Oxford Review of Economic Policy, Volume 34, Issue 1-2, 5 January 2018, Pages 156–168,

05 January 2018

Abstract

I. Introduction

It’s somewhat startling, at least for those of us who bloviate about economics for a living, to realize just how much time has passed since the 2008 financial crisis. Indeed, the crisis and aftermath are starting to take on the status of an iconic historical episode, like the stagflation of the 1970s or the Great Depression itself, rather than that of freshly remembered experience. Younger colleagues sometimes ask me what it was like during the golden age of economics blogging, mainly concerned with macroeconomic debates, which they think of as an era that ended years ago.

Yet there is an odd, interesting difference, both among economists and with a wider audience, between the intellectual legacies of those previous episodes and what seems to be the state of macroeconomics now.

Each of those previous episodes of crisis was followed both by a major rethinking of macroeconomics and, eventually, by a clear victor in some of the fundamental debates. Thus, the Great Depression brought on Keynesian economics, which became the subject of fierce dispute—and everyone knew how those disputes turned out: Keynes, or Keynes as interpreted by and filtered through Hicks and Samuelson, won the argument.

In somewhat the same way, stagflation brought on the Friedman–Phelps natural rate hypothesis—yes, both men wrote their seminal papers before the 1970s, but the bad news brought their work to the top of the agenda. And everyone knew, up to a point anyway, how the debate over that hypothesis ended up: basically everyone accepted the natural rate idea, abandoning the notion of a long-run trade-off between inflation and unemployment. True, the profession then split into freshwater and saltwater camps over the effectiveness or lack thereof of short-run stabilization policies, a development that I think presaged some of what has happened since 2008. But I’ll get back to that.

For now, let me instead just focus on how different the economics-profession response to the post-2008 crisis has been from the responses to depression and stagflation. For this time there hasn’t been a big new idea, let alone one that has taken the profession by storm. Yes, there are lots of proclamations about things researchers should or must do differently, many of them represented in this issue of the Oxford Review. We need to put finance into the heart of the models! We need to incorporate heterogeneous agents! We need to incorporate more behavioural economics! And so on.

But while many of these ideas are very interesting, none of them seems to have emerged as the idea we need to grapple with. The intellectual impact of the crisis just seems far more muted than the scale of crisis might have led one to expect. Why?

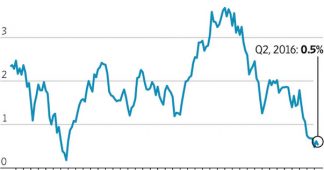

Well, I’m going to offer what I suspect will be a controversial answer: namely, macroeconomics hasn’t changed that much because it was, in two senses, what my father’s generation used to call ‘good enough for government work’. On one side, the basic models used by macroeconomists who either practise or comment frequently on policy have actually worked quite well, indeed remarkably well. On the other, the policy response to the crisis, while severely lacking in many ways, was sufficient to avert utter disaster, which in turn allowed the more inflexible members of our profession to ignore events in a way they couldn’t in past episodes.

In what follows I start with the lessons of the financial crisis and Great Recession, which economists obviously failed to predict. I then move on to the aftermath, the era of fiscal austerity and unorthodox monetary policy, in which I’ll argue that basic macroeconomics, at least in one version, performed extremely well. I follow up with some puzzles that remain. Finally, I turn to the policy response—and its implications for the economics profession.

Read more at https://academic.oup.com/oxrep/article/34/1-2/156/4781811