Premier Li Keqiang makes fresh appeal to multinationals, but six months after foreign ownership changes, applications are still not being approved

By 26 September, 2018

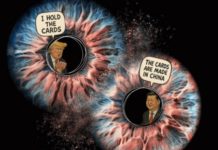

Beijing has again told global financial executives it will open its financial sector wider, under pressure from Western businesses for unrestricted access and despite signs of existing opening-up measures stalling.

But foreign financial firms retain strong doubts about how opening it up will proceed, and under what conditions, with the trade war with the United States complicating matters by putting pressure on China to do more – which China is loath to be seen to be responding to.

“We are making preparations, hoping that a few qualified foreign players can have their fully owned and fully licensed financial subsidiaries in China in three years,” Premier Li Keqiang told a small group of multinational company executives during the World Economic Forum (WEF) meetings in Tianjin last week.

In April, the Chinese government released a timetable for allowing full foreign ownership of financial firms. The restriction limiting foreign ownership of Chinese banks to stakes of less than 50 per cent was scrapped straight away, with promises that ownership limits on Chinese securities and insurance operations would get the same treatment in three years, although there were still many technical issues to solve.

Read more at www.scmp.com