to be discarded unilaterally by any single party. The second reason was as a response to Naftogaz multi-billion lawsuit on the transit of gas from Russia through Ukraine to Europe. The Ukrainian side believes that Gazprom should pay them extra for not sending 110 billion cubic meters of gas through pipelines annually across Ukraine. In the transit contract, there is no obligation for any such volumes to be transited through Ukraine’s pipelines.

To sum up this drama, the Stockholm arbitration declared that Naftogaz must honor their contract, and buy from Gazprom 5 billion cubic meters of gas annually. As it turns out the “take or pay” clause remains in force, but the volume has been significantly reduced. How this volume of 5 billion cubic meters was arrived at remains a mystery, but one which will surely become clear over time. The political spin, however, will be interesting to observe since Ukraine must now buy (and pay for) this Russian gas. How will Kiev explain now having to buy Russian gas when since 2014 it stridently proclaimed it shall never buy fuel from “that aggressor nation.”

The irony is that while this is a loss of face for Kiev politically, economically it benefits the Ukrainian consumer. To date, Ukraine’s purchases of “reverse gas” from Europe has been far more expensive than that which was contracted reliably over the years by Gazprom. Now Kiev will have to find the funds to pay for Gazprom’s gas, settle their debt and ever-growing fines, plus meet the rest of their energy needs by purchasing expensive reverse gas from Europe. It will take spin that is a lot more imaginative from Kiev to package this settlement into a believable political victory, and very creative accounting to get the money to pay for it.