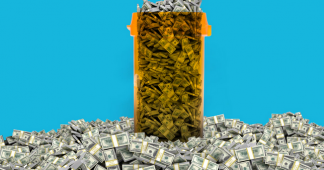

REVEALED: Two executives at drug firm Moderna quietly sold nearly $30 million of stock when they unveiled coronavirus vaccine and value rose – before share price went down again

- Moderna’s share price skyrocketed after it released promising results from its vaccine trial Monday, sparking hope that a vaccine could be available January

- Stocks surged as much as 30 percent Monday to $87 a share following the news

- Lorence Kim, Moderna’s chief financial officer, exercised 241,000 options for $3 million Monday, then sold them for $19.8 million, taking a $16.8 million profit

- Tal Zaks, Moderna’s chief medical officer, exercised $1.5 million stock options before making a profit of $8.2 million when he offloaded them for $9.77 million

- Moderna said this week’s sales from the two insiders were executed under automated insider trading plans, known as 10b5-1 plans, making them legal

- The transactions are generally carried out automatically, meaning that the insiders would not have taken any action

- Share price wavered more as the week went on and mixed opinions over the success of the vaccine trials came from the medical community

- Shares went up again Friday to $68.60 after Dr Anthony Fauci, the federal government’s top immunologist, said he was ‘cautiously optimistic’

- Here’s how to help people impacted by Covid-19

Two executives at drug firm Moderna quietly sold nearly $30 million of stock when they unveiled a coronavirus vaccine and value surged, before the share price quickly fell again amid skepticism from the medical community.

Moderna’s chief financial officer Lorence Kim and chief medical officer Tal Zaks dumped the staggering value of stocks on Monday and Tuesday when the share price skyrocketed following the company’s announcement of what it described as ‘positive’ results from its vaccine trial.

The two executives pocketed almost $25 million in profits in a day’s work before experts cast doubt on the vaccine’s success and sent shares tumbling.

Kim exercised 241,000 options for $3 million Monday, then instantly sold them for $19.8 million, taking a tidy profit of $16.8 million, SEC filings seen by CNN Business show.

On Tuesday, Zaks exercised $1.5 million stock options before making a profit of $8.2 million when he immediately offloaded them for $9.77 million.

Read more at https://www.dailymail.co.uk