By Ama Nunoo

May 20, 2020

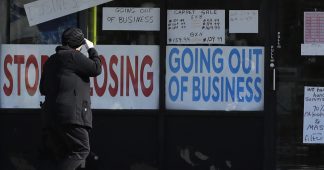

Many Black and Latino business owners say they are on the verge of losing their businesses because they are currently out of work due to the coronavirus pandemic. However, that may not be the only reason because according to a new survey, these two minority groups have also been side-lined and are barely benefiting from the Paycheck Protection Program and other government aid efforts.

The Paycheck Protection Program (PPP) is a part of the Coronavirus Aid, Relief and Economic Security (CARES) Act that is intended to provide some form of financial aid to small business owners who are finding it hard to function amid the coronavirus pandemic.

Nonetheless, Black and Latino small business owners are on the losing end of the scale, according to the survey conducted by the Global Strategy Group for two equal-rights organizations, Color of Change and UnidosUS. From April 30 to last Monday, a total of 500 business owners and 1,200 workers were interviewed, according to the New York Times.

The government has availed a $650 billion paycheck for this initiative but only 12 percent of business owners from these minority groups were fully supported or had what they requested. About 26 percent of the respondents said they only got a fraction of their initial request with almost half of the business owners ready to shut their businesses permanently.

Comparing this survey to one run by the Census Bureau of small businesses from April 26 to May 2, three-quarters of the respondents said they made a loan request and 38 percent of them received it.

Color of Change president Rashad Robinson has grave concerns about the future of Black and Latino small businesses.

He told the Times that, “If we don’t get policies to protect these communities, we will lose a generation of black and brown businesses, which will have deep impacts on our entire country’s economy.”

Sadly, not only the business owners are being affected by the lack of financial aid from the government. This lack of assistance trickles down to their employees and they have had to lay off some workers although the loans some of them requested were under $50,000.

Blacks, Latinos, and other minority groups have been disproportionately affected by coronavirus from testing to getting medical assistance and now evidently to getting aid from governed aid programs. The GSG survey’s findings have pushed Color of Change and other equal-rights advocacy groups to speak up for those businesses, who have been hard hit by the virus in order for them to get a fair chance of accessing the PPP funding in its next phase.

Minority business owners have not been able to access loans from big banks for years, which is making it more difficult for them to have their fair share from the aid relief funds.

According to the Times, the initiatives from these equal-rights groups include “reserving $60 billion in funding for small banks and nonprofit lenders—which the study suggests are more likely to work with black and Latino business owners than larger banks.”

Also, making “direct payments to businesses’ employees through payroll processors or other means.”