By Eric Toussaint

5 March 2020

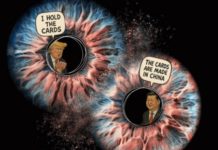

We are witnessing a big crisis in the stock markets of the Wall Street, Europe, Japan and Shanghai, and many blame the coronavirus for it. In the last week of February 2020, the worst week since October 2008, the Dow Jones fell 12.4%, the S&P 500 fell 11.5% and the Nasdaq Composite fell 10.5%. The scenario is similar in Europe and Asia for the corresponding period. On the London Stock Exchange, the FTSE-100 fell by 11.32%, in Paris the CAC 40 fell by 12%, in Frankfurt the DAX lost 12.44%, on the Tokyo Stock Exchange the Nikkei fell by 9.6%, the Chinese stock exchanges (Shanghai, Shenzhen and Hong Kong) also fell. On Monday, March 2, following (promises of) massive interventions by central banks to support the stock markets, most of the indices went up again except in London. On Tuesday, March 3, the panicked U.S. central bank, the Fed, lowered its key rate by 0.50%, which is a considerable drop. The Fed’s new key rate is now in a range of 1 to 1.25%. It should be noted that the inflation rate in the United States between February 2019 and January 2020 reached 2.5%, which means that the Fed’s real interest rate is negative. The mainstream press writes that this measure is intended to support the U.S. economy threatened by the COVID-19 epidemic. The leading American media put out large headlines “The Fed just hit the coronavirus panic button” (https://edition.cnn.com/2020/03/03/investing/federal-reserve-interest-rate-cut-coronavirus-emergency/index.html ). However, the poor health of the American economy dates back well before the first cases of coronavirus in China and its effects on the world economy (see https://www.cadtm.org/The-Credit-Crunch-is-Back-and-the-Federal-Reserve-Panics-on-an-Ocean-of-Debt). In short, the Fed and the mainstream press are not telling the truth when they state that the measure is designed to deal with the coronavirus. In spite of the Fed’s decision, on Tuesday March 3, the S&P 500 fell again by 2.81% and the Dow Jones fell by 2.9% (https://edition.cnn.com/2020/03/03/investing/dow-stock-market-today/index.html ). On March 3 and 4, several Asian stock exchanges also experienced a decline. Nevertheless, on March 4 there has been a stock market rally in New York to celebrate the return of Joe Biden to the presidential race in the United States during the Democratic primaries on March 3, as this is a relief for them in front of Bernie Sanders. Joe Biden is clearly the candidate of the Democratic establishment and the billionaires who support that party. Also note that Donald Trump has in a tweet last week linked his fate to that of the Wall Street stock market. On February 26, he called on his colleagues from the richest 1% asking them not to sell their shares and to support the stock market. He further stated that if he is re-elected as the president of the United States in October 2020, the stock market will rise enormously, while if he loses, there will be a stock market crash on a scale never seen before (according to the Financial Times, Trump announced that the market will “jump thousands and thousands of points if I win,” … “and if I don’t, you’re going to see a crash like you’ve never seen before …. I really mean it.” https://www.ft.com/content/399783e2-57e9-11ea-a528-dd0f971febbc ). Precisely what will happen in the stock markets in the coming days and weeks is unpredictable, but it is very important to analyse the real causes of the current financial crisis.

The mainstream media, in an oversimplification, claimed that this worldwide stock market collapse was caused by the coronavirus and this explanation is widely echoed on social networks. However, it is not the coronavirus and its expansion that is the cause of the crisis, the epidemic has only triggered it. All the ingredients for a new financial crisis have been present for several years, at least since 2017-2018 (see https://www.cadtm.org/Dancing-on-the-Volcano dating back to November 2017; https://www.cadtm.org/Sooner-or-later-there-will-be-a dating from April 2018). When the air is replete with inflammable materials, any given spark can cause a financial explosion, at any time. It was hard to predict where the spark was going to come from. The spark sets the fire but it is not the root cause of the crisis. We are yet to know whether the sharp stock market crash of late February 2020 will “escalate” into a huge financial crisis but there is a real possibility. The fact that the stock market crash coincides with the effects of the coronavirus epidemic on the productive economy is no accident, but to say that the coronavirus is the cause of the crisis is untrue. It is important to see where the crisis really comes from and not be fooled by explanations that put up a smokescreen over the real causes.

Big businesses, the rulers and the media at its service have every interest in blaming the virus for a major financial and then economic crisis. This allows them to wash their hands off it (excuse the expression).

The drop in stock prices was predicted long before the coronavirus appeared.

The rise of share prices and the price of debt securities (also known as bonds) have far outpaced the growth of output over the last ten years, with an acceleration in the last two or three years. The wealth of the richest 1% has also grown strongly as it is largely based on the growth of financial assets.

It must be stressed that the stock prices fall due to a willing choice (I am not talking about a conspiracy): a part of the very rich (the 1%, the big business) decides to start offloading the shares it has acquired not forgetting the fact that every financial party has an end. And, rather than suffer in the process, it prefers to take the lead. These large shareholders prefer to be the first to sell in order to get the best possible rates before the share price falls very sharply. End of February 2020, large investment companies, large banks, large industrial companies and billionaires have ordered traders to sell off a part of the shares or private debt securities (i.e. bonds) they hold in order to pocket the 15% or 20% appreciations of the recent years. They decided the time to do it: they call it booking “their profits”. They are least bothered if it generates a herd behaviour of others trying to sell. The important thing for them is to sell before others do. This can cause a domino effect and escalate into a global crisis. They know that and they feel that they will get away with it in the end without too much trouble, as a large number of them did in 2007-2009. In the United States, for example, the two main investment and asset management funds BlackRock and Vanguard have done very well, as have Goldman Sachs, Bank of America, Citigroup and Google, Apple, Amazon, Facebook, etc.

Another important point to note is that the 1% sells shares of private companies, causing the share prices of the latter to fall and the stock markets to plummet. At the same time, however, they buy public debt securities that are considered safe. This is particularly the case in the United States, where the price of US treasury securities has risen in response to very strong demand. Please note that an increase in the price of treasury securities that are sold on the secondary market results in a decrease in the yield of these securities. The wealthy who buy these treasury securities are willing to accept a low return because what they are currently looking for is security when corporate stock prices are falling. Consequently, it must be stressed that once again it is the securities issued by the states that are considered to be the safest, by the richest. Let’s keep this in mind and be prepared to say it publicly, because we can expect the familiar refrain of the public debt crisis and the markets’ fears about government securities to return soon.

Nevertheless, let’s revisit what has been happening repeatedly for a little over thirty years, that is, since the neoliberal offensive and the massive deregulation of the financial markets have taken deep roots: [1] big business (the 1%) has reduced its investment share in production and increased it in the financial sphere (this includes the case of the iconic “industrial” firm such as Apple). It did that in the 1980s and it produced the bond market crisis of 1987. It repeated it in the late 1990s and it produced the dot-com and Enron crisis in 2001. It repeated it again between 2004 and 2007 and created the subprime crisis, structured products and a series of high-profile bankruptcies, including that of Lehman Brothers in 2008. This time around, big business mainly speculated long [2] on the price of shares on the stock market and on the price of debt securities on the bond market (i.e. the market where shares of private companies and debt securities issued by governments and other public authorities are sold). Among the factors that have led to the extravagant rise in the prices of financial assets (stock market equities and private and public debt securities), are the negative actions of the major central banks since the financial and economic crisis of 2007-2009. I have analysed this in https://www.cadtm.org/The-Economic-Crisis-and-the-Central-Banks

This phenomenon does not therefore begins only the day after the 2008-2009 crisis; it is a recurring phenomenon in the context of the financialisation of the capitalist economy. And before that, the capitalist system had also undergone important phases of financialisation both in the 19th century and in the 1920s, which led to the great stock market crisis of 1929 and the prolonged period of recession of the 1930s. Then the phenomenon of financialisation and deregulation was partly muzzled for 40 years following the Great Depression of the 1930s, the WWII and by the ensuing radicalisation of the class struggle. Until the end of the 1970s there were no major banking or stock market crises. The banking and stock market crises re-emerged when governments gave big business the freedom to do whatever it wanted in the financial sector.

Let us look back at the last few years. Big business, which considers that the rate of return it derives from production is not sufficient, develops financial activities not directly related to production. This does not mean that it abandons production, but that it is proportionally developing its investments in the financial sphere more than its investments in the productive sphere. This is also known as financialisation or financialised globalisation. Capital “makes profit” from fictitious capital through largely speculative activities. This development of the financial sphere increases the massive indebtedness of large corporations, including firms such as Apple (I have written a series of articles on this subject https://www.cadtm.org/The-mountain-of-corporate-debt-will-be-the-seed-of-the-next-financial-crisis).

Fictitious capital is a form of capital, it develops exclusively in the financial sphere without any real link to production (see box: What is fictitious capital?). It is fictitious in the sense that it is not directly based on material production and the direct exploitation of human labour and nature. I am talking about direct exploitation because, of course, fictitious capital speculates on human labour and on nature, which generally degrades the living conditions of workers and Nature itself.

What is fictitious capital?

“Fictitious capital is a form of capital (public debt securities, shares, debts) that circulates while the income from production to which it gives entitlement is merely promises, the outcome of which is by definition uncertain”. Interview with Cédric Durand conducted by Florian Gulli, “Le capital fictif, Cédric Durand”, La Revue du projet: http://projet.pcf.fr/70923

According to Michel Husson, “Marx’s theoretical framework allows him to analyse ‘fictitious capital’, which can be defined as the set of financial assets whose value is based on the capitalisation of a flow of future income: “The formation of a fictitious capital is called capitalisation.”” [Karl Marx, Capital, Vol III]. If a share provides an annual income of £100 and the interest rate is 5%, its capitalised value will be £2000. [3] But this capital is fictitious, insofar as “there remains absolutely no trace of any relationship whatsoever with the real process of capital development” [Karl Marx, Capital, Vol III]. Michel Husson, “Marx et la finance : une approche actuelle”, À l’Encontre, December 2011, https://alencontre.org/economie/marx-et-la-finance-une-approche-actuelle.html

| For Jean-Marie Harribey: “Bubbles burst when the gap between realised value and promised value becomes too great and some speculators understand that promises of profitable liquidation cannot be honoured for all, in other words, when financial gains can never be realised for lack of sufficient capital gains in production”. Jean-Marie Harribey, “La baudruche du capital fictif, lecture du Capital fictif de Cédric Durand”, Les Possibles, N° 6 – Printemps 2015 : https://france.attac.org/nos-publications/les-possibles/numero-6-printemps-2015/debats/article/la-baudruche-du-capital-fictif

See also François Chesnais, “Fictitious Capital, Dictatorship of Shareholders and Creditors: Current Challenges,” Les Possibles, No. 6 – Spring 2015: https://france.attac.org/nos-publications/les-possibles/numero-6-printemps-2015/debats/article/capital-fictif-dictature-des I agree with Cédric Durand when he says: “One of the major political consequences of this analysis is that the social and political left must become aware of the class content of the notion of financial stability. Preserving financial stability means making the claims of fictitious capital come true. To free our savings from the grip of fictitious capital, we need to engage in financial de-accumulation. In concrete terms, this refers of course to the issue of cancelling public debt and the private debt of ordinary households, but also to the decrease in shareholder returns, which automatically translates into a decrease in market capitalisation. Make no mistake, such objectives are very ambitious: they inevitably involve socialising the financial system and breaking with the free movement of capital. But they allow us to grasp precisely some of the conditions necessary to turn the page on neo-liberalism.“ Cédric Durand,”Sur le capital fictif, Réponse à Jean-Marie Harribey”, Les Possibles, N° 6 – Printemps 2015 : https://france.attac.org/nos-publications/les-possibles/numero-6-printemps-2015/debats/article/sur-le-capital-fictif |

Fictitious capital wishes to capture part of the wealth produced in production (Marxists say part of the surplus value produced by workers in the sphere of production) without getting its hands dirty, that is, without going through the process of being invested directly in production (in the form of buying machines, raw materials, paying for human labour power in the form of wages, etc.). The fictitious capital is a share whose owner expects it to pay a dividend. He will buy a Renault share if it promises a good dividend, but he can also sell it to buy a General Electric or Glaxo Smith Kline or Nestlé or Google share if it promises a better dividend. Fictitious capital is also a debt bond issued by a company or a public debt security. It is also a derivative, a structured product… Fictitious capital can give the illusion that it generates profits on its own while having detached itself from production. Traders, brokers or managers of large companies are convinced that they “produce”. However, at some point, a brutal crisis erupts and a mass of fictitious capital goes up in smoke (falling stock prices, falling bond market prices, falling property prices…).

Big business repeatedly wants us to believe or make us believe that it is capable of turning lead into gold in the financial sphere, but periodically reality brings it to order and the crisis breaks out.

When the crisis erupts, a distinction must be made between the spark on one hand (today, the coronavirus pandemic may be the spark) and the root causes on the other.

Over the past two years, there has been a very significant slowdown in productive sectors. In several major economies such as Germany, Japan (last quarter 2019), France (last quarter 2019) and Italy, industrial production has declined or slowed down sharply (China and the United States). Some industrial sectors that had recovered after the 2007-2009 crisis, such as the automobile industry, entered into a very strong crisis during the years 2018-2019 with a very significant drop in sales and production. Production in Germany, the world’s largest car manufacturer, fell by 14% between October 2018 and October 2019. [4] Automobile production in the United States and China also fell in 2019, as it did in India. Automobile production will fall sharply in France in 2020. The output of another flagship of the German economy, the machinery and equipment producing sector, fell by 4.4% in October 2019 alone. This is also the case for the production of machine tools and other industrial equipment. International trade has stagnated. Over a longer period of time, the rate of profit has declined or stagnated in material production, and productivity gains have also declined.

In 2018-2019, these various phenomena of economic crisis in production manifested themselves very clearly, but as the financial sphere continued to operate at full capacity, the big media and governments did everything possible to affirm that the situation was positive overall and that those who announced the next major financial crisis, in addition to the marked slowdown in production, were only bringers of bad luck.

The perspective of social class is also very important: for big business, as long as the wheel of fortune in the financial sphere continues to turn, the players stay on track and are happy with the situation. The same is true for all governments because they are currently linked to big business, both in the old industrialised economies such as North America, Western Europe or Japan, and in China, Russia or other large so-called emerging economies.

Despite the fact that real output stopped growing significantly in 2019 or began to stagnate or decline, the financial sphere continued to expand: stock prices continued to rise, even reaching record highs, the price of private and public debt securities continued to rise, real estate prices began to rise again in a series of economies, etc.

In 2019, production slowed down (China and India), stagnated (much of Europe) or started to decline in the second half of the year (Germany, Italy, Japan, France), notably because global demand shrinkage: most governments and employers were active to lower wages and pensions, which reduced consumption because the increasing debts incurred by families were not enough to offset the drop in income. Similarly, governments pursued a policy of austerity leading to cuts in public spending and public investment. The combination of the fall of purchasing power of the majority of the population and the fall in public spending leads to a reduction of aggregate demand and therefore part of the production does not find sufficient outlets, resulting in a fall of [5] economic activity.

It’s important to clarify where we stand: I’m talking about a production crisis not because I’m in love with production growth. Rather, I am for organising (planning) a de-growth in order to respond, in particular, to the current ecological crisis. So, personally, I am not saddened by the fall or stagnation of production at world level, but the opposite. It’s all very well if fewer cars are produced and their sales drop. On the other hand for the capitalist system, it is not the same: the capitalist system needs to constantly develop production and conquer new markets. When it does not succeed or when it starts to get stuck, it responds to the situation by developing the world of financial speculation and issuing more and more fictitious capital not directly related to the productive sphere. It seems to work for years, and then at some point speculative bubbles burst. At several moments in the history of capitalism, the logic of permanent expansion of the capitalist system and of production has been expressed through trade wars (and this is again the case today, especially between the United States and its main partners) or through real wars, and this outcome is not entirely excluded today.

From the point of view of the exploited and despoiled social classes that make up the overwhelming majority of the population (hence the image of the 99% as opposed to the 1%), it is clear that the conclusion is that a radical break must be made with the logic of capital accumulation, whether productive or financial, or financialised productive, whatever the name. De-growth must be started immediately and urgently planned to combat the ecological crisis. We must produce less and better. The manufacture of certain products vital to the well-being of the population must increase (construction and renovation of decent housing, public transport, health centres and hospitals, drinking water supply and sewage treatment, schools, etc.) but many other productions must radically decline (personal cars) or disappear (arms manufacturing). Greenhouse gas emissions must be drastically and abruptly reduced. A whole range of industries and agricultural activities need to be converted. A large part, and in some cases all, of the public debt must be cancelled. Banks, insurance companies, the energy sector and other strategic sectors must be expropriated without compensation and transferred to the public service. Central banks must be given other tasks and structures. Other measures include the implementation of a comprehensive tax reform with high taxation of capital, an overall reduction in working time with compensatory hiring and maintenance of wage levels, free public health services, education, public transport, effective measures to ensure gender equality. Wealth must be distributed respecting the social justice and prioritising human rights and respecting fragile ecological balances.

The large mass of the population that sees its real income decrease or stagnate (i.e. its real purchasing power) compensates for this decrease or stagnation by resorting to debt to maintain its level of consumption, including on vital issues (how to buy foodstuffs, how to ensure schooling of children, how to reach the workplace if you have to buy a car since there is no public transport, how to pay for health care, etc.). Radical solutions to the growing indebtedness of a majority of the world’s population around the world must be found and debt cancellation must be used. A large part of private household debts (including student debts, abusive mortgage debts, abusive consumer debts, debts related to abusive microcredit, etc.) must therefore be cancelled. It is necessary to increase the income of the majority of the population and to greatly improve the quality of public services in health, education and public transport, free of charge for the population.

We are facing a multidimensional crisis of the world capitalist system: economic crisis, trade crisis, ecological crisis, crisis of several international institutions, part of the system of capitalist domination of the planet (WTO, NATO, G7, crisis in the Fed – the central bank of the United States -, crisis in the European Central Bank), political crisis in important countries (especially in the United States between the two big parties of big business), In the opinion of many people in many countries, the rejection of the capitalist system is higher than it has ever been in the last five decades, since the beginning of the neo-liberal offensive under Pinochet (1973), Thatcher (1979) and Reagan (1980) see: https://www.cadtm.org/International-situation-and-Radical-Alternatives

The abolition of illegitimate debts, this form of fictitious capital, must be part of a much broader programme of additional measures. Eco-socialism must be put at the heart of the solutions and not left aside. We must lead the fight against the multidimensional crisis of the capitalist system and resolutely embark on the path of an ecologist-feminist-socialist exit. This is an absolute and immediate necessity.Translated by Sushovan Dhar

Footnotes

[1] See Eric Toussaint, Bankocracy, 2015, Chapter 3 “Thirty years of financial deregulation”.

[2] In finance, a long position in a financial instrument means the holder of the position owns a positive amount of the instrument. The holder of the position has the expectation that the financial instrument will increase in value.

[3] “For example, if the annual income is £100 and the rate of interest 5%, then the £100 would represent the annual interest on £2,000, and the £2,000 is regarded as the capital-value of the legal title of ownership on the £100 annually. For the person who buys this title of ownership, the annual income of £100 represents indeed the interest on his capital invested at 5%. All connection with the actual expansion process of capital is thus completely lost, and the conception of capital as something with automatic self-expansion properties is thereby strengthened.” Karl Marx, Capital, Vol III. Chapter 29 (Component Parts of Bank Capital)

[4] The German car industry, directly employs 830,000 people and supports a further 2m jobs in the wider economy (Source: Financial Times, “German industry hit by biggest downturn since 2009”, 6-7 December 2019).

[5] Regarding the explanation of the crises, among Marxist economists, two great ‘schools’ have arisen. One claims that the crises are caused by the under-consumption of the masses (that is, over-production of consumer goods), the other that they are caused by over-accumulation (meaning the insufficiency of profit to continue expansion in the production of producer goods). This debate is but a variant of the old debate between those who explained the crises by ‘insufficient aggregate demand’, and those who explained them by ‘disproportionality’. Ernest Mandel, Theories of Crisis: An Explanation of the 1974-82 Cycle, in M. Gottdiener & Nicos Komninos ed. Capitalist Development and Crisis Theory: Accumulation, Regulation and Spatial Restructuring, New York, 1989, p 30. Following Ernest Mandel, I consider that the explanation of the current crisis must take into account several factors that cannot be reduced to a crisis produced by the overproduction of consumer goods (and therefore insufficient demand) or by the over-accumulation of capital (and therefore insufficient profit).

He is the author of Debt System (Haymarket books, Chicago, 2019), Bankocracy (2015); The Life and Crimes of an Exemplary Man (2014); Glance in the Rear View Mirror. Neoliberal Ideology From its Origins to the Present, Haymarket books, Chicago, 2012 (see here), etc.

See his bibliography: https://en.wikipedia.org/wiki/%C3%89ric_Toussaint

He co-authored World debt figures 2015 with Pierre Gottiniaux, Daniel Munevar and Antonio Sanabria (2015); and with Damien Millet Debt, the IMF, and the World Bank: Sixty Questions, Sixty Answers, Monthly Review Books, New York, 2010. He was the scientific coordinator of the Greek Truth Commission on Public Debt from April 2015 to November 2015.

Published at https://www.cadtm.org/No-the-coronavirus-is-not-responsible-for-the-fall-of-stock-prices