Michael Hudson is the President of The Institute for the Study of Long-Term Economic Trends (ISLET), a Wall Street Financial Analyst, Distinguished Research Professor of Economics at the University of Missouri, Kansas City, author of many books and an outspoken critic of capitalism.

In this video he is speaking at the 14th Forum of the World Association for Political Economy, which was held in Winnipeg at the University of Manitoba in July [2019]. The theme of the conference was “Class, State and Nation.” Professor Hudson’s talk charts the rise and decline of the American Empire and some of the strategies implemented by other nations (principally China) to overcome the domination of the United States.

The video was recorded by Paul S. Graham and is followed (for those who prefer to read) by a transcripts of his remarks, lightly edited for clarity.

By Michael Hudson

Published on Paul S. Graham,

Nov 19, 2019

TRANSCRIPT

I can’t think of a conference where I’ve learned so much starting with the wonderful three-hour tour of Winnipeg and the general strike in 1919. It’s sort of a metaphor for everything that we’re describing in the world today. That here you had a city that had the potential to be taking off. They talked of it as a potential Chicago. And what happened? The workers and the general strike wanted the same things that workers all over the world have wanted. They wanted higher prosperity. They wanted a decent pay. Shorter hours would have been more productive.

And yet the ruling class of Winnipeg, the Thousand said, we, we could have a wonderful growth. We could make a lot of money in real estate alone by immigrants coming here. We could make it a centre , but then other people would have to get rich just like we are. We don’t want it. We would rather be relatively rich and keep them poor than have development. We want to keep our status of control over them so that we have all of the initiative, all of the planning power and they are powerless because that is for us the system.

It’s not an economic system. It’s the same system that existed in Rome. And the result of course is that Winnipeg didn’t become another Chicago. It became Winnipeg today.

Well, this same attitude is the attitude that the United States is taking towards the rest of the world. And the question is, will, the rest of the world be more successful than the Winnipeg strikers were in 1919?

From the very beginning, I’ve been a part of WAPE [World Association for Political Economy] and the very first issue, volume one, number one David Laibman and I had an article. So, we’ve been part of this for a long time. Uh, I want to thank both Radhika and Ellen for the wonderful organization of this meeting.

I did write a paper for it that maybe will be posted. But after listening to the discussions here, I’ve decided to make a different set of comments. And I think the framework for my comments is that capitalism has not evolved in the way that Marx expected.

Marx wasn’t wrong, but he was an optimist. He thought that capitalists would act in their own self-interest. Well, of course, if they would have acted in their self interest, you wouldn’t have had the Winnipeg general strike. He thought that their interest was going to be in becoming more efficient in streamlining the economy and getting rid of the fictitious costs, what he called the false costs or full fray of production. And he’s rightly been called a revolutionary. But what upset the vested interests more than anything else was not simply that Marx is a revolutionary, but that he showed that capitalism itself was revolutionary. He said the historical destiny of capitalism was to get rid of the landlord class that simply collected rent without providing any productive service. The task of capitalism was to get rid of parasitic finance and instead finance would be used to fund industrialization as it seemed to be happening in his time in Germany and in central Europe. And he thought that the role of capitalism was to be so much more efficient that in a speech he gave before the Chartists in London, he supported free trade, not on the basis of the neoclassical and neoliberal silliness of free trade is being productive.

But he said, well, the one virtue of free trade is going to be that since Britain is the most efficient economy its trade with India is going to break down all of the backwardness of India. And as British manufacturers undersell the manufacturers of countries that are backward, that have elites that have predatory and parasitic vested interests and ruling classes, they would have to either modernize or be swept away. And it seemed logical to him that capitalism would pave the way for a natural evolution into socialism by at least getting rid of the carryovers of feudalism the landed invasions, the warlords that became the Lords and controlled the politics and the land.

Well, as we all know, that’s not what the leading economy of the United States is today. If Marx were looking at the United States, he wouldn’t say, I think that it’s wonderful that all the other countries should follow the United States lead because it’s going to bring about prosperity and efficiency. In contrast to England and the industrial revolution, the United States has become the most inefficient economy in the world in terms of manufacturing. The reason that there cannot be a revival of a manufacturing industry in this country is simply because the accumulation of debt has gotten so large and the price of housing and the privatization of monopolies and health insurance has become so expensive that if American workers were to get all of their food, all of their clothing, all of their transportation for nothing, for zero, they still couldn’t compete with China or even Europe because out of every paycheck they have to pay up to 40% of their income for rent. 15% is taken off for social insurance and medical care, another 10% for payments of interest and debt.

Only a small portion of the worker’s budget is available to be spent on the goods and services they produce. So the United States is left in a very high cost position and has become something that is different from the industrial capitalism that Marx talked about in his day. Industrial capitalism has become finance capitalism and the roots of finance capitalism, the basic analysis for it is all outlined in Marx’s volume three of Capital and volume two. The reason he left it for volume three and volume two and not in volume one was he thought that there was already the 1848 revolutions in Europe; already there was pressure to tax away of the rent of the landlords. Already there was pressure to create a public subsidy of health, of basic monopolies of post office, of transportation, and communication.

And by the time Marx wrote, he thought, okay, that fight has been won. Capitalism can take care of the post feudalism problem. And Marx talked about the problems of capitalism itself, the relationship between the employer and the employee. And for him, industrial capital was money that was spent on employing labor to make a profit and squeeze out surplus value.

This seemed to be the way that the world was evolving until World War One and World War One really changed all of that. England found itself bankrupted by the debt that it owed to the United States when the war was over. For hundreds of years, Europeans at the end of a war had simply canceled the mutual debts because they thought we’re all in it together. But the United States said, well, we sold you a lot of arms before we were in the war. So we’re really not brothers. You have to pay us enough money that to cause mass unemployment there — to essentially do to England what the IMF has done to the Third World after World War Two. And so England and France also had to pay into her ally debts turned to Germany to pay the reparations and caused austerity and a crisis in Germany. And the result of course was a chronic depression that a build up of debts that finally all had to be wiped out in 1931, 1932, when the inter allied debts and reparations were forgiven. And the crisis was so great that it brought on the world depression of the 30s that was only pulled out by World War Two.

So, what has happened since World War Two was something that Marx could not have expected. He thought that banking and finance capital would be industrialized. He described finance as external. Finance existed in Babylonia in the third millennium BC. Interest bearing debt was in Rome and Greece. But all of this debt Marx described was simply parasitic. It took money and it accumulated and it grew by the mathematics of compound interest. And Marx collected everything that was written in his day on the mathematics of compound interest. And he said, it grows inexorably by purely a mathematical laws of its own power and there’s not part really of the capitalist system, but if the banks made productive loans to industry where the bank credit provided the industrial borrower with the means of earning a profit, able to repay the debt, then that would become productive. And that would become a basis that even socialism could apply.

Many of Marx’s followers in the 19th century expected the banks to be the planning center, the incipient planning center of the socialism to come. And this view was based largely on the German experience where there was a combination of the Reichsbank, the large banks the military for credit for armaments, especially for the building of navies and heavy industry. And it was largely a government coordinated development in Germany, which seemed to be headed towards the leadership of the world.

This terrified England because England really had failed to do what seemed potentially able to do in 1848. It wasn’t able to get rid of the banks by the time that in 1914 when World War One broke out, there was a set of articles in the economic journal in England worrying that England was going to lose the war because its financing was so predatory, so greedy, so corrupt and its behavior was so short term hit and run that it could not possibly compete against an economy that had basically planned productive credit as a Germany had. The stockbrokers in England were notorious for putting their customers into financial frauds and just hitting and hitting and running, for taking over companies and insisting that the companies pay all of their income out as dividends, not reinvest their profits, not accumulate productive power, but rather simply build up debt. And the Marxists were in the lead of describing this phenomenon of finance capitalism that at the time it seemed to be a perversion of industrial capitalism, but turned out to be something almost entirely different. And we all know the result of that.

That was World War Two. And in World War Two, the United States set out to dominate the world and make itself the center, sort of a wheel and spoke system. The United States called this globalization or internationalism.

But the role of the World Bank and the International Monetary Fund was not internationalist at all in the spirit that we just heard describing the Belt and Road Initiative. The idea of the World Bank was not to promote development, but to promote dependency. The leading assumption of the World Bank was under no case would domestic currency loans be made to develop agricultural self sufficiency and countries to become independent and grow their own food. From the very beginning, the United States wanted loans to go only to the export sector. Third World countries, Latin America, Africa, the Near East were told to depend on American grain and the loans were only for export crops to build railroads and roads to lower the cost of making exports so that America could get raw materials from other countries.

And America became [what it] accused England of wanting to make it in the 19th century — hewers of wood and drawers of water. That was how the Bible phrased it. So you know, what has happened as a result? Well we had a dependency system here. At the time America emerged from World War Two, it had by far most of the gold supply of the world. And at that time the domestic money created by central banks with based on gold. The United States had such a dominant possession that by the time the Korean war broke out in 1950, the United States had accumulated 75% of the world’s gold supply.

This meant that other countries were facing austerity. The Americans expected quite correctly that as a result there was going to be rising social revolution in these countries. So the American free market planners realized the first premise of free market economic theory — I don’t know why this is left out of the textbooks that they teach — the first premise is you cannot have a free market unless you’re willing to assassinate everyone who opposes you, unless you can have a regime change for any country that does not follow a free market. All of Roman history is this. The fifth fourth, third, first century BC. Every single advocate of debt cancellation, of land redistribution, of democracy, was killed. The United States immediately set up a regime change in Guatemala overthrowing the Arbenz government that wanted land reform.

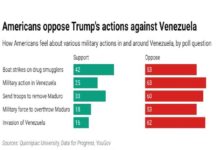

And it came in, in support of British Petroleum in Iran and overthrew the elected Mosaddegh regime. And it installed dictators throughout Latin America long before you had Pérez Jiménez in Venezuela. You had everyone there. Kissinger was very open in backing Pinochet in Chile saying if you have an opponent of free markets — meaning American dominated — you’re free to buy anything you want in the United States, but you have to buy it — whatever you buy — in the United States. He said we have to kill, not only the leader, but the entire class. And the result was a huge 10-year war throughout all of Latin America, political assassinations of labor leaders, of socialists, of academics, of professors — a mass of terrorism.

And it was really in the 1970s that America emerged as the leading terrorist country in the world backing its concept of free markets and democracy. By democracy. It meant pro American. Any regime including the Ukrainian Nazis that are pro American are called a democracy. Any country no matter of whether they elect their leaders or not is called anti-democratic or totalitarian, meaning other than the United States.

So, the problem is: where can we go from here? Well, the problem of finance capitalism is finance is extractive: leveraged buyouts, stock buybacks, finances short term. Banks look at something [as] “how much can we collect?” And banks don’t lend in terms of “what can our loan create in productive capacity to earn the profits to pay?” They say, “if we make a loan, where is the property that we can grab when there is a default?” The aim of creditors throughout history has not been primarily to earn interest. It’s not to earn interest. It’s to foreclose and get the property of the debtors that cannot pay the interest. This is essentially the IMF’s policy, in a nutshell. It will make loans to countries as long as they’re in the US orbit. It will not make loans to countries opposing the US and it makes loans in conjunction with World Bank plans that cannot be paid. And when there is a balance of payments crisis of countries IMF’s clients, they’re told “you can pay us by selling off your property, by privatizing your property, privatizing your mineral resources, privatizing your public utilities, and your natural monopolies, especially your electric companies, your water companies your oil reserves.”

This is the game and the IMF essentially is the knee-capper, as we say in America, it’s the gangster for the American objective of buying out control of other countries. Because we’re in a position now which Alan Freeman has pointed out where we’re not growing in the United States. And if you look at the actual growth in GDP, all of the growth in American GDP since 2008 has only gone to the top 5% of the American economy, Wall Street, the finance, insurance, and real estate finance sector. The 95% of the economy is shrunk. And if you say, well, what is this GDP growth? Well, one big element is late fees charged by banks on debtors that can’t pay. When banks charge a late fee the GDP economists say that’s providing a service of taking a risk to provide the economy with credit.

The other maybe 8% of the GDP is the increased value of homeowners’ homes. In other words, they’re asked, if you own your home, what if you had to pay rent for your home? How much rent would you have to pay? And as housing prices are inflated on credit the houses price goes up, the rents go up more and more. And so this increase in GDP is the increased value of homeowners’ living conditions, even though it’s the same home. No new home has been built, nothing has changed except the inflation of housing prices. So basically, what passes for GDP growth in the United States is simply the increased asset pricing the inability of labor and industry to pay debts, causing late fees, and what the classical economists called unearned income, economic rent.

So, we’re a rentier society and America’s relationship to the rest of the world is that of a rentier, that is a rent extractor. It lives off the interest and the property that it can grab as a result of its international credit. It lives off the dollar standard, a free ride. After America went off gold in 1971, countries had to keep their foreign reserves in some kind of risk-free asset. And the only risk free asset large enough was the US dollar. And the reason there were so many US dollars in the world is they were pumped into the world economy by means of the balance of payments deficit. Now, balance of payments deficit: that sounds abstract, but in practice, the entire deficit, every cent from the 1950s, 1960s onward, it was military and other, the private sector is just about in balance, but the America through its 800 military bases over the world, and its supply of dirty tricks and the American foreign Legion is very expensive.

The foreign Legion is ISIS, Al Qaeda and the other terrorist groups. So all of this is creating a huge influx of dollars and these dollars end up by the free market being spent largely in China, Asia and other countries and America, until about a year ago, said you countries can earn as much as you want by running your own balance of payments trade surpluses, but you have to send all of your surplus to the United States by buying US treasury bonds to finance, not only the US budget deficit, but to finance our expenditure on encircling you with our 800 military bases. That’s called a circular flow, and that was the definition of equilibrium that they had. Now, you can imagine my surprise a few months ago when Donald Trump came out and accused China of manipulating its currency by buying US treasury bonds.

And Trump’s argument was — somehow, he read an economics textbook — this was a disaster. He was very successful being a petty criminal throughout his life. He made his money by not paying his workers, by not paying his suppliers. He’d go to suppliers, offer 50 cents on the dollar and say, well, if you don’t like it, sue me. And in the United States, it costs about $50,000 to mount a court case to collect. And he ended up cheating people. He didn’t pay the banks. He defaulted. No bank in the United States will lend to Donald Trump. No contractor in New York city, where I live, will deal with him. No labor will deal with him. He thought that it worked for him; it will work for the United States. All you have to do is promise the moon which is called equilibrium I guess for economists and then say, well, here’s what we’re going to pay you.

It obviously is not working, but this puts other countries including China in a dilemma. What is it going to do with all of the dollar payments that it gets from other countries in Asia, in the Third World and the United States ? What will it do with them? Well, a few years ago, it said, well, the natural thing for us to do is what the United States does. We will recycle these dollars by buying up foreign industry. They tried to buy oil, not just filling stations. Oil distributors in America. America said, that’s a national security threat. There was a discussion in Congress. They said, anything China owns that makes them richer is a threat to our national security. Well, this is just what was said in Winnipeg in 1919. Any improvement in the status of labor or to anyone but us is a threat to our security and our domination.

So, China is considered a threat to our national security by being prosperous. This is not a case of the most efficient economy in the world spreading its way of production into other countries. It makes other countries essentially colonies. It’s a form of financial neocolonialism. And the advantage of neocolonialism in a financial means is you don’t have to draft an army. In fact, the whole character of control has shifted away from military. The last draft in America was in the Vietnam war, and if America tried to invade Venezuela or any other country you would have the same kind of riots in America that you had during the Vietnam war. So that’s why America needs either a Foreign Legion or what’s called client oligarchies like it’s trying to install throughout Latin America and for other countries.

But you have to sort of feel a little sympathy for America’s position. And I want, I want to make a plea for sympathy. How can this country survive if it can’t be permitted to kill your leaders? If it can’t be permitted to take over your industry and get all of the rents and the profits and the raw materials for free? How on earth can it survive if it can’t produce its own industrial goods? It’s high cost. It’s heavily indebted. How on earth are American companies and the employers and the employees who worked for them that are heavily indebted — pension funds will lose their money, the stock prices will go down, the banks will go bust, there will be defaults on the real estate. So America really feels that the only way that it can survive is by international sabotage.

The only kind of war that a democracy can afford to fight is by bombing. It can’t afford to have a military draft, it can’t afford to invade a country because of the domestic politics. It can only bomb. It can only destroy. That is the only form of warfare that is available right now. So what is amazing is the lack of response by Europeans. All of this has been celebrated since about 1980 as the end of history. And this end of history book came out right after the Soviet Union dissolved. And that was taken by America to say, well, we’ve won. The end of history means there is no alternative and they’ll make sure there is no alternative because American policy is to make sure that history will not change, that there won’t be an alternative to the current way of doing, of doing things.

So, this is not survival of the fittest. It looks like it’s the survival of the parasites. It’s the survival of an unproductive, predatory economy. And if you’re making a forecast about the future, the natural tendency is to assume that everyone will act in their self interest and everything will grow better and better. But that’s not happening. If you looked at Rome, exactly the same thing happened in Rome. Finally by the first century, there was such a land grab, such a monopolization of land, such a power of creditors. Revolution after revolution uprising after uprising — everybody expected Caesar to cancel the debts. And he was killed by the oligarchy for wanting to be even, even moderate. The result of what then was neo-liberalism, meaning the vested interests are in control, was the dark age in feudalism.

So, the question is whether the American plan, the neoliberal economics, is going to lead to a new kind of feudalism and how other countries can protect themselves. Rome survived for a century by looting its more productive richer provinces like Asia minor and Gaul. But finally, there was no more money to loot and the economy just collapsed from within. And in a way, this, this problem is inherent in Western civilization. It made Greece and Rome different from Sumer, Babylonia, Persia, the Near East. All the Near Eastern countries, when they had a debt problem, the rulers, would step in and cancel the debts and they would reverse all of the land transfers. Where people had lost their land to the creditors, the land would be returned to them. Every single ruler of Sumer and Babylonia in the third millennium and second millennium did this. This became the Jubilee year of the Bible, which was taken over word for word from the Babylonian lawyers. It remained in force in Constantinople, the Eastern Christian empire, but not in the West.

The West has the concept of progress and this ideal of progress is irreversibility. You can’t go back. This is the problem that president Obama faced himself with. He’d promised to write down the debts of the junk mortgage loans of the fictitious loans, and keep the homeowners in their houses. But then he said, no progress means you can’t cancel the debts. You let the debts completely go up.

No member of the 1% will lose their money. That means the 99% has to lose their property. And President Obama invited his Wall Street backers to the White House and said, I’m the only person standing between you and the mob with pitchforks. These are the people that Hillary Clinton called the deplorables. The role of the American president was basically to convince the population that somehow all of this neoliberal stagnation that they’re experiencing is all for the good. And you’ll have the economics profession sort of looking at all of history this way.

All of you have heard about Rome falling into the Dark Age, but there is a new economic history of neo-liberals. It said, well, it wasn’t so dark. If you look at the rich people, there were a lot of big manors. And there was a lot of trade and nice ceramics, all Near Eastern. All the traders were Near Eastern. All the money that Rome could extract from its colonies was sent to India or further East. But they say that the rich people had such an enjoyable life that we really can’t call it a dark age. It was only a dark age for the 99% of the people. And but look at the 1%, you know that’s what we have in the museums. Was it all worth it or no?

So the question is, what does China do in response to all of this? Well, obviously the first thing it’s doing is agreeing with Donald Trump. Yes. We’re going to de-dollarize. We’re certainly not going to keep our savings and loans to the US treasury that enable you to encircle us with military bases. So de-dollarization is one aspect.

China’s not going to ask the International Monetary Fund the planet’s economy and tell it what industry is to be privatized and sell off to private managers who will simply increase the prices that China has to pay for its electricity, transportation and others. So, and in fact, it’s set up its own independent bank as a by-product of the Belt and Road Initiative. It has its own bank and its bank is financing actual tangible investment instead of financing dependency. In response to the unilateral us trade war and protectionist tariffs, China has the option of countervailing sanctions. The United States already has large investments in China. The balancing factor would be for China to say, okay, you’ve grabbed our money. We’ll just take what you have here and call it even.

There’s obviously a cyber war. Also, as you know, the American CIA and national security system have worked with Silicon Valley to install back doors so that it can spy on every other country. What makes China’s Huawei so undemocratic is it doesn’t have spyware for the United States. And so that obviously is a threat to US control. So you have that in place of the class war and the austerity program in the US China’s kept its credit in the public domain.

This means that in America, when the company — you’ve seen the wave of bankruptcies of American corporations recently, especially in the retail sales — when an American corporation goes out, a hedge fund or a vulture fund comes in and buys it at a fraction of the cost. In China, there are many industrial plants that have been unable to pay the debt, but because the creditor is the government, the bank of China can simply write down the debt. It writes it down so that it keeps the industrial employer in business. It doesn’t sell it off to a hedge fund or an American. China realizes what Marx expected to be the future for banking and finance. It’s a public utility. It’s created electronically, basically credit. Any bank can simply make a loan and create money.

China’s already doing that, and the final capstone is that China’s developed an alternative economic theory to neo-liberalism and that’s Marxism. Marxism looks at the overall context. It places it in the context of politics so that it looks at the economy as a system, not as parts to be carved up and essentially looted. So, as long as China can continue to develop its monetary policy, its trade policy, its foreign policy and military policy, in keeping with this overall view of systemic growth, it’s going to be operating in a way that creates its own future instead of passively surrendering to America’s neoliberal future.