April 8, 2020

The mainstream financial press has been remarkably quiet about the Federal Reserve’s appointment (March 24) of BlackRock to manage its massive corporate debt purchase program in response to the Covid-19 crisis. That silence might have a simple explanation: you don’t slag your boss if you know what’s good for you.

BlackRock’s CEO Larry Fink may now be the most powerful man in the world, overseeing not just the Fed’s new (potentially $4.5 trillion) corporate slush-fund, but also managing $27 trillion of the global economy (even before the March appointment). As the world’s largest asset manager, BlackRock already was managing $7 trillion for its global corporate investor-clients, along with another $20 trillion for clients through its financial risk-monitoring software (called Aladdin).

As Andrew Gavin Marshall has explained, “Unlike a bank, asset management firms do not manage and invest their own money but do so on behalf of their many clients. In the case of BlackRock, those clients come in the form of banks, corporations, insurance companies, pension funds, sovereign wealth funds, central banks, and foundations.” [1]

With $27 trillion under various forms of its management, BlackRock towers over the finance, insurance and real estate sectors. This much consolidated financial power may be unprecedented, but with BlackRock involved in virtually every major corporation across the planet (including the media), even BlackRock’s competitors (if that word even applies) are quiet about Fink’s appointment.

To date, only Pam Martens and Russ Martens at Wall Street on Parade.com are providing the needed ongoing and intrepid coverage. [2]

How Many Bailouts?

Rolling Stone’s Matt Taibbi has called this new bailout of Wall Street a “bailout of the last bailout” in 2008. [3] Less well known is that the 2008 Wall Street bailout was itself a bailout of an earlier 2001 Wall Street bailout, in which the Fed pumped more than $100 billion into a struggling financial sector (wounded by the dot.com bust) under cover of the 9/11 crisis. [4]

Some attention has lately been paid to the fact that, during the 2008 bailout, BlackRock’s Larry Fink played a major role in advising governments and corporations in how to deal with toxic assets from crashing banks. But something important is being overlooked.

As I wrote in my 2016 book Beyond Banksters, these governments and corporations “sought Fink’s advice, despite the fact that (as Fortune reported in 2008) BlackRock’s Larry Fink ‘was an early and vigorous promoter [of] the same mortgage-backed securities’ responsible for the crisis. ‘Now his firm is making millions cleaning up those toxic assets,’ Fortune noted.”

Clearly, during the years between the 2001 Wall Street bailout and the 2008 bailout, BlackRock saw an opportunity and acted on it. Then, when those securities became toxic, BlackRock saw another opportunity and again acted. Clever.

BlackRock is a key focus in my book (along with McKinsey & Company) because both firms have been playing an outsized role in Canada’s politics since the election of Prime Minister Justin Trudeau in 2015. Trudeau has created a Canada Infrastructure Bank – widely called the “privatization bank” by us serfs – and has proposed to pour some $120 billion into infrastructure spending in order to attract investment from the international financial sector. As I wrote, by August of 2016 Trudeau was reportedly “courting BlackRock” in the hopes that some of its huge torrent of money would be directed into Canada for infrastructure projects.

Of course, those private investors would want a sizeable return (at least 9%) on their investments, so most of those projects would be either: 1) the outright conversion of a publicly-owned asset into a private one (selling off roads, bridges, ports, airports, water and wastewater systems, etc.), or 2) the building of new infrastructure (like transit) through a public-private partnership (P3) in which the private sector would pocket the tolls and operate risk-free during long-term contracts, or 3) the clever combination of both, by which an existing public asset would become a P3.

More than ‘Bad Optics’

In an outrageous display of corporate arrogance, on November 14, 2016 BlackRock hosted a private summit in Toronto for “a select group of major international investors” with trillions of dollars in assets. They were allowed to meet and question PM Trudeau, Finance Minister Bill Morneau, Infrastructure Minister Amarjeet Sohi, and other federal officials, but the press was not allowed to be there to record the “opportunities” that our elected politicians were offering these banksters.

And in the latest move, on March 27 – the same day that the U.S. Congress approved the bailout bill making BlackRock a key financial overseer – Canada’s publicly-owned central bank, the Bank of Canada (BoC), suddenly announced that BlackRock will act as its advisor for a new quantitative-easing (QE) program for corporations – basically a money-spigot for a struggling corporate sector.

There was no tendering process for this role, and as one financial writer noted, BoC Governor Stephen Poloz appeared to be “opting to put urgency ahead of dithering over potential traps such as conflicts of interest, a rushed tendering process and bad optics.” [5]

But let’s be clear: the central banks on both sides of the Canada-U.S. border have now placed BlackRock in a primary position for effecting monetary and fiscal policy in both countries. That is much more than “bad optics.” That is flagrant corporatism.

There is a terrible irony here, and it’s worth some attention.

SIFI

When I wrote Beyond Banksters in 2016, BlackRock was managing a mere $15 trillion (not the $27 tillion it’s managing now). Not surprisingly, for several years there had been some financial voices calling for BlackRock to be designated as a “systemically important financial institute” (a SIFI), which would mean that it would be far more heavily regulated and would need to meet potentially higher capital requirements from U.S. regulators.

I quoted The Economist, for example, which in 2013 was worried that because so many companies rely on BlackRock’s Aladdin financial risk-monitoring software, there is a danger that they’d all “jump the same way” and “make things worse.”

Similarly the U.S. Treasury Department’s Office of Financial Research had issued a 2013 report that concluded that asset management firms like BlackRock and the funds they run are “vulnerable to shocks” and “may engage in ‘herding’ behavior that could amplify a shock to the financial system.”

But BlackRock had long been lobbying strenuously against being considered a SIFI.

Then in 2014 BlackRock executives somehow obtained a confidential Federal Reserve PowerPoint presentation that implied that BlackRock could pose the same financial risk as big banks. [6] Angered by this new jibe, BlackRock lobbied hard against this view, and, as I wrote, in April 2016 the company “avoided greater oversight from regulators in the U.S.”

Consider BlackRock’s position now: the new bailout bill not only further erases the line between the Federal Reserve and the U.S. Treasury, it places BlackRock effectively in an overseer position for both. Those lowly bureaucrats from both institutions who had attempted to turn BlackRock into a SIFI are now answering to Larry Fink. Clever.

In what is the most thorough critique of the BlackRock appointment to date, a March 27 letter from the Sunrise Movement to Federal Reserve Chair Jerome Powell noted: “By giving BlackRock full control of this debt buyout program, the Fed is further entwining the roles of government and private actors. In doing so, it makes BlackRock even more systemically important to the financial system. Yet BlackRock is not subject to the regulatory scrutiny of even smaller systemically important financial institutions.” [7]

‘Stealth’ Bailouts

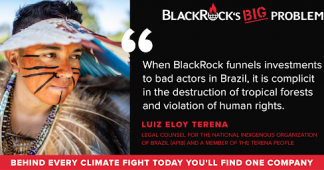

The 30 signers of that letter to Powell include Public Citizen, as well as many environmental organizations such as Greenpeace, the Indigenous Environmental Network, Amazon Watch, Stand.Earth, and the Rainforest Action Network. They rightly express concern about BlackRock’s many conflicts of interest and especially note: “…corporate bond-buying programs such as these may be stealth fossil fuel company bailouts if adequate climate safeguards are not applied. The Federal Reserve should not prop up industry destroying the climate and creating further risk to the financial system, and many of our organizations will be asking Congress to take legislative action to prevent this.” [8]

Just days later, on April 3, seven CEOs from Exxon Mobil, Chevron Corp., Continental Resources, Occidental Petroleum, Devon Energy, Phillips 66, and Energy Transfer had a private meeting with President Trump. Who knows what they asked for, or were promised?

The New York Times attempted to assure readers that BlackRock “won’t be making a mint off the Federal Reserve” and “will earn relatively modest fees” for helping the Fed “run a bond-buying program to steady markets unsettled by the pandemic.” [9] But that assurance largely misses the point: much more important is the “herding behavior” that a large asset manager like BlackRock is capable of, and about which various economists have expressed concern. With 70 offices in 30 countries, and a data-farm called Aladdin advising round the clock on that $20 trillion in investments for clients, the potential for BlackRock to shape the global economy to its liking is formidable. Add to that the fact that BlackRock is now also advising Canada’s central bank.

Here in Canada we’re waiting to see if the Trudeau government gives another bailout to the Alberta oil patch. The announcement – with possibly as much $15 billion pending – will likely come this week. With BlackRock a major shareholder is almost every oil company involved in the tar sands (and around the globe), it will be difficult for the government to explain such a bailout without looking like it’s taking direction from Larry Fink.

On the other hand, maybe this pandemic has moved everything to a “new normal” where there is no such thing as “bad optics,” only urgent, pragmatic action. Clever.

By the Way

The last time the financial press indulged in massive coverage of BlackRock was during the 2016 U.S. presidential campaign, when numerous financial pundits were exchanging gossip about Fink’s desire and potential to be Hillary Clinton’s Treasury Secretary. Of course, the result of the election changed all that. But now, with Larry Fink overseeing the virtual merger of the Fed and Treasury while advising Treasury’s Steve Mnuchin, his position might be even more powerful than any appointment Clinton would have made. Clever.

As Matt Taibbi observed way back in 2009 in the midst of the previous bailout, “By creating an urgent crisis that can only be solved by those fluent in a language too complex for ordinary people to understand, the Wall Street crowd has turned the vast majority of Americans into non-participants in their own political future. There is a reason it used to be a crime in the Confederate states to teach a slave to read: Literacy is power. In the age of CDS [credit-default swap] and CDO [collateralized-debt obligation], most of us are financial illiterates. By making an already too-complex economy even more complex, Wall Street has used the [2008] crisis to effect a historic, revolutionary change in our political system – transforming a democracy into a two-tiered state, one with plugged-in financial bureaucrats above and clueless customers below.” [10]

So keep your eyes on your pension fund and Social Security, my fellow serfs (or should I say: fellow slaves?). Larry Fink has long been committed to privatizing Social Security and this current crisis might just be the right opportunity. Of course, it will be called something innocuous or warm and fuzzy, like the CARES Act, and it will be greeted in the mainstream media as an urgent, pragmatic decision.

Footnotes:

[1] Andrew Gavin Marshall, “Exposing BlackRock: Who’s Afraid of Laurence Fink and His Overpowering Institution?” Occupy.com, December 23, 2015.

[2] Pam Martens and Russ Martens, “Icahn Called BlackRock ‘An Extremely Dangerous Company’; the Fed Has Chosen It to Manage Its Corporate Bond Bailout Programs,” wallstreetonparade.com, March 30, 2020.

[3] Matt Taibbi, “Bailing Out the Bailout,” Rolling Stone, March 31, 2020.

[4] Pam Martens, “Looking at 9/11 in the Context of the Wall Street Bailout of 2008,” Wall Street on Parade.com, September 8, 2016.

[5] Kevin Carmichael, “Why Bank of Canada needs BlackRock’s help,” Financial Post, March 27, 2020.

[6] Ryan Tracy and Sarah Krouse, “One Firm Getting What It Wants in Washington: BlackRock,” The Wall Street Journal, April 20, 2016.

[7] Sunrise Movement, “30 Groups Release Letter to Fed Raising Concerns Over Details of BlackRock Deal,” Common Dreams, March 27, 2020.

[8] Ibid., Letter to The Honorable Jerome Powell, March 27, 2020.

[9] Matthew Goldstein, “Fed Releases Details of BlackRock Deal for Virus Response,” The New York Times, March 27, 2020.

[10] Matt Taibbi, “How Wall Street Is Using the Bailout to Stage a Revolution,” Rolling Stone, April 2, 2009.