by Milan Rivié

18 December 2019

Public external debt in countries of the South [1] is a source of concern, notably because of its dramatic increase within the last two decades and because of parallels with the pre-crisis debt situation of Third World countries in the 1980s. Beyond the similarities, the widespread use of bond issues poses a new challenge. With nearly ten over-indebted countries and seventeen in suspension of payments, the debt crisis has already begun. [2]

Recent evolution of the debt in countries of the South

In July 2019, according to the IMF, among low-income countries, 9 are over-indebted and 24 nearly are, which amounts to 39%. [3] As evidence of the inability (and unwillingness) of international financial institutions (IFIs) to respond effectively and sustainably to over-indebtedness, half of these 31 countries had strictly implemented the adjustment policies of the HIPC initiative [4] launched by the G7 in 1996. [5] And according to a German NGO, 122 countries are in fact in a critical debt situation. [6]

Since 2010, the share of public external debt repayments by countries of the South in their total revenues has increased by 85%, peaking at an average level of 12.2% of state public revenues, the highest level since 2004. [7] The majority of countries affected by this increase in debt service had contracted loans and/or obligations with the IMF. [8]

| “Debt levels have reached new highs in advanced, emerging, and low-income countries […]global debt—both public and private — has reached an all-time high of $182 trillion — almost 60 percent higher than in 2007 […] Emerging and developing economies are already feeling the pinch as they adjust to monetary normalization in the advanced world.”

Christine Lagarde, Managing Director, IMF – October 1, 2018 [9] |

Between 2000 and 2017, the public external debt in countries of the South more than doubled, from US$ 1,304 billion to US$ 2,936 billion (see Table 1). Several factors may explain this increase. Taking advantage of high commodity price levels until 2013, countries of the South generated significant revenues from their export products and the economic growth rates were high for a majority of them.

Table 1: Evolution of the public external debt in countries of the South by category of creditors (in millions of US dollars and as a percentage) [10]

At the same time, the 2007-2008 financial crisis had an impact on the economies of Western countries. In search of more profitable financing, banks and private investors invested their substantial cash in the sovereign debt of countries of the South. [11] Fuelled by the low level of key interest rates in the United States and Europe, this cycle is currently coming to an end and has caught countries of the South in a “debt trap”.

The end of the commodity supercycle

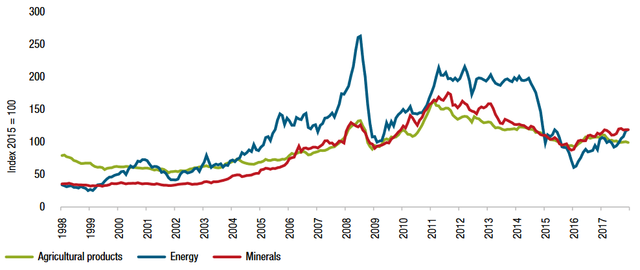

At the beginning of the 1980s, the fall in commodity prices was one of the elements that triggered the Third World debt crisis. History is repeating itself today for these vulnerable countries that are still dependent on their export revenues. [12] Mainly intended to provide the foreign currencies needed to repay external debt, raw materials have been exported since 2013 at prices well below those previously achieved (see figure 1). This reversal is causing significant financial difficulties for a number of countries dependent on oil, agricultural or mining revenues. [13] This factor is aggravated by the recent depreciation of Southern currencies against the US dollar. [14]

Figure 1: Monthly commodity prices indices, 1998-2018 (base year 2015 = 100) [15]

Rising interest rates

| As the article was written in May 2019, this paragraph on interest rates should be qualified since in the summer of 2019, the FED announced a (temporary) reduction in its interest rates, and the ECB announced an extension of the Quantitative easing mechanism. |

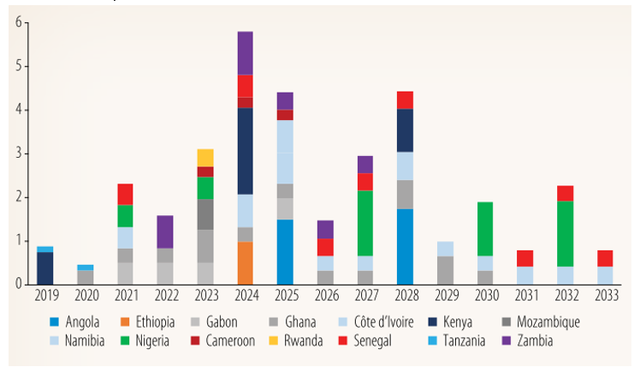

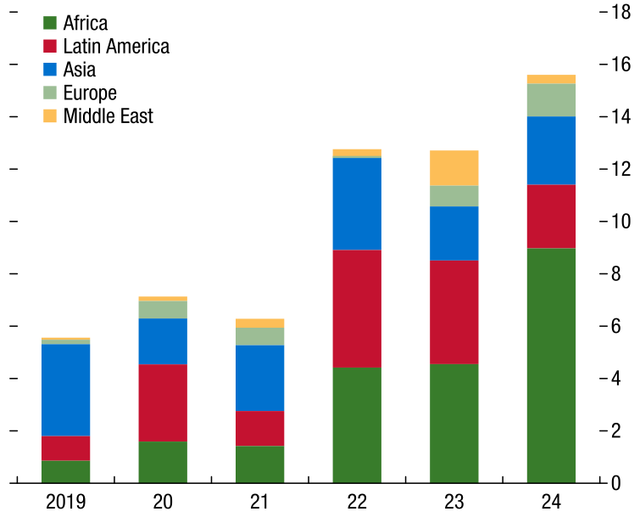

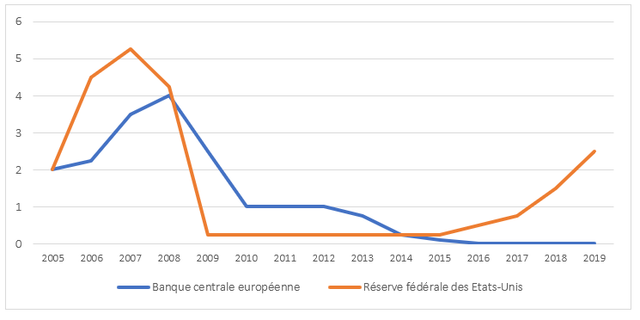

In response to the 2007-2008 financial crisis, central banks (US Federal Reserve – FED, European Central Bank – ECB, etc.) lowered their key interest rates. The measure was aimed at facilitating the financing of States and economic actors by promoting investment at a lower cost. However, central banks soon put an end to this policy of key rates close to zero or even zero (see figure 2). Mainly denominated in US dollars, [20] the external debt service of countries of the South consequently deteriorated while causing a decline in investment in these countries through a decline in investment because of private capital returning to more industrialized countries. [21] In 2017, more than 60% of the debt of the countries of the South consisted of variable-rate loans [22] and maturities of sovereign bonds will begin in 2021 (see figures 3 and 4). [23]

Figure 2: Changes in the key rates of the European Central Bank and the United States Federal Reserve since 2005 (in percentage terms) [24]

Figure 3: Selected International Bond Redemptions in SSA (Billions of U.S dollars) [25]

The IMF’s comeback

As a sign of the times, the IMF has made a strong comeback in recent years. After being weakened in the early 2000s, [27] 35 countries are currently implementing the policies required by the IMF in return for financial assistance. [28] The populations of Argentina, [29] Egypt, [30] Greece, [31] Morocco, [32] Tunisia, [33] Ukraine [34] and Central African countries [35] are among the latest victims of this undemocratic neoliberal institution in the service of Western interests. [36] After the failure of the structural adjustment plans of the 1980s, the IMF still insists on demanding the implementation of anti-social policies, [37] leading to an increase in inequalities [38] and causing major popular revolts in its wake. [39]

Cancelling illegitimate debts

Donald Trump’s recent announcement to stop the rise in FED interest rates in response to the deteriorating economic situation in the United States [40] may delay the spread of the debt crisis, but vigilance is required. Faced with the debt trap, the climate emergency, the challenges of development and social justice, it is necessary to work towards the application of collective and solidarity-based alternatives. The establishment of a citizen audit [41] to identify and abolish odious and illegitimate debts resulting from creditor greed and corruption of local elites [42] is a first example, as is the effective creation of a Bank of the South to help countries escape the domination mechanisms inherent in the IFIs, the Paris Club and other major new creditors such as China.

Translated by Milan Rivié and Christine Pagnoulle

Footnotes

[1] By ‘countries of the South’, we mean all low- and middle-income countries defined by the World Bank. Available at: https://data.worldbank.org/income-level/low-and-middle-income?view=chart

[2] UNCTAD, “Debt vulnerabilities a new debt trap”, October 2018. Available at: https://unctad.org/en/pages/PublicationWebflyer.aspx?publicationid=2259

[3] List of the nine over-indebted countries on November 30, 2019: Congo (Republic of), Gambia, Grenada, Mozambique, São Tomé and Principe, Somalia, South Sudan, Sudan and Zimbabwe. List of 24 countries in high risk of debt distress: Afghanistan, Burundi, Cameroon, Cabo Verde, Central African Republic, Chad, Djibouti, Dominica, Ethiopia, Ghana, Haiti, Kiribati, Lao P.D.R., Maldives, Marshall Islands, Mauritania, Micronesia, Samoa, Sierra Leone, St Vincent and the Grenadines, Tajikistan, Tonga, Tuvalu and Zambia. See IMF, “List of LIC DSAs for PRGT-Eligible Countries. As of November 30, 2019”. Available at: https://www.imf.org/external/Pubs/ft/dsa/DSAlist.pdf

[4] Ibid. Countries eligible to the HIPC initiative, currently in a situation of over-indebtedness: Gambia, Mozambique, São Tomé and Principe, South Sudan, Sudan ; currently in high risk of debt distress: Afghanistan, Burundi, Cameroon, Central African Republic, Chad, Ethiopia, Ghana, Haiti, Sierra Leone, Zambia.

[5] For a critical overview of the HIPC initiative, see Damien Millet, « Third World Debt », March 6, 2006, CADTM, Act 5 (in French). Available at: https://www.cadtm.org/La-dette-du-Tiers-Monde

[6] Jürgen Kaiser, “Global sovereign debt monitor”, Erlassjahr & Misereor, 2019, p.4. Available at: https://erlassjahr.de/en/news/global-sovereign-debt-monitor-2019/

[7] Jubilee Debt Campaign, “Crisis deepens as global South debt payments increase by 85%”, April 3, 2019. Available at: https://jubileedebt.org.uk/press-release/crisis-deepens-as-global-south-debt-payments-increase-by-85

[8] Ibid.

[9] Christine Lagarde, ‘Steer, Don’t Drift’: Managing Rising Risks to Keep the Global Economy on Course, speech at the seat of the IMF, October 1st, 2018. Available at: https://www.imf.org/en/News/Articles/2018/09/27/sp100118-steer-dont-drift

[10] According to World Bank datas available in the Global Development Finance reports, 2000 and 2009 editions and the World Bank’s International Debt Statistics Online.

[11] Andrea F.Presbiteroa, Dhaneshwar Ghurab, Olumuyiwa S.Adedejib et Lamin Njie, “Sovereign bonds in developing countries: Drivers of issuance and spreads”, Review of Development Finance 6, no. 1, August 3, 2016, 1-15. Available at:

https://www.sciencedirect.com/science/article/pii/S1879933716300483

[12] “State of commodity dependence 2019”, UNCTAD. Available at:

https://unctad.org/en/PublicationsLibrary/ditccom2019d1_en.pdf

[13] For instance, in 2017, fuels accounted for 50 to 97% of exports: Congo 50%, Gabon 70%, Chad 78% and Angola 97%; agricultural products accounted for 80% of Gambia’s exports and 57% of Grenada’s exports; mining products for 75% of Zambia’s exports and 92% of Botswana’s. Ibid. Note also the effects of speculation on commodities.

[14] Bodo Ellmers, “The evolving nature of developing country debt and solutions for change”, Eurodad, July 2016, p.6. Available at: https://eurodad.org/files/pdf/1546625-the-evolving-nature-of-developing-country-debt-and-solutions-for-change-1474374793.pdf and Claude Quémar, « Nouvelle donne pour la dette en Afrique : alerte au Mozambique », April 2, 2016, CADTM. Available at: https://www.cadtm.org/Nouvelle-donne-pour-la-dette-en (in French).

[15] “State of commodity dependence 2019”, UNCTAD. Available at:

https://unctad.org/en/PublicationsLibrary/ditccom2019d1_en.pdf, p.8.

[16] Bodo Ellmers, “The evolving nature of developing country debt and solutions for change”, Eurodad, July 2016, p.9. Available at: https://eurodad.org/files/pdf/1546625-the-evolving-nature-of-developing-country-debt-and-solutions-for-change-1474374793.pdf

[17] Ibid., p.8

[18] Andrea F.Presbiteroa, Dhaneshwar Ghurab, Olumuyiwa S.Adedejib and Lamin Njie, “Sovereign bonds in developing countries: Drivers of issuance and spreads”, Review of Development Finance 6, no. 1, August 3, 2016, 1-15. Available at:

https://www.sciencedirect.com/science/article/pii/S1879933716300483

[19] Anastasia Guscina, Guilherme Pedras and Gabriel Presciuttini, “First-Time International Bond Issuance—New Opportunities and Emerging Risks”, IMF Working Paper, WP/14/127, July 2014, p.8. Available at: https://www.imf.org/external/pubs/ft/wp/2014/wp14127.pdf

[21] Bodo Ellmers, “The evolving nature of developing country debt and solutions for change”, Eurodad, July 2016, p. 8. Available at: https://eurodad.org/files/pdf/1546625-the-evolving-nature-of-developing-country-debt-and-solutions-for-change-1474374793.pdf

[22] United Nations, Financing for Sustainable Development Report, 2019, p.119. Available at: https://developmentfinance.un.org/sites/developmentfinance.un.org/files/FSDR2019.pdf

[23] For a State, the repayment of a loan is carried out in two main stages. During the entire repayment period defined with its creditor, the State reimburses only the interest on the amount borrowed. At the end of this period, he will pay the capital in a single instalment.

[24] See https://global-rates.com/, accessed on 23 May 2019.

[25] Bloomberg in “Africa’s Pulse, An analysis of issues shaping Africa’s economic future”, World Bank, vol. 18, October 2018, p.21. Available at:

http://documents.worldbank.org/curated/en/881211538485130572/pdf/130414-PUBLIC-WB-AfricasPulse-Fall2018-vol18-Web.pdf

[26] IMF, “Global development finance report”, 2018, chapter 1, p.17. Available at: https://www.imf.org/en/Publications/GFSR/Issues/2018/09/25/Global-Financial-Stability-Report-October-2018

[27] Éric Toussaint, Damien Millet and Jérôme Duval, « Un FMI ‘redevenu utile’, mais pour qui ? », CADTM, 5 June 2011. Available at: https://www.cadtm.org/Un-FMI-redevenu-utile-mais-pour

[28] The 35 countries: Afghanistan, Angola, Argentina, Armenia, Barbados, Benin, Bosnia and Herzegovina, Burkina Faso, Cameroon, Chad, Colombia, Congo (Republic of), Côte d’Ivoire, Ecuador, Gabon, Georgia, Guinea, Honduras, Jordan, Madagascar, Malawi, Mali, Mauritania, Mexico, Moldova, Mongolia, Morocco, Niger, Pakistan, São Tome and Principe, Sierra Leone, Sri Lanka, Togo, Tunisia and Ukraine. IMF Lending Arrangements as of November 30, 2019 Available at: https://www.imf.org/external/np/fin/tad/extarr11.aspx?memberKey1=ZZZZ&date1key=2020-02-28

[29] Jérôme Duval, “Forced marriage between Argentina and the IMF turns into a fiasco”, CADTM, October 3, 2018. Available at: https://www.cadtm.org/Forced-marriage-between-Argentina-and-the-IMF-turns-into-a-fiasco

[30] Collective, “Open letter to the Egyptian President on the pending agreement with the IMF”, August 20, 2016. Available at: https://www.cadtm.org/Open-letter-to-the-Egyptian

[31] Marie-Laure Coulmin Koutsaftis, « La Grèce sous tutelle jusqu’au remboursement des prêts », CADTM, May 11, 2018. Available at: https://www.cadtm.org/La-Grece-sous-tutelle-jusqu-au-remboursement-des-prets

[32] Omar Aziki, « Le FMI continue à imposer ses réformes catastrophiques au Maroc », CADTM, February 12, 2017. Available at: https://www.cadtm.org/Le-FMI-continue-a-imposer-ses

[33] Fathi Chamkhi, « Tunisie : Aux origines de l’embrasement social de janvier 2018 », CADTM, March 12, 2018. Available at: https://www.cadtm.org/Tunisie-Aux-origines-de-l

[34] Jérôme Duval, “IMF Interference Plunges Ukraine into Recession”, CADTM, November 23, 2015. Available at: https://www.cadtm.org/IMF-Interference-Plunges-Ukraine

[35] Jean Nanga, « Afrique centrale : Retour à l’ajustement structurel néolibéral et mobilisations populaires », CADTM, May 12, 2017. Available at: https://www.cadtm.org/Afrique-centrale-Retour-a-l

[36] Éric Toussaint, “The IMF and the World Bank: It’s time to replace them”, CADTM, October 17, 2017. Available at: https://www.cadtm.org/The-IMF-and-the-World-Bank-It-s

[37] Émilie Paumard, « Le FMI et la Banque mondiale ont-ils appris de leurs erreurs ? », CADTM, October 13, 2017. Available at: https://www.cadtm.org/Le-FMI-et-la-Banque-mondiale-ont

[38] Mark Weisbrot, Rebecca Ray, Jake Johnston, Jose Antonio Cordero and Juan Antonio Montecin, “IMF ‐ Supported Macroeconomic Policies and the World Recession : A Look at Forty‐One Borrowing Countries”, Center for Economic and Policy Research, october 2009, p.4. Available at: http://cepr.net/documents/publications/imf-2009-10.pdf ; Jesse Griffiths and Konstantinos Todoulos, “Conditionally yours : An analysis of the policy conditions attached to IMF loans”, Eurodad, april 2014, p.4. Available at: https://eurodad.org/files/pdf/1546182-conditionally-yours-an-analysis-of-the-policy-conditions-attached-to-imf-loans.pdf, and Gino Brunswijck, “Unhealthy conditions : IMF loan conditionality and its impact on health financing”, Eurodad, November 28, 2018. Available at: https://eurodad.org/Entries/view/1546978/2018/11/20/Unhealthy-conditions-IMF-loan-conditionality-and-its-impact-on-health-financing

[39] Claude Quémar, « Le FMI met le feu en Haïti, en Guinée, en Égypte… », CADTM, August 8, 2018. Available at: https://www.cadtm.org/Le-FMI-met-le-feu-en-Haiti-en-Guinee-en-Egypte-16476

[40] Éric Toussaint, « The mountain of corporate debt will be the seed of the next financial crisis », CADTM, May 3, 2019. Available at: https://www.cadtm.org/The-mountain-of-corporate-debt-will-be-the-seed-of-the-next-financial-crisis

[41] Éric Toussaint and Damien Millet, « Citizen debt audits : how and why ? », CADTM, January 4, 2012. Available at: https://www.cadtm.org/Citizen-debt-audits-how-and-why

[42] CADTM, « Droits devant ! Plaidoyer contre toutes les dettes illégitimes », CADTM, February 1, 2013. Available at: https://www.cadtm.org/Droits-devant

Published at http://www.cadtm.org/New-debt-crisis-in-the-South