Government by Goldman

Gary Cohn Is Giving Goldman Sachs Everything It Ever Wanted From the Trump Administration

By Gary Rivlin, Michael Hudson

Steve Bannon was in the room the day Donald Trump first fell for Gary Cohn. So were Reince Priebus, Jared Kushner, and Trump’s pick for secretary of Treasury, Steve Mnuchin. It was the end of November, three weeks after Trump’s improbable victory, and Cohn, then still the president of Goldman Sachs, was at Trump Tower presumably at the invitation of Kushner, with whom he was friendly. Cohn was there to offer his views about jobs and the economy. But, like the man he was there to meet, he was at heart a salesman.

On the campaign trail, Trump had spoken often about the importance of investing in infrastructure. Yet the president-elect had apparently failed to appreciate that the government would need to come up with hundreds of billions of dollars to fund his plans. Cohn, brash and bold, wired to attack any moneymaking opportunity, pitched a fix that would put Wall Street firms at the center: Private-industry partners could help infrastructure get fixed, saving the federal government from going deeper into debt. The way the moment was captured by the New York Times, among other publications, Trump was dumbfounded. “Is this true?” he asked. Was a trillion-dollar infrastructure plan likely to increase the deficit by a trillion dollars? Confronted by nodding heads, an unhappy president-elect said, “Why did I have to wait to have this guy tell me?”

Within two weeks, the transition team announced that Cohn would take over as director of the president’s National Economic Council.

1. GOLDMAN ALWAYS WINS

Goldman Sachs had been a favorite cudgel for candidate Trump — the symbol of a government that favors Wall Street over its citizenry. Trump proclaimed that Hillary Clinton was in the firm’s pockets, as was Ted Cruz. It was Goldman Sachs that Trump singled out when he railed against a system rigged in favor of the global elite — one that “robbed our working class, stripped our country of wealth, and put money into the pockets of a handful of large corporations and political entities.” Cohn, as president and chief operating officer of Goldman Sachs, had been at the heart of it all. Aggressive and relentless, a former aluminum siding salesman and commodities broker with a nose for making money, Cohn had turned Goldman’s sleepy home loan unit into what a Senate staffer called “one of the largest mortgage trading desks in the world.” There, he aggressively pushed his sales team to sell mortgage-backed securities to unaware investors even as he watched over “the big short,” Goldman’s decision to bet billions of dollars that the market would collapse.

Now Cohn would be coordinating economic policy for the populist president.

The conflicts between the two men were striking. Cohn ran a giant investment bank with offices in financial capitals around the globe, one deeply committed to a world with few economic borders. Trump’s nationalist campaign contradicted everything Goldman Sachs and its top executives represented on the global stage.

Trump raged against “offshoring” by American companies during the 2016 campaign. He even threatened “retribution,” a 35 percent tariff on any goods imported into the United States by a company that had moved jobs overseas. But Cohn laid out Goldman’s very different view of offshoring at an investor conference in Naples, Florida, in November. There, Cohn explained unapologetically that Goldman had offshored its back-office staff, including payroll and IT, to Bangalore, India, now home to the firm’s largest office outside New York City: “We hire people there because they work for cents on the dollar versus what people work for in the United States.”

Candidate Trump promised to create millions of new jobs, vowing to be “the greatest jobs president that God ever created.” Cohn, as Goldman Sachs’s president and COO, oversaw the firm’s mergers and acquisitions business that had, over the previous three years, led to the loss of at least 22,000 U.S. jobs, according to a study by two advocacy groups. Early in his candidacy, Trump described as “disgusting” Pfizer’s decision to buy a smaller Irish competitor in order to execute a “corporate inversion,” a maneuver in which a U.S. company moves its headquarters overseas to reduce its tax burden. The Pfizer deal ultimately fell through. But in 2016, in the heat of the campaign, Goldman advised on a megadeal that saw Johnson Controls, a Fortune 500 company based in Milwaukee, buy the Ireland-based Tyco International with the same goal. A few months later, with Goldman’s help, Johnson Controls had executed its inversion.

With Cohn’s appointment, Trump now had three Goldman Sachs alums in top positions inside his administration: Steve Bannon, who was a vice president at Goldman when he left the firm in 1990, as chief strategist, and Steve Mnuchin, who had spent 17 years at Goldman, as Treasury secretary. And there were more to come. A few weeks later, another Goldman partner, Dina Powell, joined the White House as a senior counselor for economic initiatives. Goldman was a longtime client of Jay Clayton, Trump’s choice to chair the Securities and Exchange Commission; Clayton had represented Goldman after the 2008 financial crisis, and his wife Gretchen worked there as a wealth management adviser. And there was the brief, colorful tenure of Anthony Scaramucci as White House communications director: Scaramucci had been a vice president at Goldman Sachs before leaving to co-found his own investment company.

Even before Scaramucci, Sen. Elizabeth Warren, D-Mass., had joked that enough Goldman alum were working for the Trump administration to open a branch office in the White House.

“There was a devastating financial crisis just over eight years ago,” Warren said. “Goldman Sachs was at the heart of that crisis. The idea that the president is now going to turn over the country’s economic policy to a senior Goldman executive turns my stomach.” Prior administrations often had one or two people from Goldman serving in top positions. George W. Bush at one point had three. At its peak, the Trump administration effectively had six.

Earlier this summer, Trump boasted about his team of economic advisers at a rally in Cedar Rapids, Iowa. “This is the president of Goldman Sachs. Smart,” Trump said. “Having him represent us! He went from massive paydays to peanuts.”

Trump waved off anyone who might question his decision to rely on the very people he had demonized. “Somebody said, ‘Why did you appoint a rich person to be in charge of the economy?’ … I said: ‘Because that’s the kind of thinking we want.’” He needed “great, brilliant business minds … so the world doesn’t take advantage of us.” How else could he get the job done? “I love all people, rich or poor, but in those particular positions, I just don’t want a poor person.”

“Does that make sense?” Trump asked. The crowd cheered.

Years of financial disclosure forms confirm that Cohn is indeed very rich. At the end of 2016, he owned some 900,000 shares of Goldman Sachs stock, a stake worth around $220 million on the day Trump announced his appointment. Plus, he’d sold a million more Goldman shares over the previous half-dozen years. In 2007 alone, the year of the big short, Goldman Sachs paid him nearly $73 million — more than the firm paid CEO Lloyd Blankfein. The disclosure forms Cohn filled out to join the administration indicate he owned assets valued at $252 million to $611 million. That may or may not include the $65 million parting gift Goldman’s board of directors gave him for “outstanding leadership” just days before Trump was sworn in.

Like anyone taking a top job in the Trump administration, Cohn was required to sign a pledge vowing not to participate for the next two years in any matter “that is directly and substantially related to my former employer or former clients, including regulations and contracts.” But presidents have sometimes issued waivers to these requirements, and it is unclear whether the Trump administration is making such waivers public.

Sens. Warren and Tammy Baldwin, a Democrat from Wisconsin, sent Cohn a letter a few days later. They brought up the $65 million bonus and asked him to publicly recuse himself from any issue that could have a direct or “significant indirect” impact on his old firm. Cohn never responded to the letter, and if he has ever received a waiver, it has not been made available to the public or the Office of Government Ethics.

“Consistent with the Trump administration’s stringent ethics rules, Mr. Cohn will recuse himself from participating in any matter directly involving his former employer, Goldman Sachs,” White House spokesperson Natalie Strom said. “The White House will not comment further.”

The White House declined requests to make Cohn available for an interview and declined to answer a detailed set of questions.

Cohn shared the podium with fellow Goldman alum Mnuchin (the two made partner there the same year) when the administration unveiled its new tax plan, one that, if the past is prelude, had the potential to save Goldman more than $1 billion a year in corporate taxes. The president had promised to “do a number” on financial reforms implemented after the 2008 subprime crisis, including one that threatened to cost Goldman several billion dollars a year in revenues. Under Cohn, the administration has introduced new rules easing initial public offerings — a Goldman Sachs specialty dating back to the start of the last century, when the firm handled the IPOs of Sears, Roebuck; F. W. Woolworth; and Studebaker. As Trump’s top economic policy adviser, Cohn can exert influence over regulatory agencies that have shaken billions in penalties and settlements out of Goldman Sachs in recent years. And his former colleagues inside Goldman’s Public Sector and Infrastructure group likely appreciate the Trump administration’s infrastructure plan, which is more or less exactly as Cohn first pitched it inside Trump Tower in November.

“It’s hard to see how Gary Cohn recusing himself would solve a lot of these conflicts because nearly every major decision of his job would have a significant impact, likely billions of dollars, on Goldman Sachs and its executives,” said Tyler Gellasch, an attorney and former Senate staffer who helped draft Dodd-Frank, the landmark financial reform law passed in the wake of the financial meltdown. “Goldman touches nearly every aspect of the economy, from selling U.S. treasuries to helping companies go public, and the National Economic Council advises on all of that.”

In the wake of last month’s white supremacist rally in Charlottesville, Virginia, Cohn confessed to the Financial Times that he has “come under enormous pressure both to resign and to remain.” But the man who the Washington Post has dubbed Trump’s “moderate voice” declared that neo-Nazis would not force “this Jew” to leave his job. “As a patriotic American, I am reluctant to leave my post as director of the National Economic Council,” Cohn told FT. “I feel a duty to fulfill my commitment to work on behalf of the American people.”

Or at least a few of them. The Trump economic agenda, it turns out, is largely the Goldman agenda, one with the potential to deliver any number of gifts to the firm that made Cohn colossally rich. If Cohn stays, it will be to pursue an agenda of aggressive financial deregulation and massive corporate tax cuts — he seeks to slash rates by 57 percent — that would dramatically increase profits for large financial players like Goldman. It is an agenda as radical in its scope and impact as Bannon’s was.

2. ALPHA MALES

Donald Trump, the “blue-collar billionaire,” has taken great pains to write grit and toughness into his privileged biography. He talks of military schools and visits to construction sites with his father and wrote in “The Art of the Deal” that in the second grade, “I actually gave a teacher a black eye. I punched my music teacher because I didn’t think he knew anything about music and I almost got expelled.” Yet when the authors of the book “Trump Revealed: An American Journey of Ambition, Ego, Money, and Power” spoke to several of his childhood friends, none of them recalled the incident. Trump himself crumpled when asked about the incident during the 2016 campaign: “When I say ‘punch,’ when you’re that age, nobody punches very hard.”

Gary Cohn, however, is the middle-class kid and self-made millionaire Trump imagines himself to be. It appears that Cohn actually did slug a grade-school teacher in the face. “I was being abused,” Cohn told author Malcolm Gladwell, who interviewed him for his book, “David and Goliath: Underdogs, Misfits, and the Art of Battling Giants,” back when Cohn was still president of Goldman Sachs. As a child, Cohn struggled with dyslexia, a reading disorder people didn’t understand much about when Cohn attended school in the 1970s in a suburb outside Cleveland. “You’re a 6- or 7- or 8-year-old-kid, and you’re in a public-school setting, and everyone thinks you’re an idiot,” Cohn confessed to Gladwell. “You’d try to get up every morning and say, today is going to be better, but after you do that a couple of years, you realize that today is going to be no different than yesterday.” One time when he was in the fourth grade, a teacher put him under her desk, rolled her chair close, and started kicking him, Cohn said. “I pushed the chair back, hit her in the face, and walked out.”

While Trump’s father was a wealthy real estate developer, Cohn’s father was an electrician. When Trump sought to get into the casino business, his father loaned him $14 million. When Cohn couldn’t find a job after graduating from college, all his father could do was find him one selling aluminum siding. While Trump has the instincts of a reality show producer and an eye for spectacle, Cohn prefers to operate in the shadows.

But they likely recognize much of themselves in the other. Both Cohn and Trump are alpha males — men of action unlikely to be found holed up in an office reading through stacks of policy reports. In fact, neither seems to be much of a reader. Cohn told Gladwell it would take him roughly six hours to read just 22 pages; he ended his time with the author by wishing him luck on “your book I’m not going to read.” Both have a transactional view of politics. Trump switched his voter registration between Democratic, Republican, and independent seven times between 1999 and 2012. In the 2000s, his foundation gave $100,000 to the Clinton Foundation, and he contributed $4,700 to Hillary Clinton’s senatorial campaigns. He even bought and refurbished a golf course in Westchester County a few miles from the Clinton home, in part, Trump once admitted, to ingratiate himself with the Clintons. Cohn is a registered Democrat who has given at least $275,000 to Democrats over the years, including to the campaigns of Hillary Clinton and Barack Obama, but also around $250,000 to Republicans, including Senate Majority Leader Mitch McConnell and Florida Sen. Marco Rubio.

There are also striking similarities in their business histories. Both have a knack for weathering scandals and setbacks and coming out on top. Trump has filed for bankruptcy four times, started a long list of failed businesses (casinos, an airline, a football team, a steak company), but managed, through his best-selling books and highly rated reality TV show, to recast himself as the world’s greatest businessman. During Cohn’s tenure as president, Goldman Sachs faced lawsuits and federal investigations that resulted in $9 billion in fines for misconduct in the run-up to the subprime meltdown. Goldman not only survived but thrived, posting record profits — and Cohn was rewarded with handsome bonuses and a position at the top of the new administration.

Cohn’s path to the White House started with a tale of brass and bluster that would make Trump the salesman proud. Still in his 20s and stuck selling aluminum siding, Cohn made a play that would change his life. In the fall of 1982, while visiting the company’s home office on Long Island, he stole a day from work and headed to the U.S. commodities exchange in Manhattan, hoping to talk himself into a job. He overheard an important-looking man say he was heading to LaGuardia Airport; Cohn blurted out that he was headed there, too. He jumped into a cab with the man and, Cohn told Gladwell, who devoted six pages of “David and Goliath” to Cohn’s underdog rise, “I lied all the way to the airport.” The man confided to Cohn that his firm had just put him in charge of a market, options, that he knew little about. Cohn likely knew even less, but he assured his backseat companion that he could get him up to speed. Cohn then spent the weekend reading and re-reading a book called “Options as a Strategic Investment.” Within the week, he’d been hired as the man’s assistant.

Cohn soon learned enough to venture off on his own and established himself as an independent silver trader on the floor of the New York Commodities Exchange. In 1990, Goldman Sachs, arguably the most elite firm on Wall Street, offered him a job.

Goldman Sachs was founded in the years just after the American Civil War. Marcus Goldman, a Jewish immigrant from Germany, leased a cellar office next to a coal chute in 1869. There, in an office one block from Wall Street, he bought the bad debt of local businesses that needed quick cash. His son-in-law, Samuel Sachs, joined the firm in 1882. A generation later, in 1906, the firm made its first mark, arranging for the public sale of shares in Sears, Roebuck. Goldman Sachs’s influence over politics dates back at least to 1914. That year, Henry Goldman, the founder’s son, was invited to advise Woodrow Wilson’s administration about the creation of a central bank, mandated by the Federal Reserve Act, which had passed the previous year. Goldman Sachs men have played important roles in U.S. government ever since.

There was the occasional scandal, such as Goldman Sachs’s role in the 1970 collapse of Penn Central railroad, then the largest corporate bankruptcy in U.S. history. Still, the firm built a reputation as a sober, elite partnership that served its clients ably. In 1979, when John Whitehead, a senior partner and co-chairman, set to paper what he called Goldman’s “Business Principles,” he began with the firm’s most cherished belief: The client’s interests come before all else.

Two years later, Goldman took a step that signaled the beginning of the end of that culture. In the fall of 1981, Goldman purchased J. Aron & Co., a commodities trading firm. Some within the partnership were against the acquisition, worried over how profane, often crude, trading culture would mix with Goldman’s restrained, well-mannered way of doing business. “We were street fighters,” one former J. Aron partner told Fortune magazine in 2008.

The J. Aron team moved into the Goldman Sachs offices in lower Manhattan, but didn’t adopt its culture. Within a few years, it was producing well over $1 billion a year in profits. They were 300 employees inside a firm of 6,000, but were posting one-third of Goldman’s total profits. The cultural shift, it turned out, was moving in the other direction. J. Aron, according to a book by Charles D. Ellis, a former Goldman consultant, brought to Goldman “a trading culture that would become dominant in the firm.”

Lloyd Blankfein, who ascended to chairman and CEO in in 2006, started his Goldman career at J. Aron, a year after Goldman acquired the firm. “We didn’t have the word ‘client’ or ‘customer’ at the old J. Aron,” Blankfein told Fortune magazine two years after taking over as CEO. “We had counter-parties.” Cohn joined J. Aron eight years after Blankfein did, in 1990. Four years later, Blankfein was put in charge of the firm’s Fixed Income, Currency, and Commodities division, which included J. Aron. Cohn, loyal and hard-working, with an instinct for connecting with people who can help him, became Blankfein’s “corporate problem solver.”

The emergence of “Bad Goldman” — and Cohn’s central role in that drama — is really the story of the rise of the traders inside the firm. “As trading came to be a bigger part of Wall Street, I noticed that the vision changed,” said Robert Kaplan, a former Goldman Sachs vice chairman, who left in 2006 after working at the firm for 23 years. “The leaders were saying the same words, but they started to change incentives away from the value-added vision and tilt more to making money first. If making money is your vision, what lengths will you not go?”

At the height of the dot-com years, a debate raged within the firm. The firm underwrote dozens of technology IPOs, including Microsoft and Yahoo, in the 1980s and 1990s, minting an untold number of multimillionaires and the occasional billionaire. Some of the companies they were bringing public generated no profits at all, while Goldman was generating up to $3 billion in profits a year. It seemed inevitable that some within Goldman Sachs began to dream of jettisoning the Goldman’s century-old partnership structure and taking their firm public, too. Jon Corzine was running the firm then — he would later go into politics in the Goldman tradition, first as a U.S. senator and then as New Jersey governor — and was four-square in favor of going public. Corzine’s second in command, Henry Paulson — who would go on to serve as Treasury secretary — was against the idea. But Corzine ordered up a study that supported his view that remaining private stifled Goldman’s competitive opportunities and promoted Paulson to co-senior partner. Paulson soon got on board. In May 1999, Goldman sold $3.7 billion worth of shares in the company. At the end of the first day of trading, Corzine’s and Paulson’s stakes in the firm were each worth $205 million. Cohn’s and Mnuchin’s shares were each worth $112 million. And Blankfein ended up with $168 million in company stock.

Like any publicly traded company, there would now be pressure on Goldman Sachs to make its quarterly numbers and “maximize shareholder value.” Discarding the partner model also meant the loss of a valuable restraint on risk-taking and bad behavior. Under the old system, any losses or fines came out of the partners’ pockets. In the early 1990s, for example, the firm was involved in transactions with Robert Maxwell, a London-based media mogul who was accused of stealing hundreds of millions of pounds from his companies’ pension funds. The $253 million that Goldman Sachs paid to settle lawsuits brought by pension funds over its involvement was split among the firm’s 84 limited partners. Now any losses are paid by a publicly traded entity owned by shareholders, with no direct financial liability for the decision-makers themselves. In theory, Goldman could claw back bonuses in response to executives’ bad behavior. But in 2016, when Goldman paid over $5 billion to settle charges brought by the Justice Department that the firm misled customers in the sale of a subprime mortgage product during Cohn’s time overseeing that unit, the Goldman board declined to dock Cohn’s pay. Instead, the company awarded him a $5.5 million cash bonus and another $12.6 million in company stock.

As Blankfein moved up the corporate hierarchy, Cohn rose along with him. When Blankfein was made vice chairman in charge of the firm’s multibillion-dollar global commodities business and its equities division, Cohn took over as co-head of FICC, Blankfein’s previous position. That meant Cohn was overseeing not just J. Aron and the firm’s commodities business, but also its currency trades and bond sales. By the start of 2004, Blankfein was promoted to president and COO, and Cohn was named co-head of global securities. At that point, Cohn had authority over the mortgage-trading desk. Under Cohn, the firm aggressively moved into the subprime mortgage market, using Goldman’s own money and that of its customers to help stoke the housing bubble.

Goldman was already enabling subprime predators, such as Ameriquest and New Century Financial, by providing them with the cash infusions they needed to scale up their lending to individual home buyers. Cohn would steer the firm deeper into the subprime frenzy by setting up Goldman as a patron of some of these same mortgage originators. During his tenure, Goldman snapped up loans from New Century, Countrywide, and other notorious mortgage originators and bundled them into deals with opaque names, such as ABACUS and GSAMP. Under Cohn’s watchful eye, Goldman’s brokers then funneled slices to customers they sold on the wisdom of holding mortgage-backed securities in their portfolios.

One such creation, GSAA Home Equity Trust 2006-2, illustrates Goldman’s disregard for the quality of loans it was buying and packaging into security deals. Created in early 2006, the investment vehicle was made up of more than $1 billion in home loans Goldman had bought from Ameriquest, one of the nation’s largest and most aggressive subprime lenders. By that point, the lender already had set aside $325 million to settle a probe by attorneys general and banking regulators in 49 states, who accused Ameriquest of misleading thousands of borrowers about the costs of their loans and falsifying home appraisals and other key documents. Yet GSAA Home Equity Trust 2006-2 was filled with Ameriquest loans made to more than 3,000 homeowners in Arizona, Illinois, Florida, and elsewhere. By the end of 2008, 65 percent of the roughly 1,400 borrowers whose loans remained in the deal were in default, had filed for bankruptcy, or had been targeted for foreclosure.

In just three years, Goldman Sachs had increased its trading volume by a factor of 50, which the Wall Street Journal attributed to “Cohn’s successful push to rev up risk-taking and use of Goldman’s own capital to make a profit” — what the industry calls proprietary trading, or prop trading. The 2010 Journal article quoted Justin Gmelich, then the firm’s mortgage chief, who said of Cohn, “He reshaped the culture of the mortgage department into more of a trading environment.” In 2005, with Cohn overseeing the firm’s home loan desk, Goldman underwrote $103 billion in mortgage-backed securities and other more esoteric products, such as collateralized debt obligations, which often were priced based on giant pools of home loans. The following year, the firm underwrote deals worth $131 billion.

In 2006, CEO Henry Paulson left the firm to join George W. Bush’s cabinet as Treasury secretary. Blankfein, Cohn’s mentor and friend, took Paulson’s place. By tradition, Blankfein, a trader, should have elevated someone from the investment banking side to serve as his No. 2, so both sides of the firm would be represented in the top leadership. Instead he named Cohn, his long-time loyalist, and Jon Winkelried, who also had history on the trading side, as co-presidents and co-COOs. Winkelried, who had started at Goldman eight years before Cohn, had probably earned the right to hold those titles by himself. But Cohn had the advantage of his relationship with the CEO. Blankfein and Cohn vacationed together in the Caribbean and Mexico, owned homes near each other in the Hamptons, and their children attended the same school. Winkelreid was out in two years. The bromance between his fellow No. 2 and the top boss may have proved too much.

With Blankfein and Cohn at the top, the transformation of Goldman Sachs was complete. By 2009, investment banking had shrunk to barely 10 percent of the firm’s revenues. Richard Marin, a former executive at Bear Stearns, a Goldman competitor that wouldn’t survive the mortgage meltdown, saw Cohn as “the root of the problem.” Explained Marin, “When you become arrogant in a trading sense, you begin to think that everybody’s a counterparty, not a customer, not a client. And as a counterparty, you’re allowed to rip their face off.”

3. THE BIG SHORT

People inside Goldman Sachs were growing nervous. It was the fall of 2006 and, as Daniel Sparks, the Goldman partner overseeing the firm’s 400-person mortgage trading department, wrote in an email to several colleagues, “Subprime market getting hit hard.” The firm had lent millions to New Century, a mortgage lender dealing in the higher-risk subprime market. And now New Century was late on payments. Sparks could see that the wobbly housing market was having an impact on his department. For 10 consecutive trading days, his people had lost money. The dollar amounts were small to a behemoth like Goldman: between $5 million and $30 million a day. But the trend made Sparks jittery enough to share his concerns with the Goldman’s top executives: President Gary Cohn; David Viniar, the firm’s chief financial officer; and CEO Lloyd Blankfein.

Sparks, a Cohn protégé, was running the mortgage desk that his mentor, only a few years earlier, had built into a major profit center for the bank. In 2006 and 2007, a report by the Senate Permanent Subcommittee on Investigations found, the two “maintained frequent, direct contact” as Goldman worked to jettison the billions in subprime loans it had on its book. “One of my jobs at the time was to make sure Gary and David and Lloyd knew what was going on,” Sparks told William Cohan, author of the 2011 book “Money and Power: How Goldman Sachs Came to Rule the World.” “They don’t like surprises.” Viniar summoned around 20 traders and managers to a 30th floor conference room inside Goldman headquarters in lower Manhattan. It was there, on an unseasonably warm Thursday in December 2006, that the firm decided to initiate what people inside Goldman would eventually dub “the big short.”

One name tossed around during the three-hour meeting was that of John Paulson. Paulson (no relation to Goldman’s former CEO) would later attain infamy when it was revealed that his firm, Paulson & Co., made roughly $15 billion betting against the mortgage market. (His personal take was nearly $4 billion.) At that point, though, Paulson was a little-known hedge fund manager who crossed Goldman’s radar when he asked the firm to create a product that would allow him to take a “short position” on the real estate market — laying down bets that a large number of mortgage investments were going to plummet in value. Goldman sold Paulson what’s called a credit-default swap, essentially an insurance policy that would pay off if homeowners defaulted on their mortgages in large enough numbers. The firm would create several more swaps on his behalf in the intervening months. Eventually, as mortgage defaults began to mount, people inside Goldman Sachs came to see Paulson as more of a prophet than a patsy. Some sitting around the conference table that December day wanted to follow his lead.

“There will be big opportunities the next several months,” one Goldman manager at the meeting wrote enthusiastically in an email sent shortly after it ended. Sparks weighed in by email later that night. He wanted to make sure Goldman had enough “dry powder” — cash on hand — to be “ready for the good opportunities that are coming.” That Sunday, Sparks copied Cohn on an email reporting the firm’s progress on laying down short positions against mortgage-backed securities it had put together. The trading desk had already made $1.5 billion in short bets, “but still more work to do.”

Cohn was a member of Goldman’s board of directors during this critical time and second in command of the bank. At that point, Cohn and Blankfein, along with the board and other top executives, had several options. They might have shared their concerns about the mortgage market in a filing with the SEC, which requires publicly traded companies to reveal “triggering events that accelerate or increase a direct financial obligation” or might cause “impairments” to the bottom line. They might have warned clients who had invested in mortgage-backed securities to consider extracting themselves before they suffered too much financial damage. At the very least, Goldman could have stopped peddling mortgage-backed securities that its own mortgage trading desk suspected might soon collapse in value.

Instead, Cohn and his colleagues decided to take care of Goldman Sachs.

Goldman would not have suffered the reputational damage that it did — or paid multiple billions in federal fines — if the firm, anticipating the impending crisis, had merely shorted the housing market in the hopes of making billions. That is what investment banks do: spot ways to make money that others don’t see. The money managers and traders featured in the film “The Big Short” did the same — and they were cast as brave contrarians. Yet unlike the investors featured in the film, Goldman had itself helped inflate the housing bubble — buying tens of billions of dollars in subprime mortgages over the previous several years for bundling into bonds they sold to investors. And unlike these investors, Goldman’s people were not warning anyone who would listen about the disaster about to hit. As federal investigations found, the firm, which still claims “our clients’ interests always come first” as a core principle, failed to disclose that its top people saw disaster in the very products its salespeople were continuing to hawk.

Goldman still held billions of mortgages on its books in December 2006 — mortgages that Cohn and other Goldman executives suspected would soon be worth much less than the firm had paid for them. So, while Cohn was overseeing one team inside Goldman Sachs preoccupied with implementing the big short, he was in regular contact with others scrambling to offload its subprime inventory. One Goldman trader described the mortgage-backed securities they were selling as “shitty.” Another complained in an email that they were being asked to “distribute junk that nobody was dumb enough to take first time around.” A December 28 email from Fabrice “Fabulous Fab” Tourre, a Goldman vice president later convicted of fraud, instructed traders to focus on less astute, “buy and hold” investors rather than “sophisticated hedge funds” that “will be on the same side of the trade as we will.”

At Goldman Sachs, Cohn was known as a hands-on boss who made it his business to walk the floors, talking directly with traders and risk managers scattered throughout the firm. “Blankfein’s role has always been the salesperson and big-thinker conceptualizer,” said Dick Bove, a veteran Wall Street analyst who has covered Goldman Sachs for decades. “Gary was the guy dealing with the day-to-day operations. Gary was running the company.” While making his rounds, Cohn would sometimes hike a leg up on a trader’s desk, his crotch practically in the person’s face.

At 6-foot- 2, bullet-headed and bald with a heavy jaw and a fighter’s face, Cohn cut a large figure inside Goldman. Profiles over the years would describe him as aggressive, abrasive, gruff, domineering — the firm’s “attack dog.” He was the missile Blankfein launched when he needed to deliver bad news or enforce discipline. Cohn embodied the new Goldman: the man who would run through a brick wall if it meant a big payoff for the bank.

A Bloomberg profile described his typical day as 11 or 12 hours in the office, a bank-related dinner, then phone calls and emails until midnight. “The old adage that hard work will get you what you want is 100 percent true,” Cohn said in a 2009 commencement address at American University. “Work hard, ask questions, and take risk.”

There’s no record of how often Cohn visited his stomping grounds after hours in the early months of 2007, but emails reveal an executive demanding — and getting — regular updates. On February 7, one of the largest originators of subprime loans, HSBC, reported a greater than anticipated rise in troubled loans in its portfolio, and another, New Century, restated its earnings for the previous three quarters to “correct errors.” Sparks wrote an email to Cohn and others the next morning to reassure them that his team was closely monitoring the pricing of the company’s “scratch-and-dent book” and already had a handle on which loans were defaults and which could still be securitized and offloaded onto customers. An impatient Cohn sent a two-word email at 5 o’clock that evening: “Any update?” The next day, an internal memo circulated that listed dozens of mortgage-backed securities with the exhortation, “Let all of the respective desks know how we can be helpful in moving these bonds.” A week later, Sparks updated Cohn on the billions in shorts his firm had bought but warned that it was hurting sales of its “pipeline of CDOs,” the collateralized debt obligations the firm had created in order to sell the mortgages still on its books.

In early March, Cohn was among those who received an email spelling out the mortgage products the firm still held. The stockpile included $1.7 billion in mortgage-related securities, along with $1.3 billion in subprime home loans and $4.3 billion in “Alt-A” loans that fall between prime and subprime on the risk scale. Goldman was “net short,” according to that same email, with $13 billion in short positions, but its exposure to the mortgage market was still considerable. Sparks and others continued to update Cohn on their success offloading securities backed by subprime mortgages through the third quarter of 2007. One product Goldman priced at $94 a share on March 31, 2007 was worth just $15 five months later. Pension funds and insurance companies were among those losing billions of dollars on securities Goldman put together and endorsed as a safe, AAA-rated investments.

The third quarter of 2007 was ugly. A pair of Bear Stearns hedge funds failed. Merrill Lynch reported $2.2 billion in losses — its largest quarterly loss ever. Merrill’s CEO warned that the bank faced another $8 billion in potential losses due to the firm’s exposure to subprime mortgages and resigned several weeks later. The roiling credit crisis also took down the CEO of Citigroup, which reported $6.5 billion in losses and then weeks later, warned of $8 billion to $11 billion in additional subprime-related write-downs.

And then there was Goldman Sachs, which reported a $2.9 billion profit that quarter. For the moment, the financial press seemed in awe of Blankfein, Cohn, and the rest of the team running the firm. Fortune headlined an article “How Goldman Sachs Defies Gravity” that said Goldman’s “huge, shrewd bet” against the mortgage market “would seem to confirm the view Goldman is the nimblest, and perhaps the smartest, brokerage on Wall Street.” A Goldman press release drily noted that “significant losses” in some areas — the subprime mortgages it hadn’t managed to unload — had been “more than offset by gains on short mortgage products.” A Goldman trader who played a central role in the big short was not so demure when making the case for a big bonus that year. John Paulson was “definitely the man in this space,” he conceded, but he’d helped make Goldman “#1 on the street by a wide margin.”

Disaster struck nine months into 2008 with the collapse of Lehman Brothers, in large part the result of its exposure to subprime losses. Hank Paulson, the Treasury secretary and former Goldman CEO, spent a weekend meeting with would-be suitors willing to take over a storied bank that on paper was now worth virtually nothing. He couldn’t find a buyer. Nor could officials from the Federal Reserve, who were also working overtime to save the investment bank, founded in 1850, that was even older than Goldman Sachs. Shortly after midnight on Monday, September 15, 2008, Lehman announced that it would file for bankruptcy protection when the courts in New York opened that morning — the largest bankruptcy in U.S. history.

Goldman Sachs wasn’t immune from the crisis. The week before Lehman’s fall, Goldman’s stock had topped $161 a share. By Wednesday, it dropped to below $100. It had avoided some big losses by betting against the mortgage market, but the wider financial crisis was wreaking havoc on its other investments. On paper, Cohn had personally lost tens of millions of dollars. He hunkered down in an office with a view of Goldman’s trading floor and worked the phone, trying to change the minds of major investors who were pulling their money from Goldman, fearful of anything riskier than stashing their cash in a mattress.

The next week, Goldman converted from a free-standing investment bank to a bank holding company, which made it, in the eyes of regulators, no different from Wells Fargo, JPMorgan Chase, or any other retail bank. That gave the firm access to cheap capital through the Fed but would also bring increased scrutiny from regulators. The bank took a $10 billion bailout from the Troubled Asset Relief Program and another $5 billion from Warren Buffett, in return for an annual dividend of 10 percent and access to discounted company stock. The firm raised additional billions through a public stock offering.

The biggest threat to Goldman was the economic health of the American International Group. Among other products, AIG sold insurance to protect against defaults on mortgage assets, which had been central to Goldman’s big short. Of the $80 billion in U.S. mortgage assets that AIG insured during the housing bubble, Goldman bought protection from AIG on roughly $33 billion, according to the Wall Street Journal. When Lehman went into bankruptcy, its creditors received 11 cents on the dollar. Executives at AIG, in a frantic effort to avoid bankruptcy, had floated the idea of pushing its creditors to accept 40 to 60 cents on the dollar; there was speculation creditors like Goldman would receive as little as 25 percent. Goldman and its clients were looking at multibillion-dollar hits to their bottom line — a potentially fatal blow.

But as Goldman learned a century ago, it pays to have friends in high places. The day after Lehman went bankrupt, the Bush administration announced an $85 billion bailout of AIG in return for a majority stake in the company. The next day, Paulson obtained a waiver regarding interactions with his former firm because, the Treasury secretary said, “It became clear that we had some very significant issues with Goldman Sachs.” Paulson’s calendar, the New York Times reported, showed that the week of the AIG bailout, he and Blankfein spoke two dozen times. While creditors around the globe were being forced to settle for much less than they were owed, AIG paid its counterparties 100 cents on the dollar. AIG ended up being the single largest private recipient of TARP funding. It received additional billions in rescue funds from the New York Federal Reserve Bank, whose board chair Stephen Friedman was a former Goldman executive who still sat on the firm’s board. The U.S. Treasury ended up with greater than a 90 percent share of AIG, and the U.S. government, using taxpayer dollars, paid in full on the insurance policies financial institutions bought to protect themselves from steep declines in real estate prices — chief among them, Goldman Sachs. All told, Goldman received at least $22.9 billion in public bailouts, including $10 billion in TARP funds and $12.9 billion in taxpayer-funded payments from AIG.

Goldman, once again, had come out on top.

4. THE VAMPIRE SQUID

Goldman Sachs repaid repaid its $10 billion bailout partway through 2009, less than 12 months after the loan was made. Other banks in the U.S. and abroad were still struggling but not Goldman, which reported a record $19.8 billion in pre-tax profits that year, and $12.9 billion the next. Gary Cohn went without a bonus in 2008, left to scrape by on his $600,000 salary. Once free of government interference, the Goldman board (which included Cohn himself) paid him a $9 million bonus in 2009 and an $18 million bonus in 2010.

Yet the once venerated firm was now the subject of jokes on the late-night talk shows. David Letterman broadcast a “Goldman Sachs Top 10 Excuses” list (No. 9: “You’re saying ‘fraud’ like it’s a bad thing.”). Rolling Stone’s Matt Taibbi described the bank as “a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money,” a devastating moniker that followed Goldman into the business pages. After news leaked that the firm might pay its people a record $16.7 billion in bonuses in 2009, even President Barack Obama, for whom the firm had been a top campaign donor, began to turn against Goldman, telling “60 Minutes,” “I did not run for office to be helping out a bunch of fat-cat bankers on Wall Street.”

“They’re still puzzled why is it that people are mad at the banks,” Obama said. “Well, let’s see. You guys are drawing down $10, $20 million bonuses after America went through the worst economic year that it’s gone through in decades, and you guys caused the problem.”

Goldman was also facing an onslaught of investigations and lawsuits over behavior that had helped precipitate the financial crisis. Class actions and other lawsuits filed by pension funds and other investors accused Goldman of abusing their trust, making “false and misleading statements,” and failing to conduct basic due diligence on the loans underlying the products it peddled. At least 25 of these suits named Cohn as a defendant.

State and federal regulators joined the fray. The SEC accused Goldman of deception in its marketing of opaque investments called “synthetic collateralized debt obligations,” the values of which were tied to bundles of actual mortgages. These were the deals Goldman had arranged in 2006 on behalf of John Paulson so he could short the U.S. housing market. Goldman, it turned out, had allowed Paulson to cherry-pick poor-quality loans at the greatest risk of defaulting — a fact Goldman did not share with potential investors. “Goldman wrongly permitted a client that was betting against the mortgage market to heavily influence which mortgage securities to include in an investment portfolio,” the SEC’s enforcement director at the time said, “telling other investors that the securities were selected by an independent, objective third party.”

Suddenly, Cohn and other Goldman officials were downplaying the big short. In June 2010, Cohn testified before the Financial Crisis Inquiry Commission, created by Congress to investigate the causes of the nation’s worst economic collapse since the Great Depression. Cohn asked the commissioners how anyone could claim the firm had bet against its clients when “during the two years of the financial crisis, Goldman Sachs lost $1.2 billion in its residential mortgage-related business”? His statement was technically true, but Cohn failed to mention the billions of dollars the firm pocketed by betting the mortgage market would collapse. Senate investigators later calculated that, at its peak, Goldman had $13.9 billion in short positions that would only pay off in the event of a steep drop in the mortgage market, positions that produced a record $3.7 billion in profits.

Two weeks after Cohn’s testimony, Goldman agreed to pay the SEC $550 million to settle charges of securities fraud — then the largest penalty assessed against a financial services firm in the agency’s history. Goldman admitted no wrongdoing, acknowledging only that its marketing materials “contained incomplete information.” Goldman paid $60 million in fines and restitution to settle an investigation by the Massachusetts attorney general into the financial backing the firm had offered to predatory mortgage lenders. The bank set aside another $330 million to assist people who lost their homes thanks to questionable foreclosure practices at a Goldman loan-servicing subsidiary. Goldman agreed to billions of dollars in additional settlements with state and federal agencies relating to its sale of dicey mortgage-backed securities. The firm finally acknowledged that it had failed to conduct basic due diligence on the loans its was selling customers and, once it became aware of the hazards, did not disclose them.

In the final report produced by the Senate’s Permanent Subcommittee on Investigations, Goldman Sachs was mentioned an extraordinary 2,495 times, and Gary Cohn 89 times. A Goldman Sachs representative declined to respond to queries on the record.

The investigations and fines were a blow to Goldman’s reputation and its bottom line, but the regulatory reforms being debated had the potential to threaten Goldman’s entire business model. Even before the 2008 crash, the firm’s lobbying spending had grown under Lloyd Blankfein and Cohn. By 2010, the year financial reforms were being drafted, Goldman spent $4.6 million for the services of 49 lobbyists. Their ranks included some of the most well-connected figures in Washington, including Democrat Richard Gephardt, a former House majority leader, and Republican Trent Lott, a former Senate majority leader, who had stepped down from the Senate two years earlier.

Despite all those lobbyists on the payroll, Goldman made its case primarily through proxies during the debate over financial reform. “The name Goldman Sachs was so radioactive it worked to their disadvantage to be tied to an issue,” said Marcus Stanley, then a staffer for Democratic Sen. Barbara Boxer and now policy director of Americans for Financial Reform. Instead, Goldman lobbied through industry groups.

Goldman’s people likely knew that all of Wall Street’s lobbying might could not stop the passage of the sprawling 2010 legislative package dubbed the Dodd-Frank Wall Street Reform and Consumer Protection Act. Obama was putting his muscle behind reform — “We simply cannot accept a system in which hedge funds or private equity firms inside banks can place huge, risky bets that are subsidized by taxpayers,” he said in one speech — and the Democrats enjoyed majorities in both houses of Congress. “For Goldman Sachs, the battle was over the final language,” said Dennis Kelleher of Better Markets, a Washington, D.C., lobby group that pushes for tighter financial reforms. “That way they at least had a fighting chance in the next round, when everyone turned their attention to the regulators.”

There was a lot for Goldman Sachs to dislike about Dodd-Frank. There were small annoyances, such as “say on pay,” which ordered companies to give shareholders input on executive compensation, a source of potential embarrassment to a company that gave out $73 million in compensation for a single year’s work — as Goldman paid Cohn in 2007. There were large annoyances, such as the requirement that financial institutions deemed too big to fail, like Goldman, create a wind-down plan in case of disaster. There were the measures that would interfere with Goldman’s core businesses, such as a provision instructing the Commodity Futures Trading Commission to regulate the trading of derivatives. And yet nothing mattered to Goldman quite like the Volcker Rule, which would protect banks’ solvency by limiting their freedom to make speculative trades with their own money. Unless Goldman could initiate what Stanley called the “complexity two-step” — win a carve-out so a new rule wouldn’t interfere with legitimate business and then use that carve-out to render a rule toothless — Volcker would slam the door shut on the entire direction in which Blankfein and Cohn had taken Goldman.

It was 5:30 a.m. on Friday, June 25, 2010, when a joint House-Senate conference committee approved the final language of Dodd-Frank. By Sunday, an industry attorney named Annette Nazareth — a former top SEC official whose firm counts Goldman Sachs among its clients — had already sent off a heavily annotated copy of the 848-page bill to colleagues at her old agency. It was just the first salvo in a lobbying juggernaut.

Within a few months, Cohn himself was in Washington to meet with a governor of the Federal Reserve, one of the key agencies charged with implementing Volcker. The visitors log at the CFTC, the agency Dodd-Frank put in charge of derivatives reform, shows that Cohn traveled to D.C. to personally meet with CFTC staffers at least six times between 2010 and 2016. Cohn also came to the capital for meetings at the SEC, another agency responsible for the Volcker Rule. There, he met with SEC chair Mary Jo White and other commissioners. “I seem to be in Washington every week trying to explain to them the unintended consequences of overregulation,” Cohn said in a talk he gave to business students at Sacred Heart University in 2015.

“Gary was the tip of the spear for Goldman to beat back regulatory reform,” said Kelleher, the financial reform lobbyist. “I used to pass him going into different agencies. They brought him in when they wanted the big gun to finish off, to kill the wounded.”

Democrats lost their majority in the House that November, and Goldman threw its weight behind the spate of Republican bills that followed, aimed at taking apart Dodd-Frank piece by piece. Goldman spent more than $4 million for the services of 45 lobbyists in 2011 and $3.5 million a year in 2012 and 2013. Its lobbying spending was nearly as high in the years after passage of Dodd-Frank as it was the year the bill was introduced.

Goldman lobbyists dug in on a range of issues that would become top priorities for Republicans in the wake of Donald Trump’s electoral victory. Records from the Center for Responsive Politics show that Goldman lobbyists worked to promote corporate tax cuts, such as on the Tax Increase Prevention Act of 2014 and Senate legislation aimed at extending some $200 billion in tax cuts for individuals and businesses. Goldman lobbied for a bill to fund economically critical infrastructure projects, presumably on behalf of its Public Sector and Infrastructure group. Goldman had seven lobbyists working on the JOBS Act, which would make it easier for companies to go public, another bottom-line issue to a company that underwrote $27 billion in IPOs last year. In 2016, Goldman had eight lobbyists dedicated to the Financial CHOICE Act, which would have undone most of Dodd-Frank in one fell swoop — a bill the House revived in April.

Yet defanging the Volcker Rule remained the firm’s top priority. Promoted by former Fed Chair Paul Volcker, the rule would prohibit banks from committing more than 3 percent of their core assets to in-house private equity and hedge funds in the business of buying up properties and businesses with the goal of selling them at a profit. One harbinger of the financial crisis had been the collapse in the summer of 2007 of a pair of Bear Stearns hedge funds that had invested heavily in subprime loans. That 3 percent cap would have had a big impact on Goldman, which maintained a separate private equity group and operated its own internal hedge funds. But it was the restrictions Volcker placed on proprietary trading that most threatened Goldman.

Prop trading was a profit center inside many large banks, but nowhere was it as critical as at Goldman. A 2011 report by one Wall Street analyst revealed that prop trading accounted for an 8 percent share of JPMorgan Chase’s annual revenues, 9 percent of Bank of America’s, and 27 percent of Morgan Stanley’s. But prop trading made up 48 percent of Goldman’s. By one estimate, the Volcker Rule could cost Goldman Sachs $3.7 billion in revenue a year.

When regulators finalized a new Volcker Rule in 2013, Better Markets declared it a “major defeat for Wall Street.” Yet the victory for reformers was precarious. “Just changing a few words could dramatically change the scope of the rule — to the tune of billions of dollars for some firms,” said former Senate staffer Tyler Gellasch, who helped write the rule. Volcker gave banks until July 2015 — the five-year anniversary of Dodd-Frank — to bring themselves into compliance. Yet apparently the Volcker Rule had been written for other financial institutions, not elite firms like Goldman Sachs. “Goldman Sachs has been on a shopping spree with its own money,” began a New York Times article in January 2015. The bank used its own funds to buy a mall in Utah, apartments in Spain, and a European ink company. Paul Volcker expressed disappointment that banks were still making big proprietary bets, as did the two senators most responsible for writing the rule into law. That June, Cohn appeared to reassure investors that Goldman would find a workaround. Speaking at an investor conference, he said Goldman was “transforming our equity investing activities to continue to meet client needs while complying with Volcker.”

Goldman had five years to prepare for some version of a Volcker Rule. Yet a loophole granted banks sufficient time to dispose of “illiquid assets” without causing undue harm — a loophole that might even cover the assets Goldman had only recently purchased, despite the impending compliance deadline. The Fed nonetheless granted the firm additional time to sell illiquid investments worth billions of dollars. “Goldman is brilliant at exercising access and influence without fingerprints,” Kelleher said.

By mid-2016, Goldman, along with Morgan Stanley and JPMorgan Chase, was petitioning the Fed for an additional five years to comply with Volcker — which would take the banks well into a new administration. All Blankfein and Cohn had to do was wait for a new Congress and a new president who might back their efforts to flush all of Dodd-Frank. Then Goldman could continue the risky and lucrative habits it had adopted since traders like Cohn had taken over the firm — the financial crisis be damned — and continue raking in billions in profits each year.

Goldman’s political giving changed in the wake of Dodd-Frank. Dating back to at least 1990, according to the Center for Responsive Politics, people associated with the firm and its political action committees contributed more to Democrats than Republicans. Yet in the years since financial reform, Goldman, once Obama’s second-largest political donor, shifted its campaign contributions to Republicans. During the 2008 election cycle, for instance, Goldman’s people and PACs contributed $4.8 million to Democrats and $1.7 million to Republicans. By the 2012 cycle, the opposite happened, with Goldman giving $5.6 million to Republicans and $1.8 million to Democrats. Cohn’s personal giving followed the same path. Cohn gave $26,700 to the Democratic Senatorial Campaign Committee in 2006 and $55,500 during the 2008 election cycle, and none to its GOP equivalent. But Cohn donated $30,800 to the National Republican Senatorial Committee in 2012 and another $33,400 to the National Republican Congressional Committee in 2015, without contributing a dime to the DSCC. Cohn gave $5,000 to Massachusetts Republican Scott Brown weeks after news broke that Elizabeth Warren — an outspoken critic of Goldman and other Wall Street players — might try to capture his U.S. Senate seat, which she did in 2012.

Goldman Sachs, under Cohn and Blankfein, was hardly chastened, continuing to play fast and loose with existing rules even as it plunged millions of dollars into fending off new ones. In 2010, the SEC ran a sting operation looking for banks willing to trade favorable assessments by its stock analysts for a piece of a Toys R Us IPO if the company went public. Goldman took the bait, for which they would pay a $5 million fine. An employee working out of Goldman’s Boston office drafted speeches, vetted a running mate, and negotiated campaign contracts for the state treasurer during his run for Massachusetts governor in 2010, despite a rule forbidding municipal bond dealers from making significant political contributions to officials who can award them business. According to the SEC, Goldman had underwritten $9 billion in bonds for Massachusetts in the previous two years, generating $7.5 million in fees. Goldman paid $12 million to settle the matter in 2012.

Just two years later, Goldman officials were again summoned by the Senate Permanent Subcommittee on Investigations to address charges that the bank under Cohn and Blankfein had boosted its profits by building a “virtual monopoly” in order to inflate aluminum prices by as much as $3 billion.

The last few years have brought more unwanted attention. In 2015, the U.S. Justice Department launched an investigation into Goldman’s role in the alleged theft of billions of dollars from a development fund the firm had helped create for the government of Malaysia. Federal regulators in New York state fined Goldman $50 million because its leaders failed to effectively supervise a banker who leaked stolen confidential government information from the Fed, which hit the firm with another $36.3 million in penalties. In December, the CFTC fined Goldman $120 million for trying to rig interest rates to profit the firm.

Politically, 2016 would prove a strange year for Goldman. Bernie Sanders clobbered Hillary Clinton for pocketing hundreds of thousands of dollars in speaking fees from Goldman, while Trump attacked Ted Cruz for being “in bed with” Goldman Sachs. (Cruz’s wife Heidi was a managing director in Goldman’s Houston office until she took leave to work on her husband’s presidential campaign.) Goldman would have “total control” over Clinton, Trump said at a February 2016 rally, a point his campaign reinforced in a two-minute ad that ran the weekend before Election Day. An image of Blankfein flashed across the screen as Trump warned about the global forces that “robbed our working class.”

Goldman’s giving in the presidential race appears to reflect polls predicting a Clinton win and the firm’s desire for a political restart on deregulation. People who identified themselves as Goldman Sachs employees gave less than $5,000 to the Trump campaign compared to the $341,000 that the firm’s people and PACs contributed to Clinton. Goldman Sachs is relatively small compared to retail banking giants.

Yet, according to the Center for Responsive Politics, no bank outspent Goldman Sachs during the 2016 political cycle. Its PACs and people associated with the firm made $5.6 million in political contributions in 2015 and 2016. Even including all donations to Clinton, 62 percent of Goldman’s giving ended up in the coffers of Republican candidates, parties, or conservative outside groups.

5. TROJAN HORSE

There’s ultimately no great mystery why Donald Trump selected Gary Cohn for a top post in his administration, despite his angry rhetoric about Goldman Sachs. There’s the high regard the president holds for anyone who is rich — and the instant legitimacy Cohn conferred upon the administration within business circles. Cohn’s appointment reassured bond markets about the unpredictable new president and lent his administration credibility it lacked among Fortune 100 CEOs, none of whom had donated to his campaign. Ego may also have played a role. Goldman Sachs would never do business with Trump, the developer who resorted to foreign banks and second-tier lenders to bankroll his projects. Now Goldman’s president would be among those serving in his royal court.

Who can say precisely why Cohn, a Democrat, said yes when Trump asked him to be his top economic aide? No doubt Cohn has been asking himself that question in recent weeks. But he’d hit a ceiling at Goldman Sachs. In September 2015, Goldman announced that Blankfein had lymphoma, ramping up speculation that Cohn would take over the firm. Yet four months later, after undergoing chemotherapy, Blankfein was back in his office and plainly not going anywhere. Cohn was 56 years old when he was invited to Trump Tower. An influential job inside the White House meant a face-saving exit — and one offering a huge financial advantage.

Trump spoke of the great financial price Cohn paid to join him in the White House during his speech in Cedar Rapids. But something like the opposite was true. A huge amount of Cohn’s wealth was tied up in Goldman stock. By entering government, he could sell his stake in the firm to comply with federal ethics laws. That way he could diversify his holdings and avoid roughly $50 million in capital gains taxes — at least until he sold the replacement assets.

A job in the White House might also prove an outlet for his frustrations with politicians and regulators intent on reining in the worst impulses of Wall Street. Trump was Trump, but he had also vowed to dismantle financial reform. “Dodd-Frank has made it impossible for bankers to function,” Trump said during the campaign. The new president had the potential to serve as a vessel for Goldman’s corporate interests.

“Maybe the one thing that holds this administration together is a belief that markets know best, and the least regulation is the best regulation,” said Dennis Kelleher of Better Markets. “Goldman’s interests fit with that very nicely.”

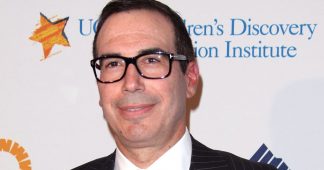

Trump had given Steve Mnuchin, his campaign finance chair, the grander title. But taking over as Treasury secretary meant being confirmed by the Senate. Mnuchin’s confirmation vote was delayed after it was revealed that he’d neglected to list $95 million in assets (including homes in New York, Los Angeles, and the Hamptons) on his Senate Finance Committee disclosure forms and failed to disclose his ties to an offshore hedge fund registered in the Cayman Islands. Mnuchin was not confirmed until mid-February. The president’s pick for commerce secretary, Wilbur Ross, a financier who had bailed out several of Trump’s casinos a few decades earlier, was not confirmed until the end of February.

As a presidential aide, Cohn did not need Senate approval. He was part of the skeletal crew that arrived at the White House on day one, giving him a critical head start on wielding his clout and cultivating his relationship with the new president. At that point, Trump was summoning Cohn to the Oval Office for impromptu meetings as many as five times a day.

In early February, Trump signed an executive order giving his Treasury secretary 120 days to give him a hit list of regulations the administration could eliminate. But with Mnuchin yet to be confirmed, the task appeared to land in Cohn’s eager hands. He was standing at the president’s shoulder when Trump said, “We expect to be cutting a lot out of Dodd-Frank.” Shares in Goldman Sachs, which had jumped by 28 percent after the election, rose another $6 a share that day. Soon Cohn was coordinating Trump’s plans not only for rolling back regulations, but also for creating jobs and slashing taxes. He met with a health care specialist, along with House Speaker Paul Ryan and other Republican leaders, to discuss alternatives to the Affordable Care Act.

Proximity is power inside any White House, especially in this one, where policy often seems shaped by Trump’s last conversation. Treasury is several blocks away, while Cohn’s office was in the West Wing, directly across the hall from Bannon’s. Operating within a chaotic administration, Cohn was reportedly energized and focused, working around the clock. Cohn is a tenacious practitioner who, after ascending to the heights of Goldman Sachs, could teach a master class on the art of seizing a leadership vacuum and building alliances. On day 39 of the new administration, the White House sent out a press release introducing the “best-in-class team” Cohn had assembled “to drive President Trump’s bold plan for job creation and economic growth.” The 13 advisers included familiar figures who had worked for George W. Bush or his father, but they also included at least three former lobbyists so conflicted they would need an ethics waiver to work in the White House. For instance, Michael Catanzaro, the man Cohn chose to oversee energy policy, was until last year a lobbyist for such oil, gas, and coal companies as Devon Energy and Talen Energy. Shahira Knight had been a lobbyist for Fidelity, the mutual fund giant, before joining Cohn’s team.

Cohn’s strategy in those early months was to make himself indispensable to the new president. Cohn emerged as one of the few people around Trump comfortable interrupting him during a meeting or openly disagreeing on points of policy. The New York Times reported that Trump often turned to Cohn during a meeting and asked him directly, “What do you want to do?” Early on, Trump referred to Cohn as “one of my geniuses” — a quote Reuters attributed to a “source close to Cohn.”

Soon, major media were painting Cohn as a leading centrist inside the Trump White House because he had staked out positions on immigration, international alliances, and global warming at odds with Bannon’s hard-right nationalism. Bannon and his allies only bolstered this narrative by characterizing “Carbon Tax Cohn” and his allies, Jared Kushner and Ivanka Trump, as interlopers — “the Democrats,” as some inside the White House called them. “Within Trump’s Inner Circle, a Moderate Voice Captures the President’s Ear,” read the headline of a Cohn profile in the Washington Post.

“Led by Gary Cohn and Dina Powell — two former Goldman Sachs executives often aligned with Trump’s elder daughter and his son-in-law — the group and its broad network of allies are the targets of suspicion, loathing and jealousy from their more ideological West Wing colleagues,” the Washington Post reported. Fueling the rage of the ideologues, Cohn and his allies were largely winning. Trump dropped Bannon from the National Security Council and elevated Powell to deputy national security adviser. When, after Charlottesville, false reports leaked that Cohn was so disgusted with the president he was resigning, blue-chip stocks slid down. Instead, Bannon was out. Cohn, despite reports that he invoked Trump’s wrath for critical remarks to the Financial Times, was still in and expected to deliver the president a win on corporate taxes.

On the day it was announced that he was joining the Trump administration, Cohn said on a goodbye podcast for Goldman Sachs, “You look at the size of our capital. You look at the size of our balance sheet. You look at the size of our people — it’s just enormous.” More than $40 billion had flowed into the bank in 2016, bringing the bank’s assets under management to a record $1.38 trillion. That meant pressure to find ways to put that money to work — an enormous challenge if regulators finally shut down Goldman’s prop trading arm.

How exactly could Cohn recuse himself from matters involving Goldman when almost every aspect of his job has the potential to either grow Goldman’s profits and inflate its stock price — or tank them both?

“To the extent Goldman Sachs is a direct party in a matter, Gary will recuse himself,” a source familiar with the situation said. But, the source added, “As NEC director, Gary is going to touch on matters on the day-to-day economy as a whole and Goldman Sachs is a participant in the economy, thus Gary will indirectly touch on things that affect Goldman Sachs along with other banks and institutions.”

Yet rather than publicly recuse himself on attempts to undo Dodd-Frank, Cohn has led the charge from inside the White House. On that matter, Cohn is a walking, talking conflict of interest.

While at Goldman, Cohn had personally met with officials at the Commodity Futures Trading Commission to discuss the derivatives reform plank of Dodd-Frank, an arena in which Goldman is a dominant player. He had taken issue with rules imposed by Dodd-Frank that require banks to keep more capital on hand. Requiring banks to hold more money in reserve made them “unequivocally” safer than before 2008, he said in a 2015 interview while still Goldman’s president, but he complained that Goldman was now able to lend less money, hurting profits. And then there’s the Volcker Rule. Cohn, while still president of the firm, had traveled to D.C. at least twice to personally lobby regulators about its implementation.

These days, it can be hard to tell whether Cohn is speaking as a high-ranking White House official or a former Goldman Sachs executive.

In the wake of Trump’s February call for a rollback in financial regulations, Cohn vowed in an interview with Bloomberg TV, “We’re going to attack all aspects of Dodd-Frank.” The first example he gave: the Volcker Rule, which he cast as harmful to the country’s competitive advantage. In an interview that same day with Fox Business, he homed in on another Goldman obsession: Dodd-Frank’s capital requirements. “Banks are forced to hoard money because they are forced to hoard capital, and they can’t take any risks,” he said. Mortgage, auto, credit card lending, and commercial lending are all up since 2010. Yet Cohn told Fox viewers, “We need to get banks back in the lending business, that’s our No. 1 objective.”

Roy Smith, a former Goldman partner now teaching at the NYU Stern School of Business, argues that Cohn should avoid the administration’s effort to unwind Dodd-Frank altogether, but “at a very minimum he has to excuse himself whenever the discussion turns to Volcker.” But Smith said he has trouble imagining Cohn leaving the room when Volcker comes up. “The hard part for someone like Cohn is that he knows where all the pain points are with Volcker and other parts of Dodd-Frank,” Smith said. “His every instinct would be to get involved.”

Beyond deregulation, two other pillars of Trump’s economic plan — cutting taxes and investing in infrastructure — would have dramatic impacts on Goldman’s bottom line.

Thanks to loopholes, many Fortune 500 corporations pay little or no corporate income tax at all. By contrast, Goldman Sachs typically pays taxes near the official 35 percent federal tax rate. In 2014, for instance, Goldman paid $3.9 billion in taxes on profits of $12.4 billion, or 31 percent. Last year, the firm’s tax bill was $2.7 billion on profits of $10.3 billion, or 28 percent. In that same Fox Business interview, Cohn said that “lower corporate taxes” was the White House’s “starting point” on tax reform; cuts to personal income taxes were a secondary concern.

Under the plan Cohn and Mnuchin announced last spring, what Cohn called “one of the biggest tax cuts in the American history,” corporate taxes would be capped at 15 percent. If Cohn succeeds, Goldman will save massive sums: At that rate, Goldman would have paid $2 billion less in taxes in 2014, $1.4 billion less in 2015, and $1.4 billion less in 2016. The Koch brothers’ network of political groups has already spent millions of dollars to promote the proposal. Even Blankfein, who the Trump campaign singled out in the commercial it ran in the final days of the campaign, acknowledged in a voicemail to employees that Trump’s commitment to tax cuts, deregulation, and infrastructure “will be good for our clients and our firm.”

The details of the president’s “$1 trillion” infrastructure plan are similarly favorable to Goldman. As laid out in the administration’s 2018 budget, the government would spend only $200 billion on infrastructure over the coming decade. By structuring “that funding to incentivize additional non-Federal funding” — tax breaks and deals that privatize roads, bridges, and airports — the government could take credit for “at least $1 trillion in total infrastructure spending,” the budget reads.

It was as if Cohn were still channeling his role as a leader of Goldman Sachs when, at the White House in May, he offered this advice to executives: “We say, ‘Hey, take a project you have right now, sell it off, privatize it, we know it will get maintained, and we’ll reward you for privatizing it.’” “The bigger the thing you privatize, the more money we’ll give you,” continued Cohn. By “we,” he clearly meant the federal government; by “you,” he appeared to be speaking, at least in part, about Goldman Sachs, whose Public Sector and Infrastructure group arranges the financing on large-scale public sector deals. “Goldman Sachs is one of the largest infrastructure fund managers globally,” according to infrastructure advisory firm InfraPPP Partners, “having raised more than $10 billion of capital since the inception of the business in 2006.” Lost in the infamous press conference the president gave in the lobby of Trump Tower a few days after Charlottesville, with Cohn and Mnuchin visibly uncomfortable at his right flank, were Trump’s remarks on infrastructure, the ostensible purpose of the event. The thrust was that the president would grease the wheels for project approvals by signing an executive order rolling back environmental impact requirements and other elements of an “overregulated permitting process.”

In countless other ways, Cohn is positioned to help the firm that has been so good to him over the years. The country’s National Economic Council adviser might caution a president against running too large a deficit, especially amid a healthy economy. But Goldman Sachs is in the business of finding investors to underwrite government debt. An economic adviser might caution a populist president that corporate inversions often cost jobs and tax revenue. Instead, Trump has ordered a review of policies Obama put in place to discourage them — good news for Cohn’s former colleagues. Transparency has been a watchword of initial public offerings dating back at least to the Securities and Exchange Act of 1934, but easing those rules, a step Goldman has sought, could potentially generate hundreds of millions of dollars in fees for investment banks such as Goldman. The SEC announced in June that it would allow any company going public to withhold details of its finances and strategies, an exemption previously available only to firms with under $1 billion in revenue — more good tidings for Goldman. Just loosening the rules for IPOs, said Tyler Gellasch, the former Senate staffer, “could mean hundreds of millions of dollars more to Goldman.”

In June, the Treasury Department released a statement of principles about the administration’s approach to financial regulation focused on promoting “liquid and vibrant markets.” Not surprisingly, the report included a call to ease capital requirements and substantially amend the Volcker Rule.

It’s Cohn’s influence over the country’s regulators that worries Dennis Kelleher, the financial reform lobbyist. “To him, what’s good for Wall Street is good for the economy,” Kelleher said of Cohn. “Maybe that makes sense when a guy has spent 26 years at Goldman, a company who has repaid his loyalties and sweat with a net worth in the hundreds of millions.” Kelleher recalls those who lost a home or a chunk of their retirement savings during a financial crisis that Cohn helped precipitate. “They’re still suffering,” he said. “Yet now Cohn’s in charge of the economy and talking about eliminating financial reform and basically putting the country back to where it was in 2005, as if 2008 didn’t happen. I’ve started the countdown clock to the next financial crash, which will make the last one look mild.”

This article was reported in partnership with The Investigative Fund at The Nation Institute.