Journal of Economic Peispectives—Volume 14, Number 1—Winter 2000—Pages 177-186

Dani Rodrik

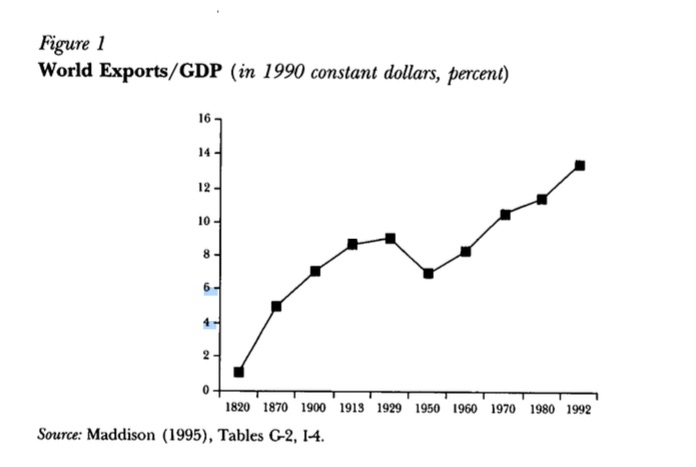

In a famous passage from The Economic Consequences of the Peace, Keynes (1920) I drew a vivid picture of an integrated world economy at the pinnacle of the gold standard. While sipping his morning tea in bed, Keynes reminisced nostalgically, the Englishmen of his time could order by telephone various com- modities of the world, invest in far-off places, purchase unlimited amounts of foreign currency or precious metals, and arrange for international travel without even requiring a passport. Keynes, who was writing in the aftermath of a devastating world war and was anticipating a period of economic turbulence and protectionism—correctly, as it turned out—considered this a lost era of great magnificence. What will a latter-day Keynes, writing a centuiy from now, say about today’s global economy wth its unparalleled prosperity and integration (illustrated by Figfure 1)? Will she bemoan, as the original Keynes did, its collapse into disarray and autarky yet again? Or will she look back at the tail end of the 20th century as the era that launched a new process of internationalization? Since economists rank second only to astrologers in their predictive abilities, the correct answer is that we have no idea. The best that one can do is speculate wildly, which is what I am about to do.

In these speculations, I will use the term “international economic integration” rather tlian “globalization,” for two reasons. First, while not as trendy, my preferred term has a distinct meaning that will be self-evident to economists. Globalization, by contrast, is a term that is used in different ways by different analysts. Second, the term “international economic integration” does not come with the value judgements—positive or negative—that the term “globalization” seems to trigger in knee-jerk fashion.

How Much More Integration Could There Be?

The natural benchmark for thinking about international economic integration is to consider a world in which markets for goods, services, and factors of produc- tion are perfectly integrated. How far are we presently from such a world?

The answer is that we are quite far. Contrary to conventional wisdom and much punditry, international economic integration remains remarkably limited. This robust finding comes across in a wide range of studies, too numerous to cite here.¹ National borders, such as the U.S.-Canadian one, seem to have a significantly depressing effect on commerce, even in the absence of serious formal tariff or nontariff barriers, linguistic or cultural differences, exchange rate uncertainty, and other economic obstacles. International price arbitrage in tradable commodities tends to occur very slowly. Investment portfolios in the advanced industrial coun- tries typically exhibit large amounts of “home bias;” that is, people invest a higher proportion of assets in their own countries than the principles of asset diversifica- tion would seem to suggest. National investment rates remain highly correlated with and dependent on national saving rates. Even in periods of exuberance, capital flows between rich and poor nations fall considerably short of what theo- retical models would predict. Real interest rates are not driven to equality even among advanced countries with integrated financial markets. Severe restrictions on the international mobility of labor are the rule rather than the exception. Even the Internet, the epitome of technology-driven internationalization, remains parochial in many ways; for example, Amazon.com feels compelled to maintain a distinct British site, Amazon.co.uk, with different recommendations and sales rankings than its American parent.

While formal barriers to trade and capital flows have been substantially re- duced over the last three decades, international markets for goods, services, and capital are not nearly as “thick” as they would be under complete integration. Why so much trade in goods and capital bas gone missing is tbe subject of an active researcb agenda in international economics. The answers are not yet entirely clear.

But at some level there is no mystery. National borders demarcate political and legal jurisdictions. Sucb demarcations serve to segment markets in mucb tbe same way tbat transport costs or border taxes do. Exchanges that cross national jurisdic- tions are subject to a wide array of transaction costs introduced by discontinuities in political and legal systems.

These transaction costs arise from various sources, but perbaps tbe most obvious is tbe problem of contract enforcement. Wben one of tbe parties reneges on a written contract, local courts may be unwilling—and international courts unable—to enforce a contract signed between residents of two different countries. Thus, national sovereignty interferes witb contract enforcement, leaving interna- tional transactions hostage to an increased risk of opportunistic bebavior. Tbis problem is most severe in tbe case of capital flows, and bas tbe implication tbat national borrowing opportunities are limited by the willingness of countries to service tbeir obligations ratber tban tbeir ability to do so. But tbe problem exists generically for any commercial contract signed by entities belonging to two differing jurisdictions.²

When contracts are implicit rather than explicit, they require either repeated interaction or other side constraints to make them sustainable. Botb of these are generally harder to achieve across national borders. In tbe domestic context, implicit contracts are often “embedded” in social networks, wbicb provide sanc- tions against opportunistic bebavior. One of the things tbat keeps businessmen honest is fear of social ostracism. The role played by etbnic networks in fostering trade linkages, as in tbe case of tbe Cbinese in soutbeast Asia, is a clear indication of tbe importance of group ties in facilitating economic exchange.³

Ultimately, contracts are often neither explicit nor implicit; they simply remain incomplete. Laws, norms and customs are some of tbe ways in which the problem of incompleteness of contracts is alleviated in tbe domestic sphere. To borrow an example from Tirole (1989, pp. 113-114), what protects a consumer from the small likelihood that a soda-pop bottle might explode is not a contingent contract signed by the manufacturer, but that country’s product liability laws. International law provides at best partial protection against incomplete contracts, and international norms and customs are hardly up to the task either.

This line of argument has important implications for the question of how far international economic integration will go. If the depth of markets is limited by the reach of jurisdictional boundaries, does it not follow that national sovereignty imposes serious constraints on international economic integration? Can markets become international while politics remains local? Or, to ask a different but related question, what would politics look like in a world in which international markets had nothing to fear from the narrower scope of political jurisdictions? The rest of the paper will advance some answers to these ques- tions, and in so doing lay out a framework for thinking about the future of the world economy.

Caught in an International Trilemma

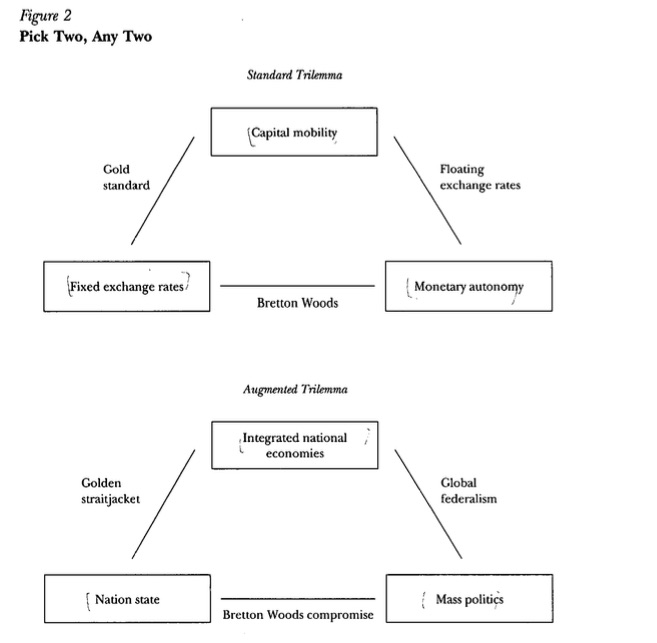

A familiar result of open-economy macroeconomics is that countries cannot simultaneously maintain independent monetary policies, fixed exchange rates, and an open capital account. This result is fondly known to the cognoscenti as the “impossible trinity,” or in Obstfeld and Taylor’s (1998) terms, as the “open- economy trilemma.” The trilemma is represented schematically in the top panel of Figure 2. If a government chooses fixed exchange rates and capital mobility, it has to give up monetary autonomy. If it wants monetary autonomy and capital mobility, it has to go with floating exchange rates. If it wants to combine fixed exchange rates with monetary autonomy (at least in the short run), it had better restrict capital mobility.

The bottom panel of Figure 2 suggests, by analogy, a different kind of tri- lemma, one that we might call the political trilemma of the world economy. The three nodes of the extended trilemma are international economic integration, the nation-state, and mass politics. I use the term “nation-state” to refer to territorialjurisdictional entities with independent powers of making and administering the law. I use the term “mass politics” to refer to political systems where: a) the franchise is unrestricted; b) there is a high degree of political mobilization; and c) political institutions are responsive to mobilized groups.

The implied claim, as in the standard trilemma, is that we can have at most two of these three things. If we want true international economic integration, we have to go either with the nation-state, in which case the domain of national politics will have to be significantly restricted, or else with mass politics, in which case we will have to give up the nation-state in favor of global federalism. If we want highly participatory political regimes, we have to choose between the nation-state and international economic integration. If we want to keep the nation-state, we have to choose between mass politics and international eco- nomic integration.

None of this is immediately obvious. But to see that there may be some logic in it, consider our hypothetical perfectly integrated world economy. This would be a world economy in which national jurisdictions do not interfere with arbitrage in markets for goods, services or capital. Transaction costs and tax differentials would be minor; convergence in commodity prices and factor returns would be almost complete. The most obvious way we can reach such a world is by instituting federalism on a global scale. Global federalism would align jurisdictions with the market, and remove the “border” effects. In the United States, for example, despite the continuing existence of differences in regulatory and taxation practices among states, the presence of a national constitution, national government, and a federal judiciary ensures that markets are truly national.⁴ The European Union, while very far from a federal system at present, seems to be headed in the same direction. Under a model of global federalism, the entire world—or at least the parts that matter economically— would be organized along the lines of the U.S. system. National governments would not necessarily disappear, but their powers would be severely circumscribed by supranational legislative, executive, and judicial authorities. A world government would take care of a world market.

But global federalism is not the only way to achieve complete international economic integration. An alternative is to maintain the nation-state system largely as is, but to ensure that national jurisdictions—and the differences among them—do not get in the way of economic transactions. The overarching goal of nation-states in this world would be to appear attractive to international markets. National jurisdictions, far from acting as an obstacle, would be geared towards facilitating international commerce and capital mobility. Domestic regulations and tax policies would be either harmonized according to international standards, or structured such that they pose the least amount of hindrance to international economic integration. The only local public goods provided would be those that are compatible with integrated markets.

It is possible to envisage a world of this sort; in fact, many commentators seem to believe we are already there. Governments today actively compete with each other by pursuing policies that they believe will earn them market confidence and attract trade and capital inflows: tight money, small government, low taxes, flexible labor legislation, deregulation, privatization, and openness all around. These are the policies that comprise what Thomas Friedman (1999) has aptly termed the Golden Straitjacket.

The price of maintaining national jurisdictional sovereignty while markets become international is that politics have to be exercised over a much narrower domain. Friedman notes (1999, p. 87):

As your country puts on the Golden Stiaitjacket, two things tend to happen: your economy grows and your politics shrinks.. . . [The] Golden Straitjacket narrows the political and economic policy choices of those in power to relatively tight parameters. That is why it is increasingly difficult these days to find any real differences between ruling and opposition parties in those countries that have put on the Golden Straitjacket. Once your country puts on the Golden Straitjacket, its political choices get reduced to Pepsi or Coke—to slight nuances of tastes, slight nuances of policy, slight alterations in design to account for local traditions, some loosening here or there, but never any major deviation from the core golden rules.

Whether this description accurately characterizes our present world is debatable. But Friedman is on to something. His argument carries considerable force in a world where national markets are fully integrated. In such a world, the shrinkage of politics would get reflected in the insulation of economic policy-making bodies (central banks, fiscal authorities, and so on) from political participation and debate, the disappearance (or privatization) of social insurance, and the replace- ment of developmental goals with the need to maintain market confidence. The essential point is this: once the rules of the game are set by the requirements of the global economy, the ability of mobilized popular groups to access and influence nadonal economic policy-making has to be restricted. The experience v^th the gold standard, and its eventual demise, provides an apt illustration of the incompatibil- ity: by the interwar period, as the franchise was fully extended and labor became organized, national governments found that they could no longer pursue gold standard economic orthodoxy.

Note the contrast with global federalism. Under global federalism, politics need not, and would not, shrink: it would relocate to the global level. The United States provides a useful way of thinking about this: the most contentious political battles in the United States are fought not at the state level, but at the federal level.

Figure 2 shows a third option, which becomes available if we sacrifice the objective of complete international economic integration. I have termed this the Bretton Woods compromise. The essence of the Bretton Woods-GATT regime was that countries were free to dance to their own tune as long as they removed a number of border restricdons on trade and generally did not discriminate among their trade partners.^ In the area of international finance, countries were allowed (indeed encouraged) to maintain restrictions on capitalflows.In the area of trade, the rules frowned upon quantitative restrictions but not import tariffs. Even though an impressive amount of trade liberalization was undertaken during successive rounds of GATT negotiations, there were also gaping exceptions. Agriculture and textiles were effectively left out of the negotiations. Various clauses in the GATT (on anti-dumping and safeguards, in particular) permitted countries to erect trade barriers when their industries came under severe competition from imports. De- veloping country trade policies were effectively left outside the scope of interna- tional discipline.⁶

Figure 2 shows a third option, which becomes available if we sacrifice the objective of complete international economic integration. I have termed this the Bretton Woods compromise. The essence of the Bretton Woods-GATT regime was that countries were free to dance to their own tune as long as they removed a number of border restricdons on trade and generally did not discriminate among their trade partners.^ In the area of international finance, countries were allowed (indeed encouraged) to maintain restrictions on capitalflows.In the area of trade, the rules frowned upon quantitative restrictions but not import tariffs. Even though an impressive amount of trade liberalization was undertaken during successive rounds of GATT negotiations, there were also gaping exceptions. Agriculture and textiles were effectively left out of the negotiations. Various clauses in the GATT (on anti-dumping and safeguards, in particular) permitted countries to erect trade barriers when their industries came under severe competition from imports. De- veloping country trade policies were effectively left outside the scope of interna- tional discipline.⁶

Until roughly the 1980s, these loose rules left enough space for countries to follow their own, possibly divergent paths of development. Hence, western Europe chose to integrate within itself and to erect an extensive system of social insurance. Japan caught up with the developed economies using its own dis- tinctive brand of capitalism, combining a dynamic export machine with large doses of inefficiency in services and agriculture. China grew by leaps and bounds once it recognized the importance of private initiative, even though it flouted every other rule in the guidebook. Much of the rest of east Asia generated an economic miracle relying on industrial policies that have since been banned by the World Trade Organization. Scores of countries in Latin America, the Middle East, and Africa generated unprecedented economic growth rates until the late 1970s under import-substitution policies that insu- lated their ecotiomies from the world economy.

The Bretton Woods compromise was largely abandoned in the 1980s, for several reasons. Improvements in communication and transportation technologies undermined the old regime by making ititernational economic integration easier. International trade agreements began to reach behind national borders; for exam- ple, policies on antitrust or health and safety, which had pteviously been left to domestic politics, now became issues in international trade discussiotis. Finally, there was a shift in attitudes in favor of openness, as many developing nations came to believe that they would be better seived by a policy of openness. The upshot is that we are left somewhere in between the three nodes of the augmented trilemma of Figure 2. Which one shall we eventually give up?

Where Next?

I have argued so far that we are presently nowhere near complete international economic integration, and that traveling the remaining distance will require either an expansion of ourjurisdictions or a shrinkage ofour politics. Now I have to stick my neck out farther and make a prediction.

I would place my bet on global federalism, as unlikely as that may seem at the moment. In the next 100 years or so, I see a world in which the reach of markets, jurisdictions, and politics are each truly and commensurately global as the most likely outcome.⁷ I may also be biased, since that is the option that I personally like best.

The bet is based on the following reasoning. First, continuing technological progress will both foster international economic integration and remove some of the traditional obstacles (such as distance) to global government. Second, short of global wars or natural disasters of major proportions, it is hard to envisage that a substantial part of the world’s population will want to give up the goodies that an increasingly integrated (hence efficient) world market can deliver. Third, hard-won citizenship rights (of representation and self-government) are also unlikely to be given up easily, keeping pressure on politicians to remain accountable to the wishes of their electorate.

The most dicey projection is that we shall see an alliance of convenience in favor of global governance between those who perceive themselves to be the “losers” from economic integration, like labor groups and environmentalists, and those who perceive themselves as the “winners,” like exporters, multina- tional enterprises, and financial interests. The alliance will be underpinned by the mutual realization that both sets of interests are best served by the supra- national promulgation of rules, regulations, and standards. Labor advocates and environmentalists will get a shot at international labor and environmental rules. Multinational enterprises will be able to operate under global accounting standards. Investors will benefit from common disclosure, bankruptcy, and financial regulations. A global fiscal authority will provide public goods and a global lender-of-last resort will stabilize the financial system. Part of the bargain will be to make international policymakers accountable through democratic elections, with due regard to the preeminence of the economically more powerful countries. National bureaucrats and politicians, the only remaining beneficiaries of the nation-state, will either refashion themselves as global officials or they will be shouldered aside.

Global federalism does not mean that the United Nations will turn itself into a world government. What we are likely to get is a combination of traditional forms of governance (an elected global legislative body) with regu- latory institutions spanning multiple jurisdictions and accountable to perhaps multiple types of representative bodies. In an age of rapid technological change, the form of governance itself can be expected to be subject to considerable innovation.

Many things can go wrong with this scenario. One alternative possibility is that an ongoing series of financial crises will leave national electorates suffi- ciently shell-shocked that they willingly, if unhappily, don the Golden Strait-jacket for the long run. This scenario amounts to the Argentinization of national politics on a global scale. Another possibility is that governments will resort to protectionism to deal with the distributive and governance difficulties posed by economic integration. That would be the backlash scenario. If I were making a prediction for the next 20 years rather than 100,1 would regard either one of these scenarios as more likely than global federalism. But a longer time horizon leaves room for greater optimism.

Now let me tell you about the Wars of Secession of 2120 . . .

• Ι thank Brad De Long, Alan Krueger and Timothy Taylor for very useful suggestions

1. See in particular Feldstein and Horioka (1980) and Helliwell (1998).

2. See Anderson and Marcouiller (1999) for empirical evidence which suggests that inadequate contract enforcement imposes severe costs on trade.

3. Casella and Rauch (1997) were the first to emphasize the importance of group ties in international trade, using a model of differentiated products.

4. However, Wolf (1997) finds that state borders within ihe United States have some deterrent elTect on trade as well.

5. Ruggie (t994) has written insightfully on this, describing the system that emerged as “embedded liberalism.”

6.Lawrence (1996) has termed the model of integration followed under the Bretton Woods-GATT system as “shallow integration,” to distinguish it from the “deep integration” that requires behind-the- border harmonization of regulatory policies.

7. Ι am purposefully vague about the specific form that global federalism might take, other than state that it will entail much greater political centralization than the ctirrent setup. See Frey (1996) on some intriguing ideas for the design of federal political systems. See Bergsten (1993) for an alternative scenario that combines political fragmentation—rather than centralization—with full international economic integration.

References

Anderson, James £. and Douglas Marcouiller. 1999. “Trade, Insecurity, and Home Bias: An Empirical Investigation.” NBER Working Paper No. 7000, March.

Bergsten, C. Fred. 1993. “The Rationale for a Rosy View: What a Global Economy Will Look Like.” The Economist. September 11.

Casella, Alessandra and James Rauch. 1997. “Anonymous Market and Group Ties in Interna- tional Trade.” NBER Working Paper No. W6186, September.

Feldstein, Martin S. and Charles Horioka.

1980. “Domestic Saving and International Capi- tal Flows.” Economic Journal. ]une, 90, pp. .314- 29.

Frey, Bruno. 1996. “FOCJ: Competitive Gov- ernments for Europe.” Internationat Review of Law and Economics. 16, pp. 315-27.

Friedman, Thomas L. 1999. The Lexus and the Olive Tree: Understanding Gtohalization. New York: Farrar, Stratis and Giroux.

HelliweU, John F. 1998. Hmv Much Do National Borders MaKCT’? Washington, DG: Brookings Insti-

Keynes, John Maynard. 1920. The Economic Consequences of the Peace. New York: Harcotirt, Brace, and Howe.

Lawrence, Robert Z. 1996. Regionatism, Mutti- tateralism, and Deeper Integration. Washington, DG: Brookings Institution.

Maddison, Angus. 1995. Monitoring the World Economy 1820-1992. Paris: OEGD.

Obstfeld, Maurice and Alan Taylor. 1998. “The Great Depression as a Watershed: Interna- tional Gapital Mobility over the Long Run,” in The Defining Moment: The Great Depression and the American Economy in the Twentieth Century. Bordo, Michael D., Glaudia D. Goldin, and Eugene N. White, eds. Ghicago: University of Ghicago Press, pp. 353-402.

Ru^e, John G. 1994. “Trade, Protectionism and the Future of Welfare Capitalism.”/ournn/o/ Internationat Affairs. Summer, 48:1, pp. 1-11.

Tirole, Jean. 1989. The Theory of Industrial Or- ganization. Gambridge, MA: MIT Press, 1989.

Wolf, Holger C. 1997. “Patterns of Intra- and Inter-State Trade.” NBER Working Paper No. W5939, February.

• Dani Rodrik is Professor of International Political Economy, John F. Kennedy School of Government, Harvard University, and Research Associate, National Bureau of Economic Research, both in Cambridge, Massachusetts. His e-mail address is {dani_rodrik ©harvard, edu).