by

Two small countries, Iceland and Latvia, were severely affected during the global crisis in 2008. Iceland was the first to be hit and Latvia the hardest hit. Two fundamental differences influenced their response. Iceland’s banking system was in local ownership and Iceland was not an EU member state, but Latvia was in the EU and its banks were mostly in foreign ownership with Sweden in a dominating role.

No country or international organization wanted to rescue the Icelandic banks that collapsed in just a few days in October 2008, but in Latvia concerted rescue efforts were made by the European Commission, the continental Nordic governments, and the IMF as the main players.

The government of Iceland reached out to the continental Nordics for assistance during the crisis as well as to major central banks such as the US Federal Reserve, the European Central Bank, and the Bank of England. The furious public forced its government/elite out of office and not just the cabinet: the top management at the Central Bank of Iceland resigned and private bankers ended up in prison.

In 2008 a Special Investigation Commission (SIC) was established by the Icelandic Parliament to investigate and analyze the processes leading to the collapse of its three main banks. During its investigation the SIC made contact with officials and experts in- and out-side Iceland. Among those was Stefan Ingves, the Governor of the Swedish Central Bank (Riksbank). In fact, the SIC wrote a letter to Governor Ingves on 4 November 2009, where he was inter alia asked to answer specific questions. He replied in a letter dated 22 January 2010 where he states his opinion that unclear ownership and rapid expansion of the banks’ balance sheets had caused a hazard which the Icelandic government had neither seemed to fully grasp, nor fully understand how to deal with it by reducing the size of the banks.

Sweden did not suffer a serious crisis in 2008 despite its extensive banking interconnections in the other continental Nordics and in the Baltics. Instead of taking a hit from excessive and irresponsible lending in the Baltics, Sweden was, with EC support, able to export the 2008 crisis to those countries. This was done with fixed exchange rate policy protecting bank portfolios and austerity BIG dose. The cost was primarily born by the poorest segment of their population, the most vulnerable with little voice to protest. Such a policy would have been considered intolerable in Sweden and impossible politically for a government wanting to stay in office for more than a day.

Vassal state

Valdis Dombrovskis (then prime minister of Latvia) co-authored a 2011 book entitled ‘How Latvia Came Through the Financial Crisis’. As the book documents, the rescue package for Latvia was not put together in Latvia’s capital Riga or in a neutral third country. Rather “Swedish Minister of Finance Anders Borg called the closest friends of Latvia to an emergency meeting at Arlanda airport.” They did not even bother to go to downtown Stockholm.

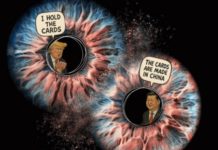

In his book Dombrovskis describes this meeting as “a kind of auction.” This was a rescue package for foreign banks more than the Latvian public. General Government Debt as percentage of GDP was very small in the Baltics when the crisis hit but during the bank rescue they increased in all the Baltic States; according to the IMF, in Latvia from 7 percent in 2007 to 40 percent in 2010.

Sweden suffered a serious financial crisis in the 1990s. Among the main lesson learned from that crisis was to keep its own currency with floating exchange rate and inflation target. But in the Baltics the exchange rate had to be fixed and this was a good portfolio protection for its banks. During a meeting with the Latvian Finance Minister in Riga in 2012, Borg urged Latvia not to delay its goal of joining the Euro Area in 2014.

But given the criticism from Governor Ingves on Iceland, questions remain: did the government of Sweden understand the hazard that the rapid expansion of its banks caused in the Baltics and did it fully understand how to deal with its cross-border interlinkages in the Nordic-Baltic region during the 2008 crisis, or since? Dombrovskis, now EC Commissioner for the Euro and Social Dialogue, gives a short answer for the Baltics. “The Swedish Riksbank and the Financial Supervisory Authority (Finansinspektionen) should also have paid attention to the excessive exposure of the Swedish commercial banks to the Baltic economies, but they did nothing.” This is hardly a pass grade for the Riksbank.

The symptoms persist

In fact, post-crisis, it is easy to get alarmed if one reads the Riksbank’s website. One recent example is as follows:

“The Swedish banking system is vulnerable due to its size, concentration and interconnectedness […] As the major Swedish banks have extensive cross-border operations, primarily through their presence in the Nordic Region, the Baltic States and the United Kingdom, they are also exposed towards short-term liquidity risks in other currencies. […] The major Swedish banks are also taking significant structural liquidity risks.”

This is the state of affair in Sweden almost a decade after the crisis in 2008 and another crisis there could affect the Nordic region and the Baltics as for example an IMF working paper states:

“The Nordic banks also dominate the banking sectors in the Baltic countries to a varying extent […] This means that risks in one country can easily spread to another.”

Does the Swedish government understand the hazard that it has caused in the Nordic-Baltic region or fully grasp how to deal with it by reducing the size of its banking system and the still dangerous cross-border banking interconnectedness in the region?

But Brussels insisted on full cooperation from the Baltic governments for bank rescue efforts as a condition for Euro Area membership and IMF staff stated in a research paper at Brookings: “if your financial sector is largely composed of foreign subsidiaries, it is a good idea to be friends with the parent banks.”

The Baltics States had about 7.8 million inhabitants at independence, but now only 6.1 million. The exodus amounts close to the current population of Latvia vanishing from the Baltics. But as Dombrovskis states in his book when presenting his “success” story around the world: “The greatest pleasure in life is doing what people say you cannot do.”

And he concludes: “the way the country [Latvia] navigated and successfully overcame the crisis is where we find lessons for Latvia itself and for the world at large.” And he wonders why Greece does not follow in Latvia‘s footsteps!

* Hilmar Þór Hilmarsson is a professor of economics at the University of Akureyri, Iceland and has held numerous visiting scholarships, including at the University of Cambridge in 2017 and 2018. He served as a specialist and co-ordinator with the World Bank Group in Washington DC from 1990 to 1995, at the World Bank office in Riga from 1999 to 2003 and in its Hanoi office from 2003 to 2006.