By Andy Storey

17 October 2018

But of course, Chequers is opposed by many within May’s own Conservative party, and senior EU figures have their doubts about it too.

So Brexit without a negotiated agreement of this sort, and therefore with greater economic shocks and instability, is still a possibility – in which case the Central Bank puts the projected loss of Irish jobs at up to 40,000.

UCD economist Ron Davies and University of Bern researcher Joseph Francois report the “hard Brexit” costs as likely to be even higher, knocking more than 5 percent off Irish national income as trade with the United Kingdom drops, as well as some trade with the rest of the EU in sectors where Ireland and the UK share links in international “value chains”.

To illustrate, one such value chain is Irish cream liqueurs and whiskeys. That would be severely disrupted by border controls on this island.

Davies and Francois expect the worst of the Brexit-related job losses to bear on agricultural and low-skill occupations here.

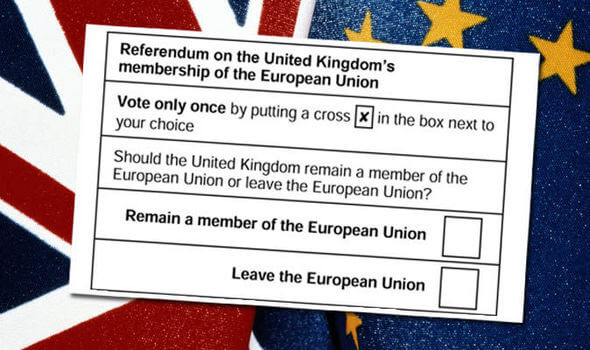

This begs a question: could Ireland at least reduce those costs by following the UK out of the EU in what might be called an “Irexit”?

Some such thinking appears to lie behind the formation last month of a new Irexit Freedom Party, though their agenda goes well beyond simple economic issues to embrace a general programme of (supposedly) reclaiming Irish freedom and democracy from Europe.

However, Davies and Francois insist that any Irexit would actually generate even worse economic outcomes than Brexit alone – while trade with the UK would be less disrupted by Ireland following the UK out the exit door, trade between Ireland and the EU (which is more important than that with the UK alone) would be damaged to a greater extent.

They conclude that “Irexit in any form is likely to make a bad situation worse”.

And this is only considering trade effects. In all likelihood, Irexit would also see a downturn in foreign (especially US) investment into Ireland on the grounds that we would no longer constitute an uncomplicated bridgehead into the EU market.

If Irexit were to be associated with the sort of rise in racist attitudes and attacks on immigrants that both fuelled and followed Brexit, than that would not be good for investment either, apart from its moral obnoxiousness.

UK studies certainly indicate that foreign investment there is going to be significantly impacted by Brexit, so similar effects could reasonably be anticipated for Ireland, whereas Ireland staying in the EU as the UK departs will see some investment diverted to this jurisdiction.

I have previously argued that Ireland is overly dependent on multinational investment. But, as the cliché goes, we are where we are, and we cannot now afford to be sanguine about anything that would impact such investment.

The extent to which Ireland is economically reliant on the EU (especially access to EU markets) may help explain why almost two-thirds of Irish people, proportionately more than anybody else in the union, tend to hold a positive image of the EU, according to the most recent Eurobarometer survey data (for Spring 2018). Only 8 percent of Irish people view the EU negatively.

The survey findings are less overwhelming when it comes to the question of trust: 54 percent of Irish people do tend to trust the EU, but 35 percent do not.

That relatively higher level of distrust may stem from the behaviour of the EU during the Irish debt and austerity crisis, when people living here were obliged to repay the debts (that were not theirs) of European banks that had lent money to Irish banks.

I have previously quoted economist Colm McCarthy on this issue but it is worth repeating his core point:

“[T]he country was the victim of a straightforward stick-up, perpetrated by Jean-Claude Trichet’s European Central Bank in Frankfurt … Trichet threatened two successive Irish governments with the withdrawal of liquidity support to the banking system in 2010 and 2011, unless the government paid numerous billions to unsecured and unguaranteed bondholders in bust banks which had already closed for keeps.”

So much for European solidarity. Davies and Francois attribute any possible future support for Irexit to “a continuing popular belief that austerity following the 2009 Euro crisis inequitably impacted the Irish …”. This is not a just a belief, it is a fact.

Ireland accounts for less than 1 percent of the EU population but it shouldered 42 percent of the cost of the European banking crisis. That’s close to €9,000 for every man, woman and child.

The EU’s institutions and its most powerful actors are broadly supportive of Ireland in the Brexit negotiations, but they have shown themselves perfectly willing to shaft us when it suits them.

This does not constitute a case for Irexit – in present circumstances that would be an act of economic self-harm. But it does constitute a case for scepticism and critical realism towards the EU rather than any deference and misplaced gratitude.

* Andy Storey is a lecturer in political economy at University College Dublin and a board member of human rights group Action from Ireland (Afri).

Published at https://dublininquirer.com/2018/10/17/andy-irexit-that-would-be-economic-self-harm