17 May, 2020

Natural gas producers could soon be about to fight out a battle for market share in which prices could fall to negative levels until some of them decide to curb output.

Oil prices have staged an impressive recovery thanks to demand starting to bounce back as well as ongoing production cuts both by OPEC+ and IOCs in the US and elsewhere.

However, the industry is far from being out of the woods.

Whereas many oil punters now feel that negative prices are unlikely to happen again any time soon due to the developing tailwinds, CFTC recently fired a warning to brokers, exchanges, and clearinghouses that it actually remains a distinct possibility.

Natural gas markets risk treading the same path as oil.

Hard hit by a double whammy of weak demand and storage nearing tank tops, Qatar, the world’s biggest LNG producer, may very soon have to bite the bullet and curb output or risk cutting prices and finding itself in a battle for market share with the likes of Australia, US, Russia, and Norway.

Lose-Lose Proposition

Either way, it’s a lose-lose proposition for Qatar, though the second option would be far more perilous for the LNG market, especially for US exporters.

Qatar began sending its LNG exports to northwestern Europe in February after the coronavirus pandemic engulfed its main Asian markets and crippled demand. However, it was not long before Europe itself started feeling the heat of the health crisis with demand sharply plummeting in April. The Persian Gulf state has now been forced to borrow a leaf from its oil brethren by storing its excess LNG cargoes–which the country’s NOC, Qatar Petroleum, does at Belgium’s Zeebrugge import terminal where it has booked all the import capacity till 2044.

But just like in the oil sector, LNG storage is quickly filling up with 17 LNG supertankers–more than normal at this stage of the year–currently idling off the emirates coast. Further, storing LNG is much more expensive–and therefore a much shorter-term solution– than storing crude oil due to the former’s “boil-off” rate, which can lead to daily losses in the range of 0.07 percent to 0.15 percent.

Qatar’s low LNG production costs, especially at its Ras Laffan plant, might tempt it to lowball the market by cutting prices. However, this is a very myopic maneuver that will only prolong the anguish, as we recently saw with Saudi Arabia and Russia. Cutting production, though, is likely to be equally painful for Qatar after it was forced to lower its crude exports from 21316 QAR Million in February to 15913 QAR Million in March due to the price collapse. Qatar, together with the next two LNG giants Australia and the US, have maintained a near-100 percent utilization rate through these tough times.

Qatar exited OPEC in January 2019 as it sought to play a more prominent role on the global scene. Though a member of Gas Exporting Countries Forum (GECF), the organization lacks the decisiveness of OPEC, usually preferring to take a hands-off approach.

Super Contango

But even deep production cuts at this juncture might not save natural gas prices in the near-term.

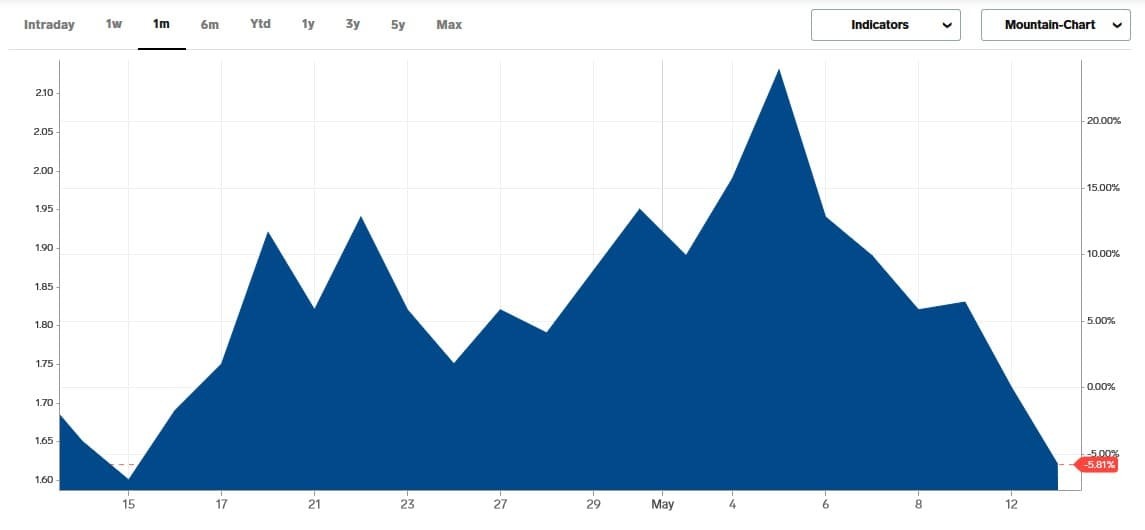

The LNG market is already in deep contango and quickly approaching super-contango. After a brief rally, natural gas prices have sunk to $1.63/MMbtu with summer month futures contracts heavily discounted compared to winter contracts. The spread between June and July Nymex contracts now sits at 23.9 cents, the widest one-month discount for the front-end strip since October 2016. The deep discount is even more baffling, given that it’s happening at the beginning of the injection season. Meanwhile, the discount for June vs. January 2021 contracts now stands at $1.33, more than double the gap a year ago.

That’s a near-term bearish signal.

At this rate, a super-contango could be reached in a matter of weeks, which incentivizes traders to buy and stockpile the commodity. BloombergNEF has predicted that this could lead to all-time highs for US inventory levels by the end of October and potentially test the working limit in the lower 48 states.