Meanwhile, the EU’s institutional barriers to long-term reform remain formidable.

Until March 21, Germany’s policymakers were like the Japanese soldiers who spent years lingering in the jungles of the Philippines, refusing to accept the reality that their country had lost World War II. In the case of Berlin, it was a case of the country stubbornly refusing to abandon six years of fiscal restraint, even as it became clear that such spending would be required to mitigate the impact of a pandemic that was bringing the global economy to a virtual standstill. That all appears to have changed now, with the government announcing a series of proposals that represent in aggregate approximately 10 percent of Germany’s GDP. Part of the package takes the form of direct public spending, but the majority is government funding for purchases of equity stakes in companies, as well as loans. Given the likely catastrophic decline in economic activity not just in Germany (which was already in recession), but the European Union as a whole, more likely needs to be done. The longer-term question, however, still remains: even if Berlin fully scales up on the fiscal front (as it should), can the EU’s institutions as a whole accommodate long-term reform that will adequately address the challenges once we get beyond the immediate crisis response occasioned by the coronavirus pandemic?

Better late than never. One should therefore applaud Berlin for finally acting decisively with the sincere hope that the deficit taboo has finally been destroyed once and for all, as it has all across the rest of the world. Germany matters: it is not only the biggest and most powerful economy in the EU, but its actions also provide political cover for other countries to follow suit (as well providing more leeway for the European Central Bank to act decisively).

Some of the early indications, however, suggest that it might take time before the country’s “stability culture”—the belief that public debt is invariably an evil, the consequences of which must be stopped at all costs—will be eradicated as quickly as one would hope. Wolfgang Munchau’s Eurointelligence March 24 briefing, “Return of the German Professors,” provides an example of potential domestic resistance to a complete volte-face in German policymaking circles posed by still influential figures such as Otmar Issing, the former chief economist and member of the board of the European Central Bank.

So how much further across the fiscal Rubicon does Berlin have to travel? To get some idea of the fiscal scale likely required, Germany might look to the UK, which has established a new Coronavirus Job Retention Scheme, which “will cover 80% of the wages of employees who would otherwise have been… ‘laid-off’ as a result of Coronavirus, subject to an overall cap of £2,500 per calendar month (£30,000 per annum)” (the UK government is also looking to expand the package to the self-employed). Taken in aggregate, the proposals represent at least 15 percent of the UK’s GDP.

The usual German phobias about inflation can also be addressed if the balance of the government spending is focused on expanding the productive capacity of the economy so as to ensure that essential goods can continue to be provided absent price rationing (or martial law). Put bluntly, if all work ceases, people will soon starve or, at the very least, experience shortages in vital supplies. Wealth needs to be added through investment, as well as labor.

Berlin’s so-called “black zero” fiscal rule, a perverse insistence on a budget balanced between fiscal spending and tax receipts, is now gone. The German chancellor, Angela Merkel, has conceded as much. And that should be welcomed. This destructive ideology has dominated not just Germany but all of Europe’s budgetary discussions for a decade. The current proposals, however, still place too much emphasis on debt and equity injections, and not enough direct spending, as the Financial Times’ Wolfgang Munchau observes: “Much of the money is credit, not grants. If a business borrows money while profits fall, solvency deteriorates. This was Italy’s problem after the eurozone crisis. Austerity left the economy in a weaker position to pay down debt.”

To Munchau’s point, the package as currently constituted consists of “a supplementary government budget of €156 billion, €100 billion for an economic stability fund that can take direct equity stakes in companies, and €100 billion in credit to public-sector development bank KfW for loans to struggling businesses,” as the Irish Times reports. Berlin is also extending €400 billion in state guarantees to underwrite the debts of companies affected by the turmoil. On the other hand, there is little direct spending to replace the incomes of those whose incomes have been lost as a result of the economic shutdown to allow small and medium-sized enterprises to weather the storm, against a backdrop of plummeting consumer confidence.

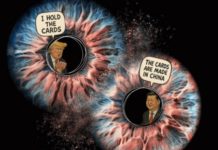

Ironically, one of the goals of the package, according to Germany’s economic affairs minister Peter Altmaier, is to preclude a “bargain sale of German economic and industrial interests,” precisely the opposite of what was forced on the Greek government in exchange for receiving economic assistance during its own financial crisis back in 2015 (when the Troika—the European Central Bank, the European Commission, and the IMF—all pressured Athens to engage in a program of wholesale privatization of state assets at highly distressed levels).

There are other indications to suggest that Germany has yet to fully shed its fiscal hair-shirt morality. The country’s leading policymakers are self-righteously suggesting that the country’s years of fiscal restraint is precisely what is now allowing Germany (and by implication no one else) to spend aggressively. This is nonsensical. As far as Germany itself goes, the low levels of the country’s national public debt have been offset by high levels of private debt, especially in the country’s rickety banking system (see Deutsche Bank as exhibit A). Additionally, the other mitigating factor has been the country’s large trade surplus (which was only made possible by the fact that many of its trading partners were willing to incur trade deficits with Berlin).

This raises another aspect of Germany’s tentative fiscal conversion: the stimulus must not be used to reconstruct the country’s export-driven mercantilist model. The rest of the global economy is being devastated. There is therefore unlikely to be much external demand for Germany’s traded goods for some time. Globalization is increasingly being reassessed as countries’ vulnerabilities to global supply chain disruptions are engendering a reexamination of existing economic theologies. There are likely to be attempts to resurrect manufacturing at home.

Some of these provisions are likely to be contrary to EU rules on state aid, but good luck insisting on their adherence as every nation races to avert a national depression. The Italian economy, for example, faces a massive challenge, given the scale of devastation (especially in its small business sector). Much as the UK government is now focusing on “leveling up” its more depressed economic regions long afflicted by globalization, so too are all of the Mediterranean nations likely to use the current suspension of budget austerity rules to maximize their respective chances of national recovery. That means Germany, too, should focus less on reviving its tradable goods sector and more on its domestic economy.

It speaks to the calamity of decades of bad policymaking, not only in Germany, but also in many other countries, that a global lockdown that potentially revives Great Depression levels of unemployment is now considered optimal policy to keep us safe and healthy. That’s the legacy of austerity of which Berlin was a leading proponent. Most of the national health care systems are unlikely to cope with the scale of the anticipated cases, and the limited hospital capacity means that they themselves are becoming vectors of contagion. A short-term depression is being risked on the basis of incomplete (and possibly faulty) information or, at the very least, models that are based on “reasonable” assumptions that are quickly undermined by events on the ground.

The good news about Berlin’s belated action is that it likely provides political cover for other eurozone nations to proceed with more aggressive government spending packages without being subject to the usual austerity-laden strictures that have been threatened and imposed by Brussels in the past (along with Germany’s enthusiastic backing and moralizing). And the ECB also has the scope to undertake more comprehensive action to ensure that national solvency does not become an issue (even though its initial maladroit response caused tremendous damage to the Italian bond market). ECB quantitative easing must continue minus any fiscal conditionality, as additional cuts to government spending as a quid pro quo to ECB bond-buying will simply exacerbate the problem by decreasing incomes and employment.

The bad news is that institutional constraints, such as the arbitrary limits on public debt and national budget deficits within the eurozone, continue to bias national policymaking toward austerity. Simply constructing temporary loopholes on the basis of COVID-19, therefore, is not enough. But attempts to ease those institutional constraints (such as via a mutualized eurobond issued by the ECB) will likely run into legal opposition in Berlin. The German constitutional court has already ruled that a political and fiscal union requires that the country hold a national referendum to transfer additional national sovereignty to the EU. Given today’s political climate in the country, it’s highly unlikely that such a high bar would pass democratic muster.

So while Germany likely will follow the UK and the U.S. with increasingly bigger fiscal actions as the scale of the pandemic’s damage becomes clearer, these measures, however welcome, are unlikely to address the longer-term challenges of attempting to govern the EU effectively absent more profound institutional changes. The political path of least resistance increasingly appears to be shifting momentum back toward a Europe of nation-states, rather than a supranational United States of Europe. On this basis, it is hard to envisage the single-currency union surviving. Governing by crisis is neither easy, nor effective, especially if one is not monetarily sovereign in one’s currency. The sooner all of Europe, especially Germany, recognizes that fact, the better the future is likely to be for all.

Marshall Auerback is a market analyst and commentator

This article was produced by Economy for All, a project of the Independent Media Institute