By James Meadway

24 March 2022

The bonfire of so many illusions. Rishi Sunak, the UK Chancellor, star of his own soft-focus Instagram series, known as ‘Dishy Rishi’ during the country’s strange first summer of Covid, when 12 million found themselves on the government payroll and a decade of debt-reduction paranoia was suspended overnight; Sunak, former hedge funder, married to the daughter of India’s sixth richest tech billionaire, wearer of sliders (£95), brand-rep for luxury coffee mugs (£180), lover of ‘fiction’ (‘all my favourite books are fiction’), famously depicted by the BBC sporting a Superman costume; a man whose ascent from backbench MP to second highest office in the land was as rapid as it was mysteriously scandal-free – a strange state of affairs in a government where financial impropriety appears to be a condition of entry; Sunak, whose Spring Statement to address Britain’s cost-of-living crisis was delivered on Wednesday, declared that ‘this day is an achievement we can all celebrate’, even as his own statisticians warned of the greatest decline in living standards since records began; whose cunning wheeze for income tax cuts in 2024 and fuel duty cuts ‘for the first time in 16 years’ was intended to elicit fawning front pages, but proved that even the supine British media have their limits, with critical write-ups on his mini-budget in the Times, FT, Sun, Daily Express and Daily Mail.

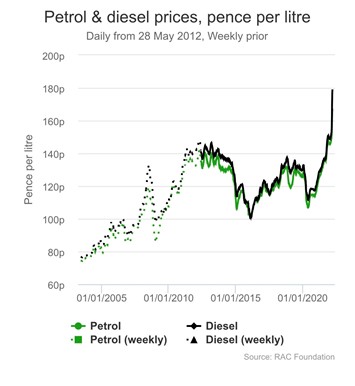

Below: fuel prices in Britain since mid-2004. Sunak’s 5p cut is enough to wipe out about a week’s worth of price rises. This cost the government £5bn. Pause for cheers.

The average household will be down around £1,000 after the various measures in the Spring Statement have been implemented. The Office for Budget Responsibility, charged with producing the official forecasts, let it be known they expect an £830 increase in average energy bills in six months’ time – this, on top of the nearly £700 increase now due on 1 April. For those not working, Sunak refused to increase the planned lift in benefits payments and the state pension from 3.1% – matching inflation last year – meaning a dramatic real-terms cut to both. Meanwhile, a £20bn tax windfall was parked, with appalling cynicism, so that it could act as the Conservative Party election war-chest come 2023. The Resolution Foundation predicts that 1.3m people, 500,000 of them children, will be plunged into absolute poverty by then. In Sunak’s Britain, the worse off you are, the worse off you will become.

It’s not that we should expect better from the Conservative Party. It’s that their viciousness usually shows more evidence of planning. Thatcher had a consistent strategy to break the trade unions; Osborne intended to drive benefits claimants into penury. This clear-sightedness has historically reflected the party’s entanglement with the major arms of the state, big business and the media, which it has maintained alongside an extraordinary degree of political-ideological flexibility. This was always its greatest strength; a capacity to oversee national economic reinvention – twice in the last century, in the 1930s and the 1980s – far exceeding Labour, who managed the same trick precisely never. (Attlee accepted the National Government’s settlement; Blair accepted Thatcherism; Wilson, who made attempts to restructure the economy, was crushed on both occasions.)

As Lord Palmerston said of British diplomacy, ‘We have no eternal allies, and we have no perpetual enemies. Our interests are eternal and perpetual’. The same applies to the Tories’ domestic political programme. In Britain’s semi-democracy (unelected head of state; unelected second chamber; official opposition tolerated within limits), the Conservatives have generally reconciled a close focus on their interests with an adaptable approach to their allies. Johnson performed this trick in 2019, moving with extraordinary speed to ditch the party’s liberal, pro-EU wing and recast it as an anti-austerity, pro-Brexit champion of the national interest, as filtered through the so-called ‘Red Wall’. This process has produced some peculiarities. Sunak identifies as a low-tax Thatcherite Conservative; yet as Chancellor he has been forced to accommodate both the demands of the Covid conjuncture and the deep unpopularity of austerity, not least amongst those swing voters in deindustrialized regions. Since he took office, increased state investment – in railways, scientific research, renewable subsidies – has formed a stark contrast with Osborne’s cutbacks, whilst spending on public services has, after a decade of reduction, been increased across the board.

This partly demonstrates the impact of Jeremy Corbyn’s time as Labour leader, in shifting the balance of public opinion back towards spending. But it also reflects the shift in elite opinion in the developed world towards supporting government intervention in the economy, the better to compete with China. The Biden administration explicitly framed the sadly deflated balloon of its spending plans as an anti-China programme, meeting the ‘peer competitor’ directly through a strong domestic economy. The European Union is looking to weaken its once-sacrosanct neoliberal commitments to State Aid and a ‘level playing field’. Even its ordoliberal revulsion at shared liabilities is being eroded, most recently in proposals for EU-wide ‘energy and security’ bonds issued by the Commission.

In Britain, this shifting consensus has seen the Tory government nationalize a ‘strategic’ steel producer, some railways and one gas supplier (with plans to nationalize another currently in the pipeline). In the guise of a ‘Future Fund’, the Treasury has taken equity stakes in more than 150 small businesses across the country, from ‘vegan food makers’ to ‘trendy cinemas’. The national lockdown merely accelerated this statist tendency. Even if one excludes additional Covid spending, the government is now set to spend more as a share of GDP than the average level under Tony Blair.

This has been a managed, intentional process. The Spring Statement, however, had a somewhat different character, representing a kind of gormless political narcissism with Sunak as its avatar. Here, it seems, the forever-war of the Tory Party’s internal factions has come to dominate its political direction – eclipsing whatever traces of an industrial strategy were discernible in Johnson’s ‘levelling-up’ agenda. Like all those at the top of the party, the Chancellor’s imperatives are self-interested: to increase the strength of his Thatcherite cadre relative to Tory dirigistas, and thereby propel himself to Number 10. Yet the result of everyone behaving self-interestedly – through a mixture of factionalism and careerism – is to create kind of random walk with drift, in which different political specks jostle for advantage, but where the overall direction is set by forces beyond their control.

We are now entering a historical moment for which Tory policymaking – despite its past triumphs – is entirely unprepared. What the pandemic heralded, unavoidably and permanently, was the end of that long period of low costs and environmental stability that, in the last four decades, undergirded neoliberal growth. Combined with the apparent breakdown of the old, dollar-centred international monetary system, fragmenting into different regional blocs, the stage is set for not only high inflation but wider price and economic instability sine die.

On this question, as on so many others, Milton Friedman was completely and disastrously wrong: inflation is not a monetary phenomenon. Far better to say, with Jonathan Nitzen, that ‘inflation is always and everywhere a phenomenon of structural change’. It is what happens when the world changes, and money changes with it. The preceding centuries of price and monetary history bear this out: transformations from one inflation regime to another matter far more than the periods between those paradigm shifts. And neither the Tory Party, nor the Bank of England – forlornly pulling on a lever marked ‘interest rates’, knowing full well it will do nothing – is remotely equipped to deal with this realignment. For that would mean moving into the truly taboo regions of price control and wage-setting. From there, one could easily envision a direct challenge to the presumed right of capital to make whatever profit it can.

Since this is a line that no Tory politician will cross, government policy inevitably degenerates into a series of emergency announcements: placing sticking-plasters on a secular crisis without so much as attempting to resolve it. Within this framework, different prime ministerial contenders – Sunak, Truss, Hunt – can argue over the most effective half-measures, and pander to their blocs within the party, but none can present a hegemonic project equivalent to Thatcher’s. Of course, to many ordinary Britons, it is clear that when the most lucrative industries in the country are gas and electricity distribution, there should be a zero-tolerance approach to profiteering. If official politics can’t deliver that, unofficial politics must step in. How long before a British gilets jaunes appears?

Published at newleftreview.org

We remind our readers that publication of articles on our site does not mean that we agree with what is written. Our policy is to publish anything which we consider of interest, so as to assist our readers in forming their opinions. Sometimes we even publish articles with which we totally disagree, since we believe it is important for our readers to be informed on as wide a spectrum of views as possible.