The emerging EU fiscal policy framework lacks clear rules, reflecting the peculiar character of German hegemony as well as deep divisions between core and periphery in the EU.

This is the introduction “A transformation in policy making” to the paper “National states, transnational institutions, and hegemony in the EU” published by Springer Link that you can read here

The pandemic crisis brought multiple changes to monetary and fiscal policy in the European Union, encouraging greater discretion by member states and the Union as a whole. Some of these changes have been in the offing for several years but were held back partly due to the resistance of Germany, the hegemonic country of the EU. Germany partially relented as the pandemic shock threatened the stability of the euro and even of the EU itself. Discretion replaced rules in economic policy making, as is clearly seen in the operations of the European Central Bank (ECB) but also in fiscal policy.

The pandemic shock also shone a fresh light on the hierarchical nature of the EU, including its division into core and periphery. Member states of the EU attempted initially to confront the crisis by drawing on their national strength and resources. Their actions inevitably meant that growing fiscal deficits pushed up public debt, thus making it difficult for heavily indebted states to access international financial markets. Borrowing rates for peripheral countries escalated rapidly.

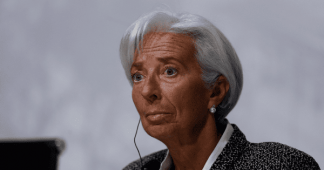

The immediate cause of the escalation was the declaration by Christine Lagarde, the President of the ECB, on 12 March 2020, that: “[w]e are not here to close spreads. This is not the function or the mission of the ECB. There are other tools for that, and there are other actors to actually deal with those issues” (ECB 2020). On the wake of this statement, concern about the ability of Italy to finance its public debt soared, posing a direct threat to the euro. By 24 March the ECB had changed course adopting the “Pandemic Emergency Purchase Programme” (PEPP), which soon acquired major dimensions driving interest rates close to zero. The very loose monetary policy of the ECB, going well beyond its original statutes, confirmed the changes originally spurred by the Eurozone crisis of 2010–12.

Fiscal policy also had to adapt to the threat of the pandemic, lifting the rigid framework of austerity that had marked the 2010s. Peripheral EU countries were given scope to boost domestic demand, through automatic stabilisers and active fiscal intervention. Nonetheless, concern about rising public debt forced peripheral countries to strive for a joint EU fiscal response, supported by France. The underlying threat to the euro, and even to the Union itself, led Germany, the hegemonic country, to accede to a joint EU fiscal response, the “Next Generation EU”. Although the plan is not particularly large and had not disbursed a single euro well into 2021, its symbolism for the evolution of the EU is not in doubt. Currently, the EU operates without a clear framework of rules of economic policy making.

This article offers an early analysis of these developments in the context of the long-standing theoretical debates on the balance between national states and transnational mechanisms in the EU. It stresses the importance of German hegemony and outlines the characteristic features of core and periphery in the EU. The institutional mechanisms that sustain the core-periphery division within the EU are primarily associated with the European Economic and Monetary Union (EMU) and chiefly the ECB. The euro had profound implications for the tiering of the EU, as is shown by analysing the balance sheet of the ECB and the operations of TARGET2.

Thus, Sect. 2 of the article briefly summarises some relevant academic arguments regarding national states and transnational institutions of the EU; Sect. 3 considers Germany’s hegemonic position and its dependence on the transnational mechanisms of the EU; Sect. 4 discusses the institutional transformation of the EU following the outbreak of the Eurozone crisis; Sect. 5 analyses the operations of the ECB focusing on TARGET2, the peculiar clearing mechanism reflecting imbalances between core and periphery within the Eurozone; Sect. 6 briefly examines the lifting of austerity as well as the joint fiscal response of Next Generation EU, and concludes.

Continue reading the paper here

Costas Lapavitsas is an Economist at SOAS University of London

Sergi Cutillas Department of Economic History, Institutions, Politics and World Economy, University of Barcelona, Barcelona, Spain

Published atbraveneweurope.com

We remind our readers that publication of articles on our site does not mean that we agree with what is written. Our policy is to publish anything which we consider of interest, so as to assist our readers in forming their opinions. Sometimes we even publish articles with which we totally disagree, since we believe it is important for our readers to be informed on as wide a spectrum of views as possible.